As different tech companies around the world jump onto the generative AI bandwagon, there is growing clamor calling for regulation of AI as it spooks users, investors, and companies alike.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Just last week, OpenAI’s CEO, Sam Altman called for the regulation of AI while earlier this month, the White House had invited Microsoft’s (MSFT) CEO, Satya Nadella, and Alphabet’s (GOOGL) CEO, Sundar Pichai to address the growing concerns of the U.S. Government over artificial intelligence (AI).

In a bid to address these concerns, and map out the risks behind AI and different ways to mitigate these risks, the Federal Government has laid out the National AI R&D Strategic Plan. The U.S. Government has invited public input to design a National AI Strategy that “will chart a path for the United States to harness the benefits and mitigate the risks of AI.” This strategy will look at “protecting individuals’ rights and safety, and harnessing AI to improve lives.” The Government is also looking at how AI can be deployed in the field of education and will look at the risks and opportunities related to this field.

Microsoft is Leading the AI Race

Meanwhile, Microsoft is going full steam ahead when it comes to generative AI and is capitalizing on its lead as evidenced by its Build Developers conference. The tech giant laid out a technology roadmap at this conference where it showed new updates to AI tools that would enable developers to develop code at a quicker pace and would slash the time required to create a developer box from two weeks to a matter of minutes.

The company’s CEO Satya Nadella stated, “The concept of a dream machine … the human-computer symbiosis … is exciting. We went from the bicycle to the steam engine with ChatGPT.”

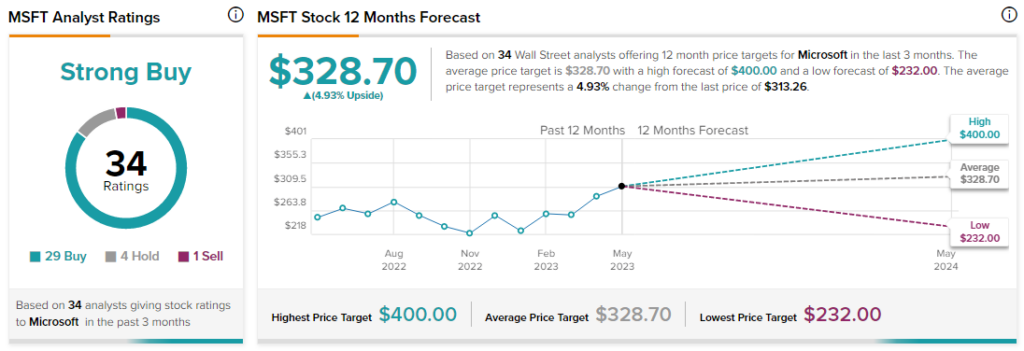

Even top-rated Bernstein analyst Mark Moerdler was impressed with MSFT’s AI advancements and noted that the company is embedding AI in each of its businesses, through Copilot. The analyst has a Buy rating on the stock with a price target of $342, implying an upside potential of 9.3% at current levels.

Moerdler commented, “By making co-pilot ubiquitous across the Windows platform, Microsoft, and third-party apps, Microsoft could put together a very large surface area for its AI and search platform. Given the size of the potential user base ([more than] 1.2B Office and [more than] 1.4B Windows users) and Microsoft’s first-mover advantage in the AI space, we think Microsoft is currently very well-positioned to be a leader in AI tech.”

Overall, analysts are bullish about MSFT stock with a Strong Buy consensus rating based on 29 Buys, four Holds, and one Sell.

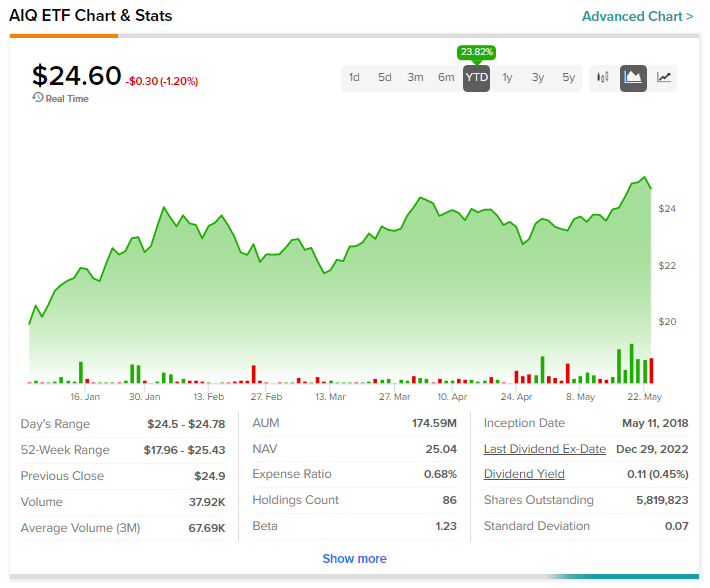

The rising interest in AI has resulted in the Global X Artificial Intelligence & Technology ETF (AIQ) going up more than 20% year-to-date.