The past week has been a good one for XPeng (XPEV) investors, with shares surging about 63%. This is coming as welcome relief after a horrible period for the Chinese EV maker. To wit, even after the uptick, the shares are still down by 76% year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

So, what’s behind the rally? According to Deutsche Bank analyst Edison Yu, the gains are largely down to a “short squeeze caused by investors getting too negative on the company’s cash runway and more generally on COVID/competition risks.”

“While XPeng has clearly made several strategic missteps this year,” Yu went on to explain, “it still has many shots on goal left (35 billion RMB net cash exiting 3Q) and just underwent a restructuring to streamline its branding/ PR efforts.”

Moving forward, Yu believes sales will get a boost from new models but the key to long-term success will depend on the company constantly attaining monthly demand of 15,000-20,000 units.

That said, Yu thinks that probably has “little chance of happening until the end of 2023.” Meanwhile, in the interim, the company will face “increasing competitive pressure,” and that means there will be plenty of “uncertainty” ahead – at least for the foreseeable future.

However, it is the ample cash reserves that Yu thinks offers the company the time needed to put things right, “win back market share and continue developing its ADAS/AD and fast charging technology.”

The company anticipates 2022 R&D expense will be around 5.5 billion RMB and then drop in 2023. Additionally, Capex is not anticipated to be higher than 4.5 billion this year and then fall below 3 billion next year. “Even with our low volume outlook,” Yu said, “we think XPeng exits 2023E with >20bn in net cash, suggesting plenty of runway.”

All told, then, Yu sticks with a Buy rating and $14 price target, suggesting shares will climb 17% higher over the coming months. (To watch Yu’s track record, click here)

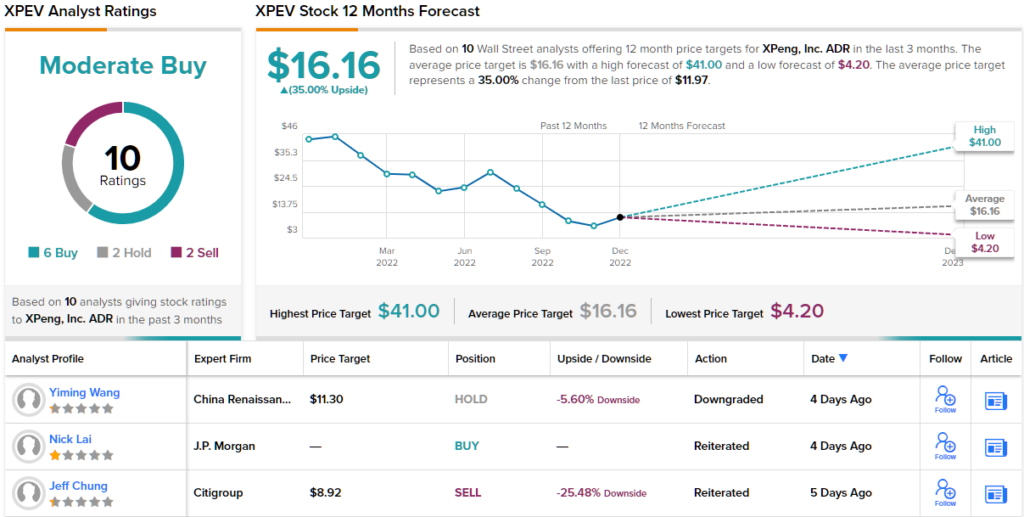

And what about the rest of the Street? The ratings are a mixed bag, but ultimately, the stock claims a Moderate Buy consensus rating, based on 6 Buys vs. 2 Holds and Sells, each. Going by the $16.16 average target, the shares are anticipated to generate 12-month returns of 35%. (See XPeng stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.