Thankfully, as far as chip stock ASML (NASDAQ:ASML) goes, it’s mostly above the fray when it comes to exports on chips and any new rules created therein. In fact, it’s so thoroughly unconcerned that it’s actually up fractionally in Tuesday afternoon’s trading. Essentially, ASML pointed out that while other companies will be impacted by the new rules about what chips can be sold to China and what chips can’t, those rules really don’t touch ASML much. After all, it doesn’t make chips, but rather the things needed to make chips.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ASML noted that its “regional split systems” sales will be impacted in the medium-term, but the new regulations will be limited to a “…limited number of fab(rication plant)s in China.” That makes the overall impact light.

Some, however, are less certain. One analyst pointed out that new system sales to China could utterly dry up as early as next year. Moreover, it’s become clear—thanks to the Huawei incident—that China really didn’t need ASML’s extreme ultraviolet lithography systems to make advanced chips anyway. And throw in the recent arrival of Canon (OTHEROTC:CAJPY) into the chipmaking scene, and bad news only gets worse for all concerned.

Is ASML a Buy, Sell, or Hold?

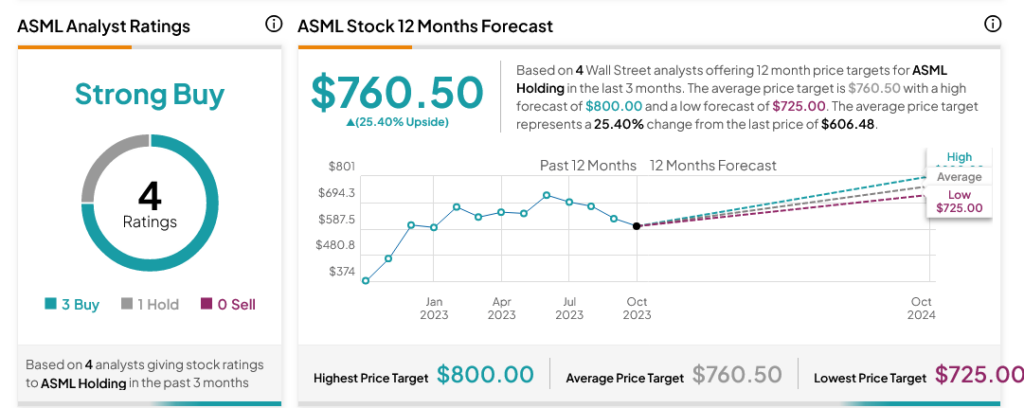

Turning to Wall Street, analysts have a Strong Buy consensus rating on ASML stock based on three Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average ASML price target of $760.50 per share implies 25.4% upside potential.