Shares of Asana (NYSE: ASAN), the work management platform slid more than 15% in pre-market trading on Friday as the company’s Q4 and FY23 revenues estimates fell short of Street estimates.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

ASAN now anticipates Q4 revenues in the range of $144 million to $146 million, below consensus estimates of $151.1 million. Even the FY23 revenue forecast is between $541 million and $543 million, missing analysts’ estimates of $545.5 million.

In Q3, disappointingly, for ASAN, the adjusted loss widened to $0.26 per share versus a loss of $0.23 in the same period last year.

However, this loss was still narrower than Street estimates of $0.33 per share.

Revenues of Asana soared 41% year-over-year to $141.4 million surpassing analysts’ estimates by $2.4 million.

In Q4 and FY23, ASAN expects an adjusted net loss of $0.28 to $0.27 and between $1.15 and $1.14 per share, respectively.

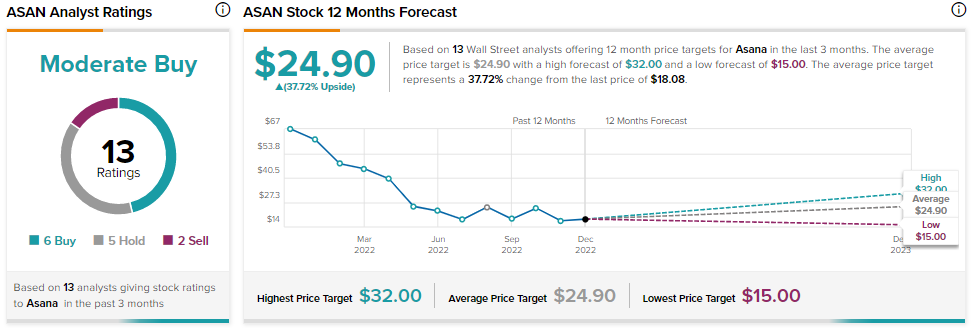

Analysts are cautiously optimistic about ASAN with a Moderate Buy consensus rating based on six Buys, five Holds, and two Sells.

Shares of ASAN have dropped more than 80% in value in the past year.