Oil prices continued to decline last week despite the announcement of output cuts by the Organization of the Petroleum Exporting Countries and allies (OPEC+). Sluggish global manufacturing activity is weighing on oil demand and, consequently, prices. However, analysts are looking beyond the near-term weakness and are bullish on several oil stocks based on their long-term growth potential and ability to offer attractive returns via price appreciation and dividends. Using TipRanks’ Stock Comparison Tool, we placed Exxon (NYSE:XOM), ConocoPhillips (NYSE:COP), and SLB (NYSE:SLB) against each other to find the oil stock that has the best upside potential as per Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Exxon Mobil Stock (NYSE:XOM)

Exxon Mobil generated phenomenal profits last year, driven by the spike in oil and gas prices due to the Russia-Ukraine war. However, energy prices have cooled down compared to the last year, resulting in a decline in the company’s third-quarter results and an earnings miss. Nonetheless, it is worth noting the company’s Q3 2023 earnings were higher than the second quarter, fueled by strong refining throughput and increased crude prices.

Looking ahead, Exxon is optimistic about its recently announced $59.5 billion acquisition of Pioneer Natural Resources. The deal will expand the company’s presence in the lucrative Permian Basin.

What is the Prediction for Exxon Stock?

On November 14, Mizuho analyst Nitin Kumar reiterated a Buy rating but lowered his price target for Exxon stock to $133 from $139 to reflect the outlook update. The analyst reduced his downstream (Refining and Chemicals business) estimates for 2024 to 2026.

That said, Kumar maintained his long-term forecasts based on the assumption that XOM would increase activity and capital expenditure to achieve the 2mmboe/d (million barrels of oil equivalent per day) volume outlook from the Permian until he has “better visibility into promised synergies” from the Pioneer acquisition.

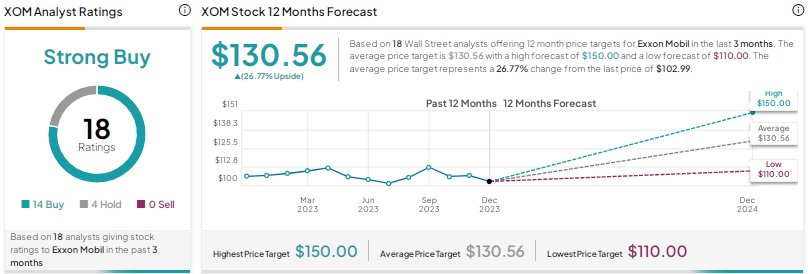

Including Kumar, 14 analysts have a Strong Buy consensus rating on Exxon stock, while four have a Hold recommendation. The average price target of $130.56 implies 27% upside potential. XOM shares have declined about 7% year-to-date.

Exxon recently raised its quarterly dividend by 4.4% to $0.95 per share. XOM stock offers a dividend yield of 3.7%.

ConocoPhillips Stock (NYSE:COP)

Last month, integrated oil and gas company ConocoPhillips impressed investors with better-than-expected third-quarter earnings, even as the bottom line declined compared to the year-ago quarter due to lower prices in contrast to the elevated levels seen last year.

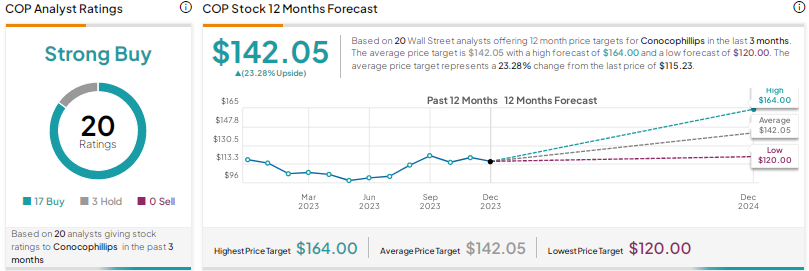

Investors also cheered a 14% hike in COP’s quarterly dividend to $0.58 per share. ConocoPhillips also paid a variable return of cash (VROC) of $0.60 per share on October 16. Including the variable component, COP’s dividend yield stands at about 4%.

ConocoPhillips raised its full-year production guidance to about 1.82 mmboe/d from the prior guidance of 1.80 to 1.81 mmboe/d due to the purchase of the remaining 50% interest in Surmont. The company is positive about its growth potential, given that several international projects reached the first production stage in October, positioning it for strong performance in 2024 and beyond.

Is COP Stock a Good Buy Now?

On November 14, RBC Capital analyst Scott Hanold reiterated a Buy rating on ConocoPhillips stock and increased his price target to $135 from $130. Hanold thinks that the breadth of strong operational performance differentiates ConocoPhillips from its peers into 2024.

Wall Street’s Strong Buy consensus rating on COP stock is based on 17 Buys and three Holds. At $142.05, the average price target implies 23.3% upside potential. Shares are down 2.4% so far in 2023.

Schlumberger Stock (NYSE:SLB)

Oilfield services company SLB, previously known as Schlumberger, delivered mixed results for the third quarter. The company’s adjusted EPS grew 24% year-over-year to $0.78 and exceeded analysts’ expectations. Revenue grew 11% to $8.3 billion but marginally lagged the Street’s estimates.

The company attributed the year-over-year growth in its third-quarter revenue to the ninth consecutive quarter of double-digit growth in revenue from international markets. Notably, the growth in its international markets’ revenue is outpacing the growth in its North America segment’s revenue.

In the international markets, SLB is seeing solid demand for its services in the Middle East and Asia. Also, it is benefiting from the resilient performance of its offshore business.

Is SLB Stock a Buy?

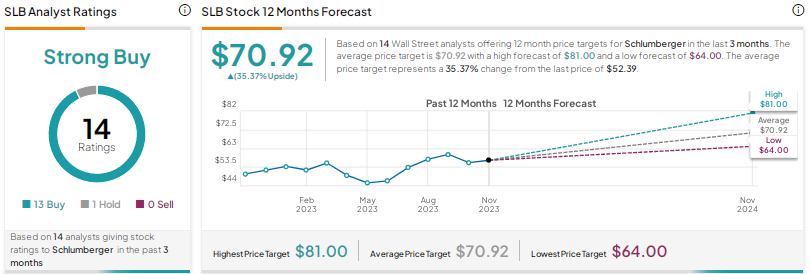

On October 24, Barclays analyst David Anderson raised his price target for SLB stock to $77 from $75 and maintained a Buy rating. The analyst stated that the company once again delivered solid quarterly results. He believes that SLB is best positioned as the cycle expands in international markets and offshore. However, Anderson thinks that the company still needs to prove to Wall Street that it can deliver sector outperformance.

With 13 Buys and one Hold, SLB stock earns a Strong Buy consensus rating. The average price target of $70.92 implies 35.4% upside potential. Shares are down 2% year-to-date. SLB offers a dividend yield of 1.8%.

Conclusion

Wall Street is bullish on all the three oil stocks discussed above. That said, they see higher upside potential in SLB than Exxon and ConocoPhillips. Mainly, SLB is expected to benefit from the robust demand for its offerings in the international and offshore markets.