The Healthcare Select Sector SPDR ETF (NYSEARCA:XLV) has had a relatively quiet 2023 thus far. XLV has a loss of about 1.1% year-to-date, but it looks like an attractive investment vehicle in the current environment — here are five reasons why.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

1. Healthcare is Defensive

Between soaring inflation, rising interest rates, and a spate of bank failures, the stock market has been volatile over the past year, and the economy is on uncertain footing. That’s why a healthcare ETF like XLV makes a lot of sense in this challenging investment environment.

Unlike parts of the consumer goods sector, for example, healthcare is not discretionary spending. In the event of an economic slowdown or a recession, many people will put off making major purchases like a house or a car and hang on to their current car or hold off on upgrading to a bigger house for a few years.

They may also forgo eating out, skip going on vacation, or cut costs in other areas, but they most likely aren’t going to forgo spending on their healthcare needs, as healthcare is more of a necessity than a want. Therefore, an ETF like XLV, which invests in the healthcare segment of the S&P 500 (SPX), should help investors fortify their portfolios in the event that the economic picture worsens.

Healthcare is less dependent on overall economic growth, and healthcare stocks have outperformed during stagflationary environments in the past. Therefore, it seems like a good sector to be exposed to amid a challenging macro backdrop.

2. Healthcare Valuations are Modest

Adding to XLV’s defensive positioning is the fact that valuations in the healthcare sector are relatively modest. The average P/E multiple for XLV as a whole was 17.2 times earnings at of the end of Q1. While this isn’t a screaming bargain, it is several turns cheaper than the broader market, as the S&P 500 currently has an average P/E multiple of 23.5.

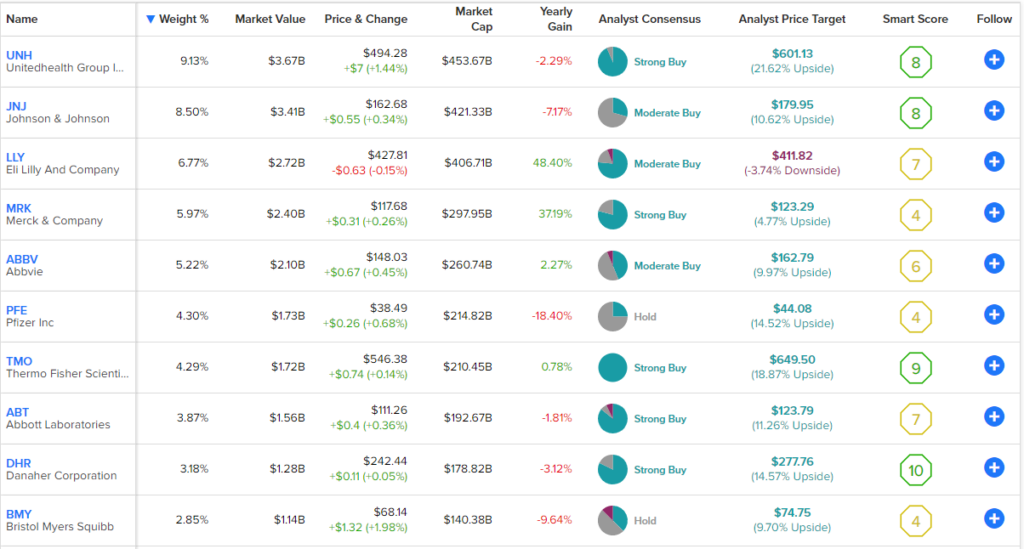

By using TipRanks’ holdings tool, we can get an overview of XLV’s top holdings. Some of these holdings trade at pretty attractive valuations. For example, top 10 holding AbbVie (NYSE:ABBV) trades at just 13.4 times earnings, while Bristol Myers (NYSE:BMY) trades at an even cheaper 8.3 times earnings.

3. Stable, Growing Dividends

Many of these individual stocks listed above also feature some pretty attractive dividend yields, such as AbbVie’s 4%, Bristol Myers’ 3.4%, and Pfizer’s (NYSE:PFE) 4.3%. Unfortunately, though, because it holds some positions with lower yields or that don’t pay a dividend at all, XLV’s dividend yield of 1.5% is lower than that of these individual examples.

