AstraZeneca (NASDAQ:AZN) has unveiled a new healthcare technology division, Evinova, tasked with developing cutting-edge digital and artificial intelligence (AI)-driven health solutions. This strategic move positions AZN to capitalize on the growing digital health market, which is projected to surpass $900 billion by 2032.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

AZN engages in the research, development, and manufacture of pharmaceutical products. Its newly formed unit is dedicated to leveraging existing digital technology solutions to accelerate drug development, reduce costs, and expand access to healthcare services. The company noted that clinical trials take nearly seven years on average to complete and 80% of trials fail to meet recruiting guidelines.

AZN has announced its initial strategic partnerships with clinical research organizations Parexel and Fortrea. Additionally, to expedite the industry adoption and broaden the global reach of its digital products, Evinova is collaborating with Accenture (NYSE:ACN) and e-commerce giant Amazon’s (NASDAQ:AMZN) Amazon Web Services.

Furthermore, AZN outlined plans to tap the expanding opportunities in digital remote patient monitoring and digital therapeutics.

Is AstraZeneca a Buy or Sell?

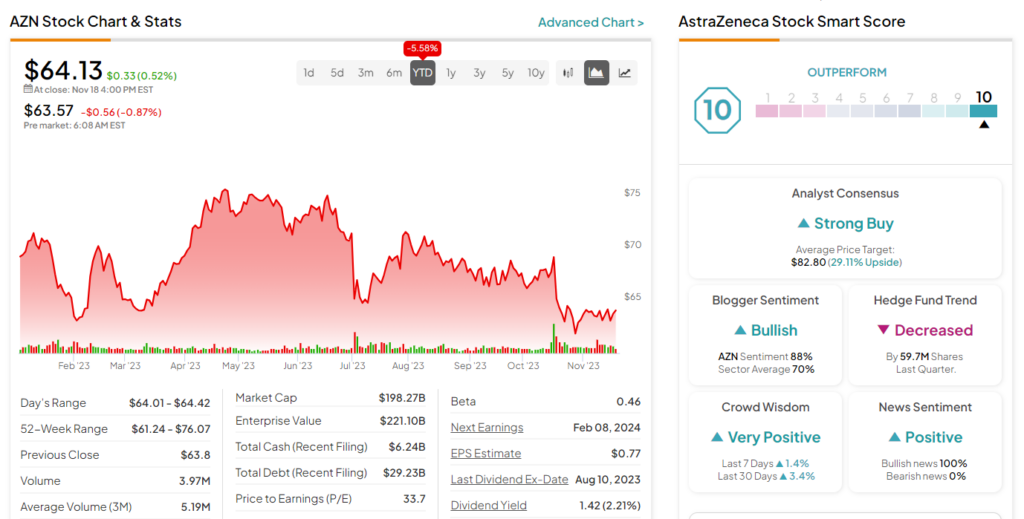

Overall, the Street has a Strong Buy consensus rating on AstraZeneca stock based on five Buys and one Hold. Meanwhile, the average AZN price target of $82.80 implies a 29.1% potential upside. Shares of the company have declined 5.6% so far in 2023.

Interestingly, AZN has a Smart Score of “Perfect 10” on TipRanks. It is worth mentioning that stocks with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.