Shares of ASML Holding (ASML) are down 17% after the Dutch semiconductor equipment maker reported dismal quarterly financial results and issued a poor outlook that disappointed investors.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The sell-off in ASML stock pulled other chip stocks lower, with Nvidia (NVDA) and Advanced Micro Devices (AMD) each down 5%. Some chip stocks are down even more in New York trading. Shares of Applied Materials (AMAT), another semiconductor equipment maker, are down 10% midday on Oct. 15.

Poor Results and Weak Guidance

The plunge is largely due to the weak guidance provided by ASML Holding. The company, which is based in the Netherlands, said it expects net sales for 2025 of between 30 billion euros ($32.72 billion) and 35 billion euros, which is the lower end of the range it issued earlier this year.

For the recently completed third quarter of this year, ASML reported net bookings of 2.6 billion euros ($2.83 billion), which was well short of the 5.6 billion euros expected among analysts who cover the company. The combination of poor bookings and soft guidance sank ASML and other chip stocks. ASML is a major supplier to the semiconductor industry and is viewed as a bellwether for the sector.

ASML’s China Exposure

ASML’s extreme ultraviolet lithography machines are used by nearly all of the world’s major chipmakers to produce advanced processors that run artificial intelligence (AI) applications and models. Poor sales for ASML portend bad things for the broader chip market, say Wall Street analysts. However, ASML Holding is unique in that much of the company’s business comes from equipment sales to China.

Earlier this year, the company said that nearly half (49%) of all its sales stem from China. That exposure has hurt ASML as China’s economy is currently slumping. Management said in releasing their latest financial results that they expect sales in China to “normalize” over the next 12 months.

Is ASML Stock a Buy?

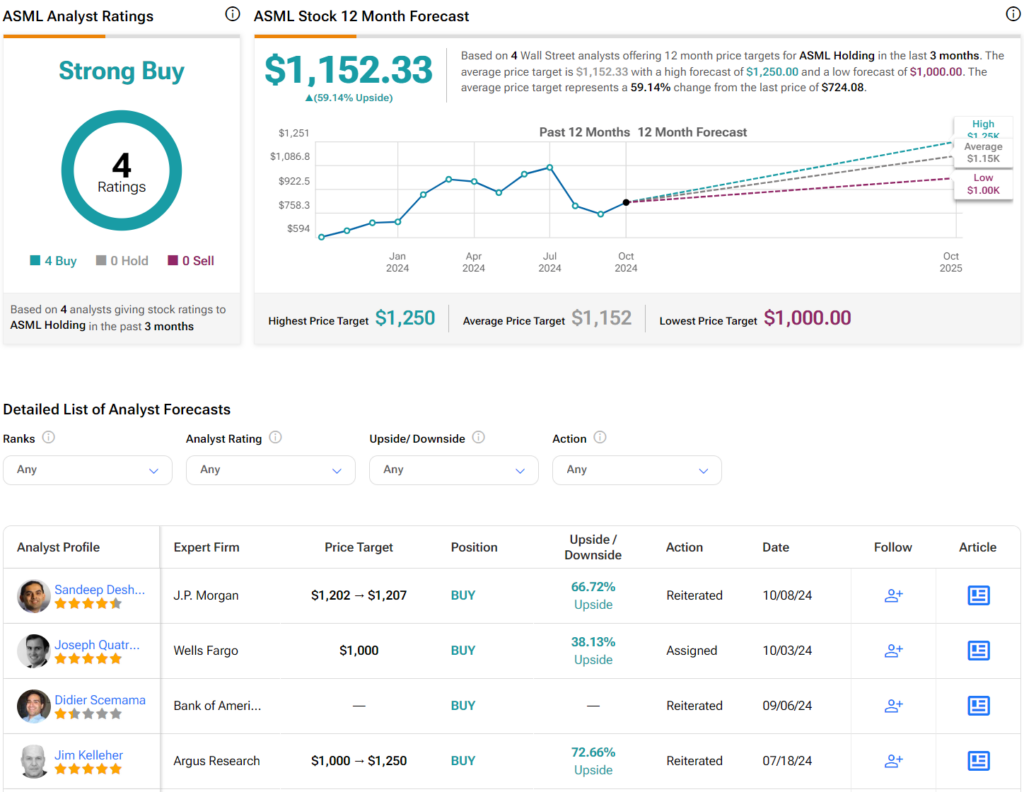

ASML Holding stock has a Strong Buy consensus rating among four Wall Street analysts. That rating is based on four Buy recommendations issued in the last three months. There are no Hold or Sell ratings on the stock. The average ASML price target of $1,152.33 implies 59.14% upside from current levels.