ASML Holding (NASDAQ:ASML)(DE:ASME) delivered Q2 financials that came ahead of analysts’ estimates. The company that provides hardware, software, and services to chipmakers for the mass production of integrated circuits (microchips) also raised its 2023 revenue outlook as demand continues to outpace expectations following better-than-expected Q2 results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Q2 Earnings in Detail

ASML reported net sales of €6.90 billion, which exceeded analysts’ estimate of €6.71 billion, reflecting additional DUV (Deep Ultraviolet, a lithography system used in the manufacturing of microchips) immersion revenue in the quarter.

The company’s top line also showed sequential and year-over-year improvement despite continued macroeconomic uncertainties. The company said that sales of the new lithography systems increased to 107 units in Q2 from 96 units in Q1. Moreover, it was significantly higher than the 83 units sold in the prior-year quarter.

While macro uncertainty is hurting end-market demand, overall demand still exceeds its capacity. Further, ASML’s solid backlog of about €38 billion and increase in net bookings suggest that the company is well-positioned to navigate the near-term challenges well and deliver strong growth in the long term. Also, solid demand for AI (Artificial Intelligence) microchips and a reacceleration in semiconductor production bode well for future growth.

Thanks to higher revenues and increased margins, ASML delivered earnings of €4.93 a share, surpassing analysts’ estimate of €4.63 and growing over 39% year-over-year.

Revenue Outlook Raised

Thanks to the momentum in its business and strong DUV revenue, ASML raised its full-year revenue outlook. The company now expects 2023 revenues to increase by 30% compared to its earlier growth projection of 25%.

As for the third quarter, ASML expects its top line to be in the range of €6.5 billion to €7.0 billion, compared to €5.78 billion in the prior-year quarter. Meanwhile, gross margin is projected to come in at 50%, reflecting a decline compared to Q3 of the previous year.

Is ASML Holding a Good Stock to Buy?

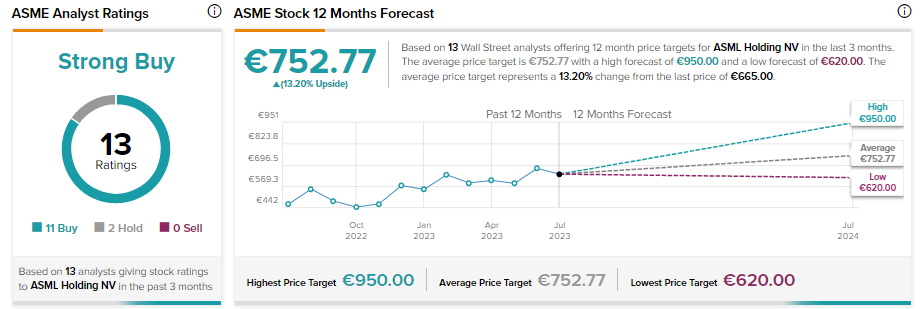

Analysts are bullish about ASML’s prospects. Goldman Sachs analyst Alexander Duval reiterated a Buy on ASML (the stock is also on Goldman’s Conviction List) on July 14. The analyst sees AI as a strong demand driver for ASML in the long term. His price target of €825 implies more than 24% upside potential from current levels.

Including Duval, ASML stock has received 11 Buy and two Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of €752.77 indicates 13.2% upside potential.