Shares of AstraZeneca (AZN) declined 3.3% in Friday’s early hours, even though the global pharmaceutical company reported better-then-expected earnings for the third quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Adjusted earnings of $1.08 topped the consensus estimate of $0.62 per share and increased 14% from the last year’s quarter.

Total revenues increased 50% year-over-year to $9.87 billion and matched the Street’s expectations. Notably, revenues excluding COVID-19 vaccine Alexion increased by 34% to $8.82 billion, primarily due to higher sales in R&I and Oncology disease related products.

See Top Smart Score Stocks on TipRanks >>

CEO of AstraZeneca, Pascal Soriot, said, “Our broad portfolio of medicines and diversified geographic exposure provides a robust platform for long-term sustainable growth. Following accelerated investment in upcoming launches after positive data flow, we expect a solid finish to the year and our earnings guidance is unchanged.”

Outlook

AstraZeneca projects Q4 total revenues to grow by a mid-to-high twenties percentage, while total revenue excluding the COVID-19 vaccine is expected to grow by a low-twenties percentage. Core ESP is expected to be in the range of $5.05 to $5.40 per share.

Analyst Recommendation

Based on the two Buy ratings assigned, the stock has a Moderate Buy consensus rating. The average AstraZeneca price target of $73 implies 16% upside potential from current levels. Shares have gained 12.6% over the past year.

Negative Investor Sentiment

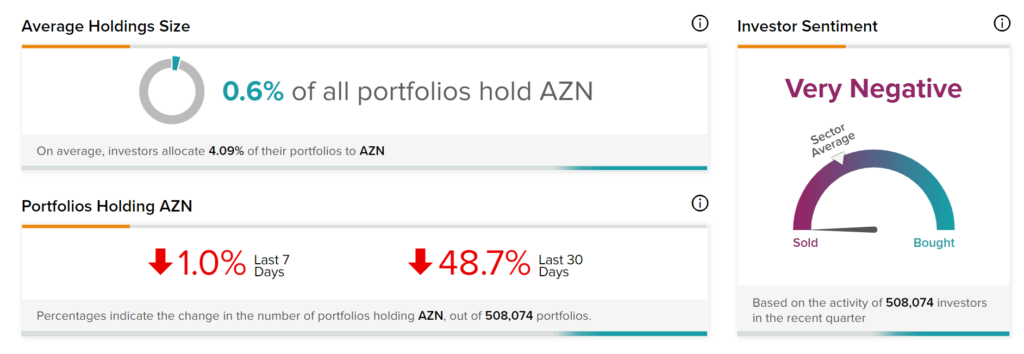

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on AstraZeneca, with 48.7% of investors decreasing their exposure to AZN stock over the past 30 days.

Related News:

Biogen Gains 3.2% on Positive ADUHELM Phase 3 Data

Lordstown Motors Posts Lower-Than-Expected Q3 Loss; Shares Fall 10%

GrowGeneration Posts Upbeat Q3 Results; Street Says Buy