Investors are often intrigued by ETFs that feature sky-high dividend yields, such as the Amplify High Income ETF (NYSEARCA:YYY), which currently yields 12.3%. While the thought of receiving passive income with this type of yield is indeed enticing, and YYY has some good things going for it, investors also need to look under the hood before committing to these types of ETFs. Here’s more on YYY and why most investors should likely proceed with caution.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What is YYY ETF?

Operated by Amplify ETFs, YYY is a “portfolio of closed-end funds (CEFs) based on a rules-based index.” The index (The ISE High Income Index) selects CEFs based on three attributes — their yield, discount to net asset value (NAV), and liquidity.

The strategy provides substantial income, as evidenced by the fund’s current 12.3% yield, and it also offers the potential for capital appreciation if some of the CEFs it holds narrow their discounts to net asset value (NAV). The average closed-end fund held by YYY currently trades at an 8.9% discount to NAV (as of March 31), so there is theoretically some value to be had here.

What are Closed-End Funds?

Closed-end funds are similar to mutual funds or ETFs but with a key difference. They raise a certain amount of money through an IPO and then trade on a stock exchange, and they are managed by investment managers.

While ETFs and mutual funds take in new money from new investors by issuing new shares at their net asset value, closed-end funds are essentially “closed off” and never issue new shares, so interested investors buy existing shares in the market, and the price of these shares can fluctuate dramatically from the net asset value of their holdings for a variety of reasons, including the fund’s distribution rate, overall market volatility, and the reputation (or lack thereof) of the fund’s manager.

No Guarantees

Note that it is not uncommon for CEFs to trade at discounts of 10% or more to NAV, so while the idea of investing in YYY’s portfolio of CEFs trading at a discount of 8.9% to NAV sounds appealing, there is no guarantee that these CEFs will narrow this gap. Investment giant Fidelity explains that “a CEF’s discount or premium tends to persist. If the CEF typically trades at a large discount, it will tend to stay at a large discount, barring any corporate actions from the board of directors.”

In essence, while the discount to NAV theoretically creates value, unless there is a tangible catalyst, this discount is often unlikely to disappear.

Two other things to be aware of when it comes to closed-end funds are that they are actively managed, so they usually feature higher fees than ETFs or mutual funds (more on this later). Also, they often use leverage to try to boost their returns, which can be great, but it can add a significant amount of risk.