That being said, it has a rock-solid track record as a dividend payer. XLV has paid out an annual dividend to its investors for 22 years in a row, and it has currently increased the amount of this payout for 13 years and counting. So, while the current dividend yield may not get your heart racing, investors can have reasonable confidence that XLV’s dividend payout will continue to grow over time.

4. Minimal Fees

Another attractive aspect of XLV is that investors in the fund pay minimal fees. XLV has an expense ratio of just 0.10%. This means that an investor putting $10,000 into XLV today would pay just $10 in fees over the course of the year.

Assuming a 5% return on the investment each year, an XLV investor would pay just $32 after three years, $56 over the course of five years, and $128 over the course of the decade (according to the ETF’s prospectus), which is very reasonable. Fees can really add up over the years, so investing in low-cost ETFs like this is a good way to preserve and grow the overall value of your portfolio over time.

5. Innovation

So far, we’ve covered this ETF’s appeal thanks to its defensive nature, modest valuation, reliable dividends, and low fees. This almost makes it easy to forget that healthcare stocks also have considerable room for upside based on their innovation.

Many of these companies are working on some pretty amazing treatments and trying to find cures for ailments and diseases that affect millions of people worldwide. Finding and commercializing cures and treatments for these diseases and conditions not only improves the lives of the people who suffer from them but can become major blockbusters for these companies.

For example, top 10 holding Eli Lilly’s weight-loss drug Mounjaro could help in the fight against obesity by helping adults lose as much as 22.5% of their body weight (measured over a 72-week period). The CDC finds that roughly 40% of Americans are obese, so there is a massive potential market for this type of treatment.

Meanwhile, Eli Lilly is also working on Donanemab, a potential cure for Alzheimer’s, and Mirikizumab, a potential treatment for ulcerative colitis and Crohn’s disease. Evaluate Vantage forecasts that if approved, both of these drugs would bring in over a billion dollars worth of annual revenue in 2028. Other top holdings like AbbVie and Merck are developing treatments for conditions like Lymphoma and Pulmonary arterial hypertension, respectively, which have similar blockbuster potential.

These types of projections should, of course, be taken with a grain of salt, as some of these treatments still have a long way to go before being approved and successfully commercialized, and their projected sales are a long way into the future. However, it does illustrate the high level of potential upside that healthcare stocks can have.

What is the Price Target for XLV Stock?

The analyst community agrees that there is some upside here as well, collectively rating the XLV stock a Moderate Buy. Of the 764 analyst ratings on XLV, 61.9% are Buys, 35.5% are Holds, and 2.6% are Sells. The average XLV stock price target of $151.66 implies upside potential of 13.5% from here.

Risks

While these are five features that make XLV an attractive investment opportunity, all investments come with risks, and XLV is no different. Since XLV holds some drug companies, drugs not being approved by the FDA or successfully commercialized are top risks that come to mind. On the other hand, this is a diversified portfolio of healthcare companies, which blunts the risk of one drug failing.

Furthermore, it’s important to note that this is a healthcare ETF, not a biotech or pharma ETF, so not all of the companies here are developing drugs. Top holding United Group (NYSE:UNH) is an insurance company, while other top 10 holdings, including ThermoFisher (NYSE:TMO) and Danaher (NYSE:DHR), provide equipment to the healthcare industry.

One additional industry-wide risk to keep an eye on is the White House’s pressure on drug companies to lower prices, but there is no guarantee that this will become law. Furthermore, the proposed drug price caps would only affect Medicare Part D, meaning that not everyone will be affected.

Lastly, I view UnitedHealth Group’s weighting of over 9% as a potential risk, not because of anything specific to the company itself but simply because this gives XLV investors a lot of exposure to a single stock and takes away from the ETF’s diversification.

Looking Ahead

In conclusion, the XLV ETF looks like a relatively appealing port in the storm of market volatility and an uncertain economic outlook. The ETF’s stocks are mostly reasonably priced, and it pays a consistent dividend, charges an investor-friendly 0.1% management fee, and invests in a defensive sector that is less dependent on overall economic growth. Therefore, XLV looks like a sensible ETF that investors should take a look at.