Shares of healthcare giant AstraZeneca (NASDAQ:AZN) are on the rise today after it announced better-than-anticipated second-quarter numbers. Revenue rose 6% year-over-year to $11.42 billion, outpacing estimates by $400 million. EPS at $2.15 too raced past expectations by $1.16.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company is witnessing strength across all of its non-COVID-19 therapy areas with Ultomiris, Imfinzi/Imjudo, and Farxiga growing at 64%, 57%, and 40% respectively. Impressively, the company has had eight positive pivotal trials in Oncology so far in 2023, and for the full year 2023, expects total revenue to increase in the low-to-mid single digit. Excluding COVID-19 products, revenue growth for the year is pegged in the low double digits.

In another major development, Alexion, a unit of AstraZeneca, has entered into a purchase and license agreement with Pfizer (NYSE:PFE) for a portfolio of preclinical gene therapy programs.

The strategic move adds multiple novel adeno-associated virus (AAV) capsids to Alexion’s stable while boosting Alexion and AstraZeneca’s capabilities in genomic medicine. The transaction involves consideration of $1 billion alongside royalties on sales and is expected to close in the third quarter of this year.

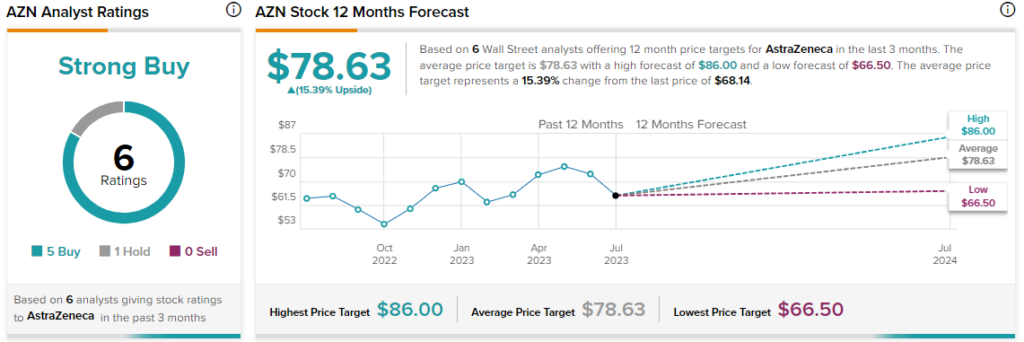

Overall, the Street has a $78.63 consensus price target on AstraZeneca alongside a Strong Buy consensus rating.

Read full Disclosure