Gambling stocks have been on the mend in recent years since the dark days of COVID-19 lockdowns. Though the casino plays tend to be tied to the state of the economy (less cash to gamble when there’s less disposable income), it certainly seems like a mild economic downturn is already priced in at current levels, at least when it comes to the physical casino firms.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, casino firms are eager to win over the online crowds as they improve their digital presence to get a piece of the fast-growing market sub-sector. Should the economy show signs of turning while online gaming continues to boom, the following trio of gambling stocks may be worth watching for the new year.

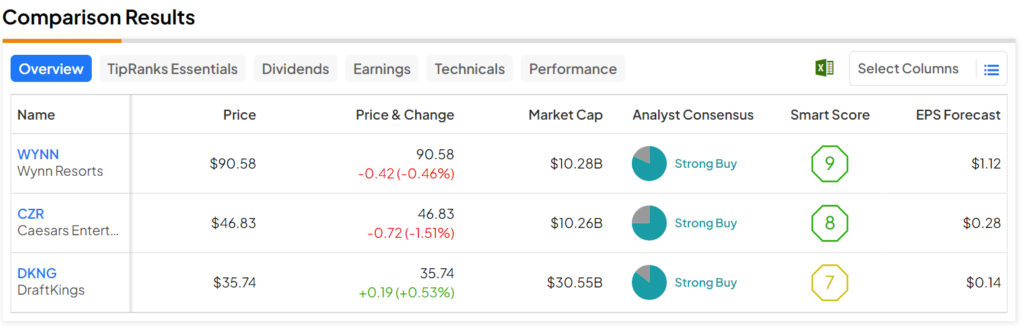

Let’s use TipRanks’ Comparison Tool to see which gaming play could sport the biggest payout for the year ahead.

Wynn Resorts (NASDAQ:WYNN)

Wynn Resorts has been a rollercoaster ride in recent years, plunging more than 40% on four separate occasions in the last 10 years. Today, the stock is down around 21% from its 52-week high and 63% from its all-time high hit back in 2014. As a way to play the high rollers in Vegas and Macau, Wynn stands out as an intriguing bounce-back candidate if 2024 ends up as another year that’s better than feared.

Undoubtedly, inflation and macro uncertainty have hit gamers and travelers quite hard in recent years. Additionally, weakness in China has continued to weigh on Wynn and its Macau business. Going into the new year, it’s hard to be optimistic about China’s economic prospects. They’re going through a brutal downturn, one that could take years to fully bounce back from. And with regulators taking aim at VIP gaming in Macau, it’s been tough to double down on Wynn over its rivals.

In any case, Wynn Macau is showing signs of continued recovery, and I believe that’s more than enough reason to stay the course with the high-end gaming stock as it continues to build brand affinity.

With fairly modest expectations baked in for 2024, I view Wynn stock as a potential value play hiding in plain sight. So, just like the Wall Street crowd, I have to stay bullish on the longer-term growth potential powered by Macau and the high-end of the gambling scene.

At writing, the stock trades at a 29.15 times forward price-to-earnings (P/E) ratio, considerably higher than the 12.6 times forward P/E of its rival Caesar’s Entertainment.

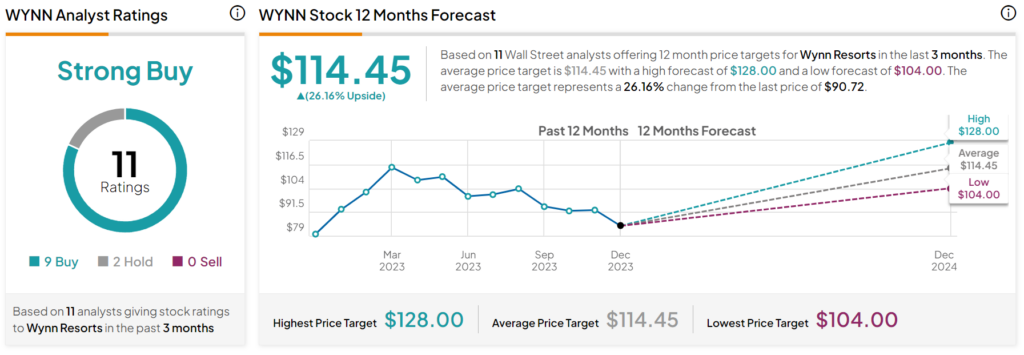

What is the Price Target for WYNN Stock?

Wynn Resorts stock is a Strong Buy, according to analysts, with nine Buys and two Holds assigned in the past three months. The average WYNN stock price target of $114.45 implies 26.16% upside potential.

Caesars Entertainment (NASDAQ:CZR)

Caesars Entertainment lacks the luxury appeal of Wynn Resorts. However, it also lacks the premium multiple attached to its stock. As one of the deepest value plays on the Vegas Strip, it’s hard not to be bullish as the stock trades at a mere 12.4 times forward expected P/E. Indeed, shares of CZR seem like dead money after flatlining for a year and a half following a brutal 2021-22 plunge that saw the stock shed more than 70% of its value. Though CZR is a less exciting play than WYNN, I remain bullish, like most analysts, due to the very modest price of admission.