YYY’s Holdings

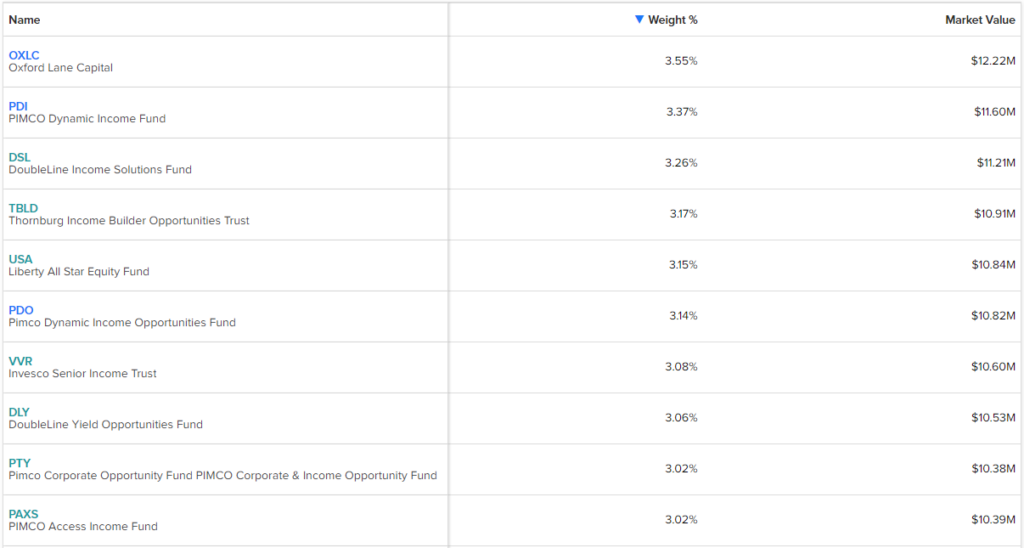

Now that we’ve covered YYY’s strategy and closed-end funds themselves, let’s take a look at YYY’s portfolio of holdings. YYY holds 47 different positions, and it is relatively diversified in that its top 10 positions make up just 31.8% of assets. Check out the overview of YYY’s top 10 holdings using TipRanks’ holdings tool below.

As you can see, no position makes up more than the 3.55% that Oxford Lane Capital accounts for, and the holdings are largely derived from closed-end funds from well-known investment firms such as PIMCO, DoubleLine, Invesco, and Thornburg. While these top holdings, like Oxford Lane Capital and the PIMCO Dynamic Income Fund, feature some tempting dividend yields, their performance over the past decade has been fairly underwhelming.

High Fees

While YYY is diversified and offers an attractive yield plus a portfolio that trades at a discount to NAV, one major drawback here is its high fees. Because it holds closed-end funds that charge their own management fees, YYY has “acquired fund fees” of 2.22%. Add in the 0.5% management fee that Amplify itself tacks on to this, and you end up with a 2.72% management fee, which is quite high. An investor putting $10,000 into YYY would pay $272 in fees over the course of the year, all else being equal. Assuming a 5% return per year, after three years, an investor would pay $844 in fees. After five years, the total would be $1,440, and after 10 years, the fees would total $3,051, according to Amplify. As you can see, these high fees really add up over time.

Unimpresive Long-Term Performance

Paying these high fees would perhaps be more palatable if YYY was trouncing the broader market. You might think that with a 12.3% yield, YYY is generating great returns. Unfortunately, that hasn’t been the case over the long term.

As of the end of the most recent quarter, YYY has a one-year total return of -12.5%. However, the market as a whole had a difficult year in 2022, so let’s give YYY a mulligan there. Looking out over a three-year time horizon, the results have been much better, with an annualized return of 7.5%.

While this isn’t bad, and YYY has given its investors some gains over this time frame, it lags the broader market by a considerable amount. For example, the SPDR S&P 500 ETF Trust (NYSEARCA:SPY), a good proxy for the S&P 500, gained a much better 18.4% (annualized) during the same three-year period and is only charging a 0.09% fee. Similarly, the Invesco QQQ Trust ETF (NASDAQ:QQQ), which invests broadly in the Nasdaq 100, returned 19.8% over the same timeframe and has a low fee of 0.2%.

Zoom out to a five-year timeframe, and the disparity grows even more pronounced. While SPY and QQQ returned 11% and 15.7%, respectively, YYY holders essentially stayed flat with a 0.7% annualized return. While investors didn’t lose money, the opportunity cost is considerable, as they could have made significantly more money by investing in a simple broad-market strategy like SPY or QQQ.

Lastly, look out even further to a 10-year time horizon, and YYY’s annualized return of 1.9% pales in comparison to SPY’s 12.1% annualized return and QQQ’s 17.7% annualized return over the same time frame.

Investor Takeaway

In conclusion, YYY has some interesting elements in its favor, such as its high yield and its portfolio’s discount to NAV, but most investors would likely be better off simply investing in a broad-market fund, as these have vastly outperformed YYY while charging dramatically lower fees than YYY’s 2.72% expense ratio.

I have seen some inexperienced investors state that they just want the big payout and the high yield and that they don’t care about the rest, but they fail to realize that their portfolio (and wealth) will be much larger over time by focusing on higher total returns. At this point, they could theoretically simply sell some of the shares of the ETF with the higher return to supplement their income and still have a larger portfolio, negating the advantage of the higher yield.