Shares of AstraZeneca (NASDAQ: AZN) gained in pre-market trading after the pharma and biotech company reported core earnings of $1.38 per share, a decline of 17% year-over-year which still beat analysts’ consensus estimate of $0.67 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Revenues declined by 7% year-over-year to $11.2 billion and beat analysts’ expectations.

The company declared a second interim dividend of $1.97 per share, with a total dividend, declared for FY 2022 of $2.90.

Looking forward, management now expects revenues to increase by a “low-to-mid single-digit percentage” with core EPS is projected to rise by a “high single-digit to low double-digit percentage.”

Pascal Soriot, AZN’s CEO commented, ” In 2023, we expect to see another year of double-digit revenue growth at CER, excluding our COVID-19 medicines. We will continue to invest behind our pipeline and recent launches while continuing to improve profitability. We plan to initiate more than thirty Phase III trials this year, of which ten have the potential to deliver peak year sales over one billion dollars.”

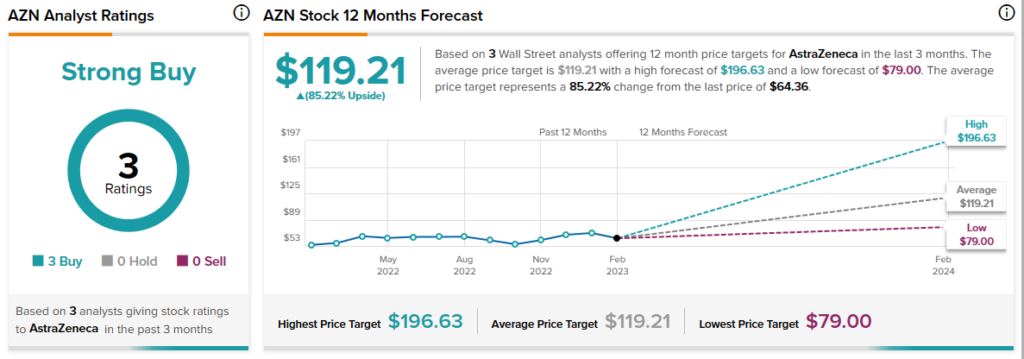

Overall, Wall Street analysts are unanimously bullish about AZN stock with a Strong Buy consensus rating based on three Buys.