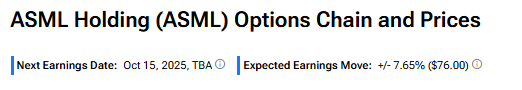

Based on options pricing, traders expect ASML Holding (ASML) stock to move about 7.65% in either direction after the company announces its third-quarter earnings results on Wednesday. Interestingly, the potential swing is much higher than the semiconductor giant’s long-term average post-earnings move of 3.59%. This suggests that investors are bracing for a more volatile reaction than usual.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ASML stock has climbed nearly 44% year-to-date due to optimism about its high-NA EUV systems and steady demand from foundries such as TSMC (TSM) and Intel (INTC). However, with geopolitical tensions, export restrictions, and macroeconomic uncertainty still looming, traders are likely hedging their bets.

What Does Wall Street Expect?

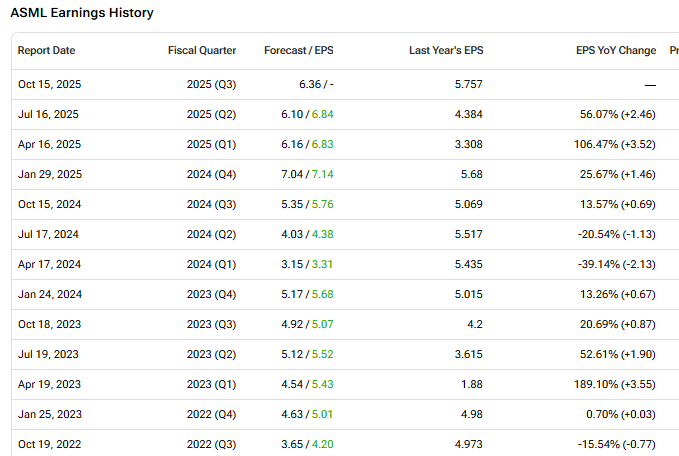

Wall Street is expecting ASML to report earnings of $6.36 per share, up 10.4% from the same period last year. Also, analysts project revenues of $9.02 billion, up from $8.20 billion in the year-ago quarter.

Will ASML be able to beat these estimates? As shown in the graph below, the company has a very strong track record of reporting better-than-expected earnings.

Whether ASML beats expectations or not, the options market is clearly expecting volatility. Investors are likely to closely watch the company’s guidance and commentary on global demand, supply chain dynamics, and geopolitical risks.

Is ASML a Good Stock to Buy?

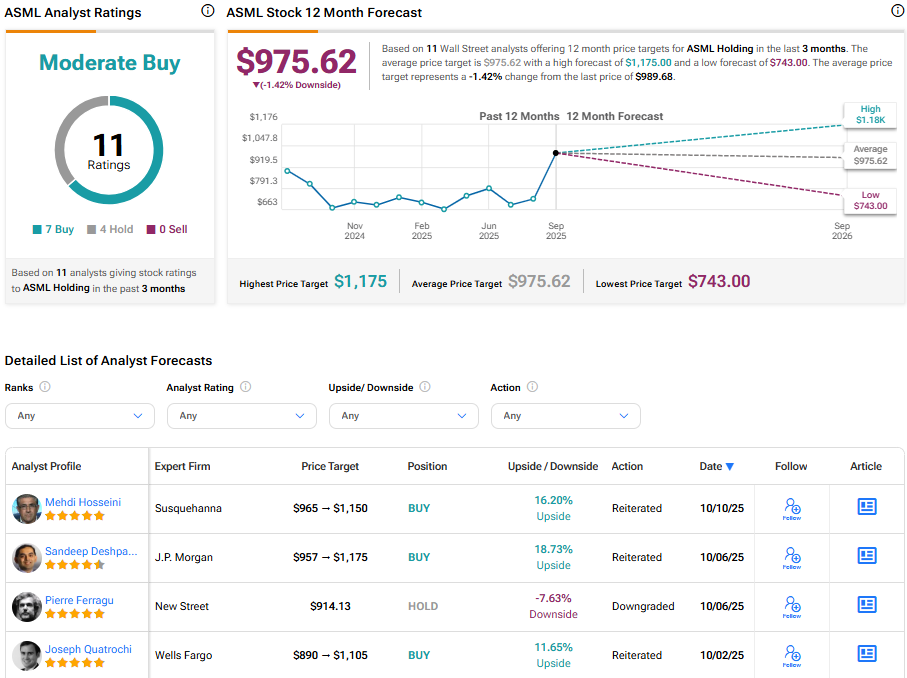

On TipRanks, ASML stock has a Moderate Buy consensus rating based on seven Buys and four Hold ratings. The average ASML price target of $975.62 implies 1.4% downside risk from current levels.