Healthcare giant AstraZeneca (NASDAQ:AZN) announced ambitious long-term plans today. The company aims to achieve $80 billion in annual revenue by the end of this decade—a substantial increase from last year’s total revenue of $45.81 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Aiming for a Bright Future

AstraZeneca plans to achieve this milestone via growth in its existing oncology, biopharmaceuticals, and rare disease portfolio. It also plans to launch nearly 20 new medicines before the end of this decade. Concurrent with its top-line ambitions, AstraZeneca endeavors to maintain its focus on research and development (R&D) and achieve a core operating margin in the mid-30s by 2026.

Importantly, AstraZeneca has the track record to back its aim. Last year, it successfully achieved its $45 billion revenue goal set nearly ten years ago. Over the past few years, AZN has introduced blockbuster drugs such as Tagrisso, Calquence, and Farxiga.

Last month, AZN reported a 19% jump in its Q1 top line. Its Oncology, CVRM (Cardiovascular, Renal, and Metabolism), R&I (Respiratory and Immunology), and Rare Disease product lines clocked double-digit growth during the quarter. At the time, the company outlined expectations of low double-digit to low-teens percentage growth in its top line for Fiscal year 2024. One can expect additional details regarding AstraZeneca’s ambitious goals and pipeline at its Investor Day today.

Is AstraZeneca Stock a Buy, Sell, or a Hold?

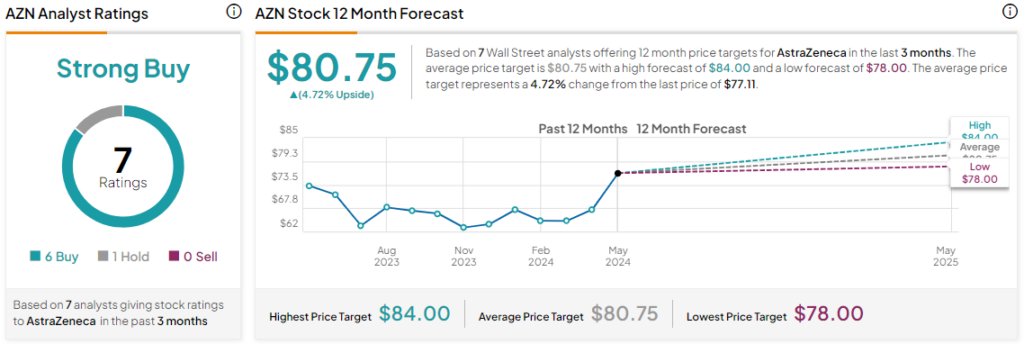

Today’s price gains further add to the nearly 22% rise in AstraZeneca’s share price over the past six months. Overall, the Street has a Strong Buy consensus rating on the stock, alongside an average AZN price target of $80.75.

Read full Disclosure