Altria stock (NYSE:MO) boasts a hefty 9.6% dividend yield, making its investment appeal stronger than ever. Despite ever-persistent concerns surrounding the tobacco industry and rising interest rates, the U.S.-based tobacco giant consistently delivers solid results, sustaining its hefty dividend and its everlasting growth. In the meantime, the current near-record-high yield not only provides substantial returns but also establishes a considerable margin of safety. Hence, I am bullish on this stock.

Altria Continues to Post Strong Profits Despite Lower Sales

Altria has continuously grappled with challenges related to a decrease in tobacco sales volumes—a matter you should find quite familiar if you have been closely monitoring the company and its industry peers.

Persistent concerns have lingered for years about the potential for an extended downturn in cigarette sales. In fact, investors have long placed their bets on a narrative anticipating a decline in the smoking population. This is underscored by the persistent downward pressure on Altria’s shares in recent years.

While it is accurate that the global smoking population has been steadily decreasing for decades, the pace of this decline remains relatively modest. Contrary to widespread perceptions, Altria has adeptly managed the decline in revenues, implementing control measures to offset the modest reduction in sales volumes. In fact, robust price increases in cigarettes have mostly effectively mitigated the impact of declining sales.

Additionally, strong sales in non-smokable products have played a pivotal role in supporting overall results. Consequently, while Altria’s revenues have indeed faced pressure, the reality is more nuanced than the prevailing narrative suggests. In the meantime, disciplined expense control and strategic share repurchases have served to bolster net income and earnings per share (EPS) over time, respectively. Altria’s most recent Q3 results once again supported this theme.

Sales Decrease is Not Catastrophic

In Q3, Altria posted net revenues of $6.28 billion, down 4.1% compared to last year. The decline can be attributed to a 5.3% decline in revenues from smokable products, and that reduction, in turn, is attributable to an 11.6% decrease in cigarette shipment volumes, offset by increased pricing.

Net revenues were also aided by higher oral tobacco revenues, which grew by 2.2%. Thus, while Altria’s top line is under pressure, without a doubt, the situation is nowhere near catastrophic. Also, Q3 suffered from seasonal headwinds in shipment volumes, meaning that the actual decline in net revenues is even softer on a normalized basis.

Robust Bottom-Line Results

As I mentioned, despite the ongoing decline in sales Altria is experiencing, the company’s profitability remains robust. At the end of the day, investors should pay more attention to this when assessing a high-yielding stock like Altria. This is because its profitability directly impacts its capacity to sustain its dividend. The stock’s entire investment proposition hinges on this factor presently.

For the third quarter, Altria reported adjusted diluted EPS of $1.28, stable year-over-year. This robust result, against the backdrop of declining revenues, can be attributed to a reduction in outstanding shares, higher adjusted earnings from Altria’s investment in ABI, and proactive debt reduction initiatives by the company.

Notably, Altria successfully lowered its long-term debt to $23.98 billion by the end of Q3, down from $25.12 billion at the year’s outset. Additionally, a 1.4% year-over-year reduction in outstanding shares, driven by continuous share buybacks, further contributed to the per-share bottom line result.

In my perspective, the sustained strength of EPS in Q3, coupled with the upward trajectory of EPS in the preceding two quarters of Fiscal 2023, strongly suggests that Altria is able to consistently outperform the ongoing decline in revenues. Notably, management anticipates an adjusted EPS between $4.91 and $4.98. This forecast signifies a growth rate of 1.5% to 3% compared to last year’s figure of $4.84, highlighting the company’s resilience in the face of persistent challenges within the tobacco industry.

The 9.6% Dividend Remains Well-Covered

I started this article by suggesting that Altria’s investment case might be the best it has looked in years due to its 9.6% yielding dividend. For starters, the hefty dividend remains well covered. Its $3.92 annual rate suggests a forward payout ratio of 80% at the midpoint of management’s guidance. Further, the 9.6% yield is nearly the highest yield the stock has ever traded at in recent history, excluding a flash period during the COVID-19 pandemic.

Altria’s healthy payout ratio and sustained growth in adjusted EPS position the company favorably for ongoing dividend increases, a trend it has successfully sustained for an impressive 54 years. Coupled with the current record-high yield, this creates a compelling investment proposition.

Is Altria Stock a Buy, According to Analysts?

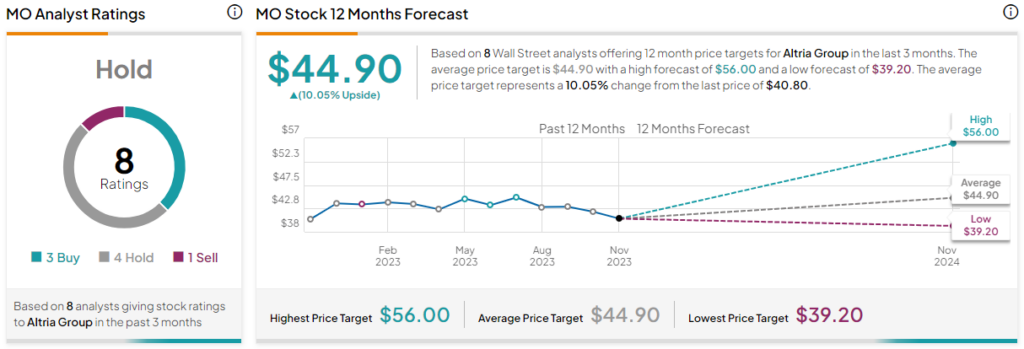

Looking at Wall Street’s sentiment on Altria, the stock has a Hold consensus rating based on three Buys, four Holds, and one Sell assigned in the past three months. At $44.90, the average Altria stock forecast implies 10.05% upside potential.

The Takeaway

Despite challenges in the tobacco industry, Altria’s robust performance underscores its resilience and ability to navigate evolving market dynamics. The sustained growth in adjusted EPS, disciplined expense control, and strategic initiatives, such as share repurchases and debt reduction, contribute to its continued profitability. The firm’s 9.6% dividend yield, near its highest ever, remains well-covered, making Altria stock a potentially highly attractive investment opportunity at its current levels.