XPeng (NYSE:XPEV) is scheduled to report its fourth quarter and Fiscal Year 2022 results on March 17, before the market opens. The Street expects XPeng to post a loss of $0.31 per share in Q4 versus earnings of $0.18 per share reported in the prior-year period. Also, revenue is expected to decline by 39% year-over-year to $813 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Supply-chain headwinds and heightened competition during the quarter impacted the company’s Q4 delivery numbers. The electric vehicle maker’s fourth-quarter vehicle delivery report reflects a 46.8% year-over-year fall in total deliveries to 22,204 vehicles. This is expected to have impacted XPeng’s top-line growth.

Furthermore, strict lockdown measures in China due to the spread of COVID-19 might have impacted the company’s production capacity in the quarter. In addition, expenses might have remained elevated in the to-be-reported quarter due to promotional activities.

For the upcoming fourth quarter, the company expects to report total revenue in the range of RMB4.8 billion to RMB5.1 billion, representing a year-over-year drop of around 40.4% to 43.9%.

Is XPEV Stock a Buy?

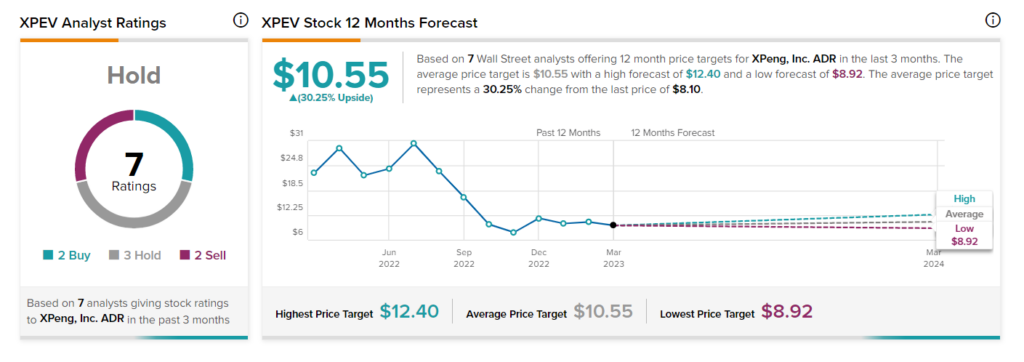

Overall, XPeng has a Hold consensus rating based on two Buys, three Holds, and two Sells. The average XPEV stock price target of $10.55 implies 30.3% upside potential. The stock has tumbled nearly 20.4% year-to-date.

Ending Thoughts

Soft vehicle delivery numbers for the first two months of 2023 continue to raise concerns about XPeng’s top-line growth. Nevertheless, the company is expected to launch three new EVs this year, which could help XPeng accelerate delivery growth.