ASML Holding (ASML) delivered record third-quarter bookings, fueled by strong demand for AI-related chips. The company’s Q3 bookings hit €5.4 billion ($6.28 billion), narrowly topping the €5.36 billion analysts expected. However, the Dutch equipment maker cautioned that slowing demand from China could temper growth, signaling potential headwinds for growth despite the AI-driven boom.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ASML designs and manufactures advanced lithography machines essential for producing cutting-edge chips, playing a critical role in the global semiconductor supply chain.

ASML Issues Tepid Outlook

For the full year 2025, ASML kept its forecast for annual sales to rise about 15% this year compared with 2024, with a gross margin of around 52%. In the third quarter, ASML reported net sales of €7.5 billion and a gross margin of 51.6%, meeting its guidance and marking a solid quarter.

Meanwhile, the company said it doesn’t expect 2026 total net sales to fall below 2025 levels and will share more details on its outlook in January.

However, CEO Christophe Fouquet cautioned that demand and sales in China are expected to drop significantly next year compared with 2024 and 2025. Overall, semiconductor industry players are under a close watch as U.S.–China tensions impact global supply chains and trade policies.

Analysts Weigh In on ASML Results

Following ASML’s results, Ben Barringer, global technology analyst at Quilter Cheviot, told CNBC that the news on China is “a little concerning” given possible U.S. restrictions. He pointed out that bookings have been unpredictable this year, so some stability is positive, and the company’s 2026 lower-bound guidance looks reasonable.

Meanwhile, Degroof Petercam’s analyst Michael Roeg believes the guidance is “a bit more enthusiastic” than previous comments. Roeg added that the expected drop in China sales will need to be compensated by stronger sales to leading customers in advanced logic and memory.

Is ASML a Good Stock to Buy?

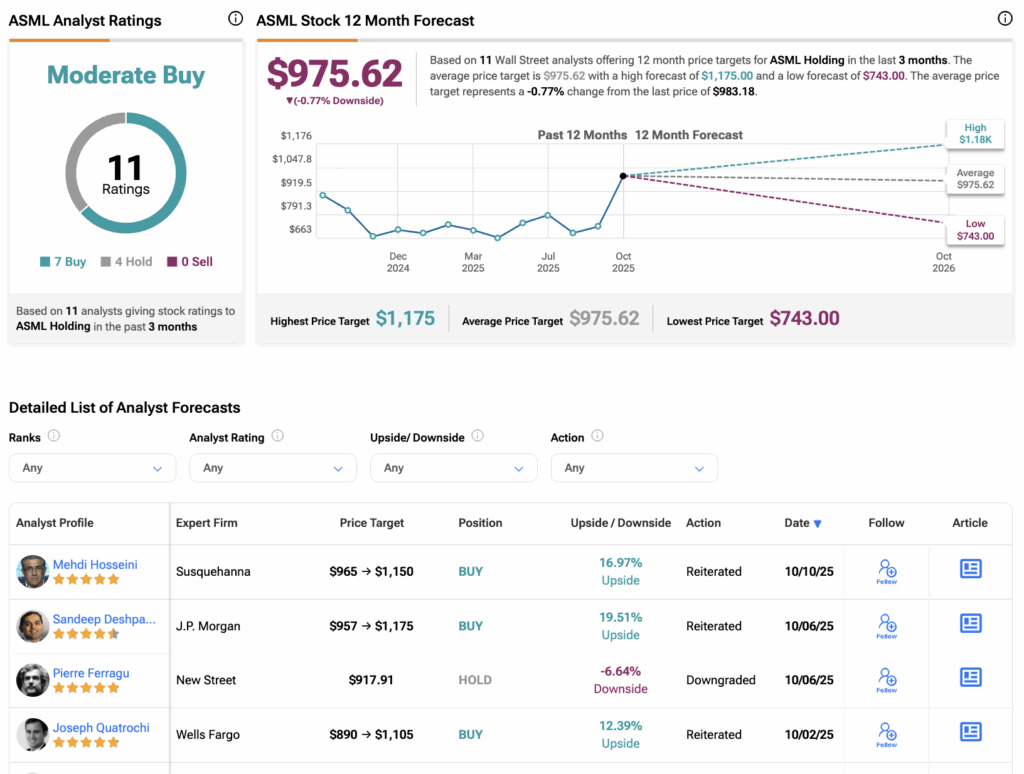

On TipRanks, ASML stock has a Moderate Buy consensus rating based on seven Buys and four Hold ratings. The average ASML price target of $975.62 implies a 0.77% downside from current levels.

Year-to-date, ASML stock has surged over 40%.

These ratings and price targets will likely change as analysts update their coverage following today’s earnings report.