YETI Holdings (NYSE:YETI) has benefited from increased consumer awareness of outdoor-focused products and has developed a very prominent brand name in a relatively short period. Its products range from drinkware to coolers, bags, and other outdoor apparel. The company strives to deliver high-quality, innovative outdoor products, which are considered by many as expensive. However, when considering some risks and weaker points regarding the company, a neutral rating seems most appropriate currently.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Even though YETI has not been around as long as many other prominent outdoor brands, the company has managed to become synonymous with outdoor fashion. YETI’s products are used by both casual and seasoned outdoorsmen. Following a strong sales performance, the stock has gained 19% over the past year, although it has dipped significantly recently.

Optimizing Sales Distribution

The key to a successful product distribution strategy lies between achieving maximum visibility and cost efficiency. With this goal in mind, YETI has wisely chosen a balanced omnichannel distribution approach. YETI distributes its products via Wholesale and Direct-to-Consumer sales.

By patterning with large outdoor retailers like Bass Pro Shops, Academy Outdoors (NASDAQ:ASO), and Dick’s Sporting Goods (NYSE:DKS), YETI achieves great visibility for its products, raising more awareness for the brand name. At the same time, the Direct-to-Consumer channel improves cost efficiency and leads to greater margin capability.

For 2022, the Wholesale channel accounted for 42% of sales (down from 44% in 2021), while the direct-to-consumer channel accounted for 58% of sales. Meanwhile, in Q3 2023, Wholesale continued to fall as a percentage of revenue, accounting for 40.2% of sales.

Cyclicality & Seasonality Risks

YETI’s products are discretionary in nature, as they cater to consumers’ leisure spending, and as such, sales are expected to fluctuate with business cycles. An unfavorable macroeconomic environment represents one of the largest risks for the company, as it should lead to a slowdown in growth.

Consumer sentiment is widely used as a gauge of discretionary consumer behavior. The Consumer Sentiment Index, reported by the University of Michigan for several decades, fell to multi-decade lows in 2022 (index level of 50.0 in June 2022). Despite showing some recovery signs in 2023, the index has recorded another drop late in the year, sitting at 61.3 as of November 2023, significantly lower than historical average levels.

YETI’s business, like most retail-focused products, also displays seasonality, with higher sales usually recorded in the fourth quarter of the fiscal year.

Evaluating YETI’s Financial Performance

Over the past few years, YETI has managed to record strong revenue growth, with sales increasing from $1.1 billion for the 2020 fiscal year to $1.6 billion for 2022. Over the past five years, YETI has recorded a 16.5% annualized growth in sales, beating sector averages (the consumer discretionary sector has grown at 6.2% annually for the past five years).

Unfortunately, the company’s profitability metrics, albeit still rather strong, have been decreasing over the past few years. Higher freight costs, voluntary recalls, and higher production costs have negatively affected YETI’s gross margin by increasing the company’s cost of goods sold. For the 2022 fiscal year, YETI’s gross margin stood at 48% (compared to nearly 58% in Fiscal 2021 and 2022). Over the past couple of quarters, however, the company’s gross margin has stabilized again above the 50% level.

While SG&A expenses also increased over the past years due to higher input cost inflation, YETI’s EBITDA margin stands around the 8% level. Overall, the company displays strong profitability, particularly on a gross margin basis.

YETI’s improved financial performance is also evidenced by its results on a TTM basis. For the past four quarters, YETI has recorded $1.59 billion in revenue and $795 million in gross profits, showing an improving gross margin. Net income for the TTM is, however, somewhat low, at $64 million.

Looking at its cash flow statement, YETI’s cash from operating activities decreased from $366 million to $100 million in the past three fiscal years. That was primarily due to increasing working capital outflows (mainly inventory) and the negative cash effect of voluntary recalls. On the bright side, cash flow from operations is expected to significantly increase for the 2023 fiscal year (it has already increased to $287.9 million on a TTM basis) and stabilize over the medium term as both inventory management and recalls normalize.

Focusing More on International Sales

One area where YETI needs and plans to expand is its international sales. Currently, just 14% of sales originate from outside the United States. International sales have increased dramatically since 2018 (when they represented only 2% of YETI’s revenue mix) and represent a major growth opportunity for the company.

A Relatively Stretched Valuation

YETI’s strong stock performance in 2023 has invited elevated valuation multiples. Currently, the stock trades at a 21.8x forward P/E, which stands significantly above the consumer discretionary sector average P/E of 16.1x. On a forward EV/EBITDA basis, YETI seems more reasonably valued (trading at a 13.4x multiple), while the stock’s 2.8x P/S is also a bit pricey relative to the industry average of just under 1.0x.

Is YETI Stock a Buy, According to Analysts?

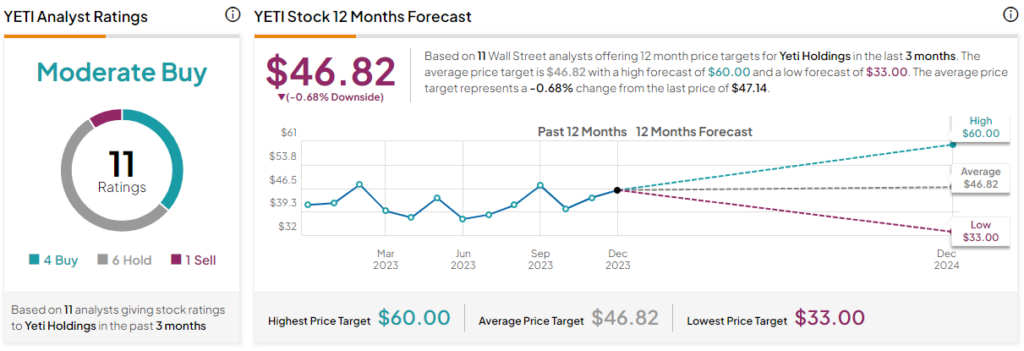

Turning to Wall Street, YETI has a Hold consensus rating based on four Buys, six Holds, and one Sell rating assigned over the past three months. The average YETI stock price forecast of $46.82 represents 0.7% downside potential, with a high forecast of $60.00 and a low forecast of $33.00.

The Takeaway

YETI is a relatively new player in the outdoor industry, and as expected, the company’s strong growth record has invited a pricey valuation. Despite that, the company exhibits some noticeable strengths, including growing brand awareness and solid profitability. By focusing more on international growth, cash flow productivity, and avoiding falling into a cyclical downturn, the stock may be able to perform better than expected, going forward.

Still, the risks and its elevated valuation warrant a neutral rating overall.