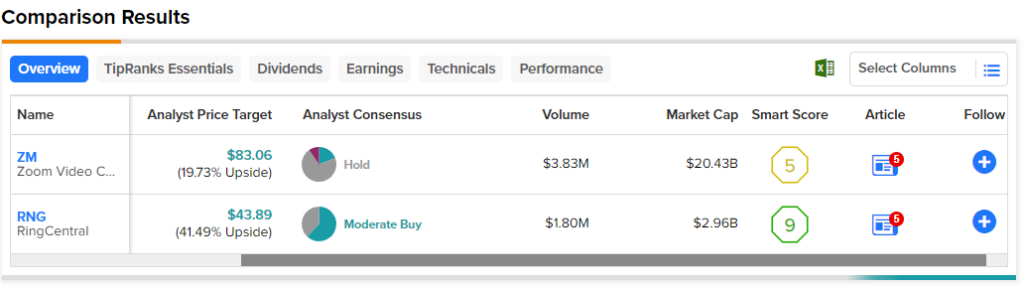

In this piece, I evaluated two video conferencing stocks, Zoom Video Communications (NASDAQ:ZM) and RingCentral (NYSE:RNG), using TipRanks’ comparison tool to determine which is better.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Neither stock has been doing very well over the last 12 months, with Zoom Video down 23% and RingCentral off more than 50%. However, while RingCentral’s slide has been somewhat slow and gradual over the last 12 months, Zoom Video plunged suddenly in August 2022 and February 2023. However, Zoom is up 4.3% year-to-date, while RingCentral is in the red, down more than 10%.

As a starting point for valuation, the application software industry is trading at a price-to-sales (P/S) multiple of about 7.0 versus its three-year average of 10.2, indicating significant pessimism in the sector among investors. Since RingCentral is unprofitable and Zoom is barely profitable, the P/S ratio is the valuation method of choice.

Of course, with such bearish sentiment around the sector, investors may be wondering if or when the tide will turn for Zoom Video and RingCentral, so a closer look is in order.

Zoom Video Communications (NASDAQ:ZM)

At first glance, Zoom Video Communications looks undervalued, as it’s trading at a P/S multiple of about 4.6. The company enjoyed massive growth during the pandemic-related lockdowns as workers stayed at home and used Zoom for video conferencing. However, it managed to hold onto most of that revenue as the pandemic ended, suggesting a tentative bullish view could be appropriate.

Zoom is a classic example of “growth at any cost,” as its revenue has been surging every year for the last few years. However, while the company generated nearly $4.4 billion in revenue in the fiscal year that ended in January, it only had $103.7 million in net income. Last year was better, as Zoom had $4.1 billion in revenue and $1.4 billion in net income.

Unfortunately, as we’ve seen with many technology companies this year, Zoom’s research and development and selling, general, and administrative costs jumped dramatically, boosting its operating expenses from less than $2 billion last year to over $3 billion this past year.

Zoom’s stock-based compensation, a long-running specter for the company, also soared this past year, nearing $1.3 billion from $477.3 million the year before. Investors may want to monitor these trends.

Zoom continues to generate lots of cash, recording $1.2 billion in free cash flow for the last year, not much worse than the $1.5 billion it had the year before, even though its operating expenses soared. However, stock-based compensation is added back in when calculating the free cash flow, which investors might not realize. It also has a solid balance sheet with relatively little debt and steadily growing assets.

What is the Price Target for ZM Stock?

Zoom Video Communications has a Hold consensus rating based on four Buys, 14 Holds, and two Sell ratings assigned over the last three months. At $83.88, the average Zoom Video Communications stock price target implies upside potential of 23.63%.

RingCentral (NYSE:RNG)

At a P/S of 1.4, RingCentral looks even more undervalued than Zoom, although its lack of profitability calls for a discount. In fact, the company’s annual losses have widened every year since 2018. While RingCentral is just barely generating positive free cash flow, its balance sheet is concerning. It’s hard to see how the company can ever become profitable, suggesting a bearish view may be appropriate.

RingCentral’s operating expenses didn’t rise as much as Zoom’s, and it doesn’t pay as much stock-based compensation. However, RingCentral’s financial position is far weaker, so it doesn’t have much room to maneuver. In fact, its total liabilities outweigh its total assets, and it has less than $300 million in cash and equivalents, a significant drop from where it stood in 2020 ($640 million).

The overall trends for RingCentral just don’t look good, suggesting it could be merely a much-hyped company due to the video conferencing explosion during the pandemic.

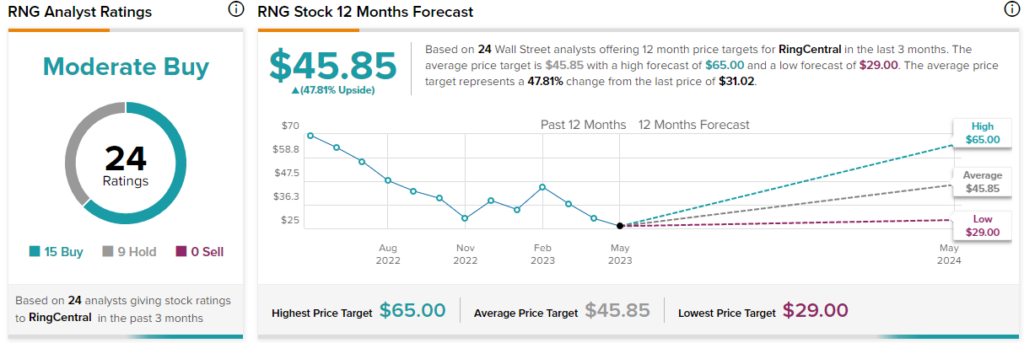

What is the Price Target for RNG Stock?

RingCentral has a Moderate Buy consensus rating based on 15 Buys, nine Holds, and zero Sell ratings assigned over the last three months. At $45.85, the average RingCentral stock price target implies upside potential of 47.8%.

Conclusion: Bullish on ZM, Bearish on RNG

Both companies may benefit from Microsoft’s (NASDAQ:MSFT) move to unbundle its Teams video conferencing software to prevent an anti-trust probe in Europe. However, without some major operational changes and cost cuts, RingCentral might never become profitable.

On the other hand, Zoom has much better fundamentals. It seems priced for failure now, having shed more than 90% of its value, so the risk/reward profile looks positive for the long term. However, Zoom’s surging operational expenses and stock-based compensation are concerning, calling for frequent near-term monitoring.