Major semiconductor supplier ASML Holding (NASDAQ:ASML) ticked lower in pre-market trading as the company’s Q3 earnings came in at €4.81 per share which fell short of analysts’ estimates of €4.93 per share. ASML posted third-quarter revenues of €6.7 billion missing Street estimates of €7.2 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s quarterly net bookings slumped by 42.2% in the third quarter to €2.6 billion.

ASML President and CEO Peter Wennink commented, “The semiconductor industry is currently working through the bottom of the cycle and our customers expect the inflection point to be visible by the end of this year. Customers continue to be uncertain about the shape of the demand recovery in the industry. We therefore expect 2024 to be a transition year.”

The chip supplier also announced an interim dividend of €1.45 per ordinary share payable on November 10.

Looking forward, the company expects its fourth-quarter net sales to be between €6.7 billion and €7.1 billion and a gross margin in the range of 50% to 51%. ASML reiterated that it anticipates its net sales growing by 30% in 2023.

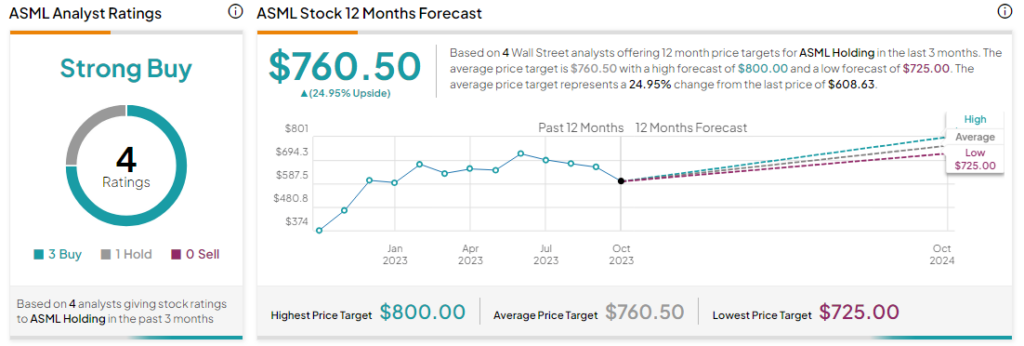

Is ASML a Buy, Sell, or Hold?

Analysts are bullish about ASML stock with a Strong Buy consensus rating based on three Buys and one Hold. The average ASML price target is $760.50 implying an upside potential of 24.9% at current levels.