AstraZeneca (NASDAQ:AZN) and Sanofi’s (NASDAQ:SNY) Beyfortus has become the first drug to receive approval from the Food and Drug Administration (FDA) for treating infections caused by respiratory syncytial virus (RSV) in all infants. The injection provides infants with antibodies to neutralize the virus before their immune systems are fully developed enough to generate them on their own.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

RSV is a significant cause of hospitalization among children under the age of one in the United States. The disease tends to be more prevalent during the fall and winter seasons. Until now, children were left to battle RSV infections on their own, often leading to symptoms such as irritability, fatigue, and breathing difficulties.

Prior to Beyfortus, a drug named Synagis was available in the market to treat RSV infections. However, Synagis is primarily prescribed for specific groups of infants who are at high risk of severe disease. It is typically administered to preterm infants and those with certain medical disorders, such as lung and congenital heart abnormalities, that make them more susceptible to severe RSV infections.

The companies aim to make Beyfortus available before this year’s RSV season. Furthermore, the Centers for Disease Control and Prevention’s panel is expected to meet in August to offer suggestions on how the shot should be given by doctors.

While the FDA’s approval is expected to help boost the toplines of both companies, let’s take a look at what Wall Street analysts think about these stocks.

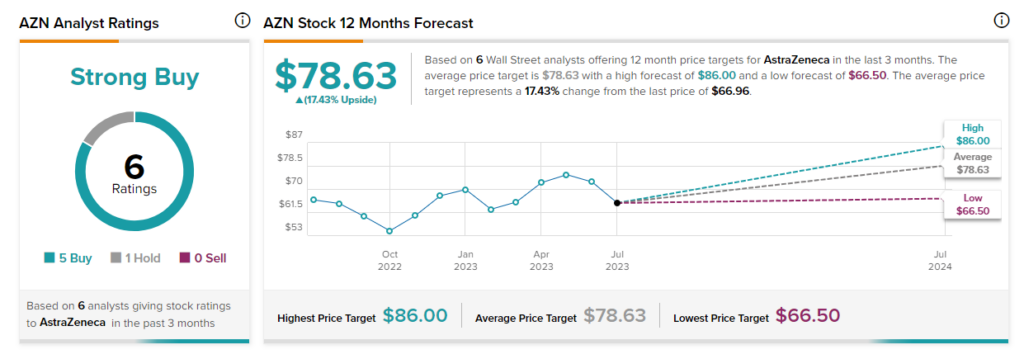

Is AstraZeneca a Buy or Sell?

Turning to Wall Street, analysts have a Strong Buy consensus rating on AZN stock based on five Buys and one Hold assigned in the past three months. In addition, the average price target of $78.63 per share implies 17.27% upside potential.

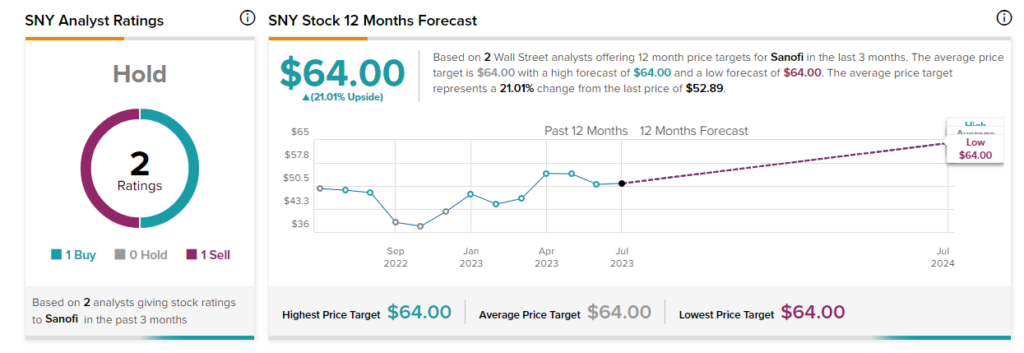

What is SNY Stock’s Price Target?

Overall, analysts have a Hold consensus rating on SNY stock based on one Buy and one Sell recommendation. Meanwhile, the average price target of $64 per share implies 21% upside potential.