Further, the third quarter had bright spots that could signify a potential turning of the tides in Vegas. For the quarter, Caesars topped estimates as guest demand experienced notable improvement. Additionally, the sports-betting and digital gaming business clocked in its second consecutive quarter of positive EBITDA.

Indeed, Caesars’ iGaming platform may very well be a wild card that helps lift CZR stock out of its multi-year funk. Now, Caesars isn’t a digital gambling pure-play, but it has shown it has game in the fast-growing segment.

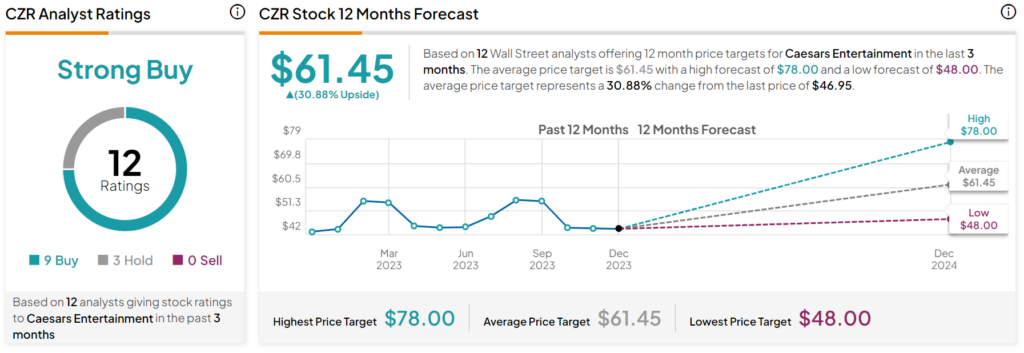

What is the Price Target for CZR Stock?

Caesars stock is a Strong Buy, according to analysts, with nine Buys and three Holds assigned in the past three months. The average CZR stock price target of $61.45 implies 30.88% upside potential.

DraftKings (NASDAQ:DKNG)

For those seeking a digital gambling pure-play, it’s hard to look past DraftKings. Famed innovation investor Cathie Wood sold some of her shares back in November, but the Wall Street community remains overwhelmingly bullish, with its “Strong Buy” rating. While I can’t fault Wood for selling around $8.8 million in DKNG stock after more than tripling (up 221% year to date) on the year, I do see many catalysts that could keep the good times going at the digital gaming firm. For this reason, I’m staying bullish on the stock.

Though online gaming is wildly competitive, with numerous players likely to bombard you when you watch your favorite sports program on television, DraftKings has found a way to flex its muscles. The company isn’t just winning over new users at an impressive rate; it’s been able to expand its margins. For 2028, DraftKings is shooting for a 30% adjusted EBITDA margin. Given management has been hitting home runs for investors through 2023, I don’t doubt the firm’s abilities to hit (or even exceed) its long-term EBITDA margin target.

DraftKings is still the best pure-play digital gambling stock, in my books, even if the odds are now somewhat less favorable than a year ago due to its price gain.

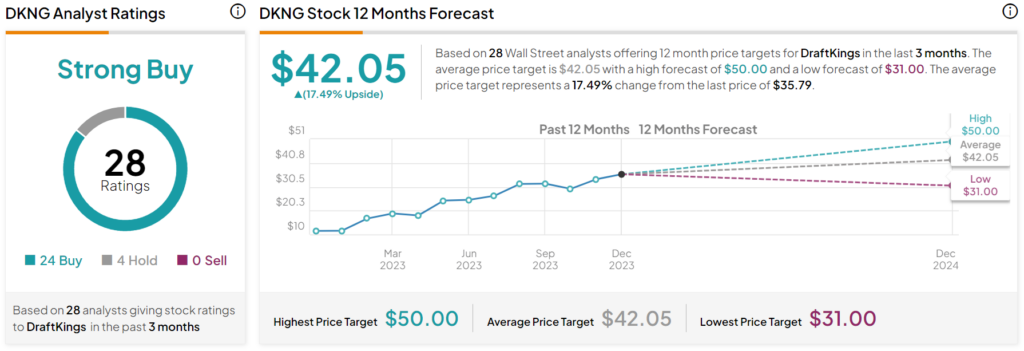

What is the Price Target of DKNG Stock?

DraftKings stock is a Strong Buy, according to analysts, with 24 Buys and four Holds assigned in the past three months. The average DKNG stock price target of $42.05 implies 17.5% upside potential.

Takeaway: Analysts Expect the Most Upside from CZR Stock

Gambling stocks are viewed quite favorably going into the new year. As digital gaming momentum continues while disposable income looks to recovery, the gaming plays look to have intriguing odds. Of the trio mentioned in this piece, analysts expect the most upside from CZR stock.