Workhorse Group (WKHS) operates in two divisions, Automotive and Aviation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Automotive division operates as an original equipment manufacturer of class 3-6 commercial-grade, medium-duty truck chassis, marketed under the Workhorse brand.

The Aviation division offers delivery drones and SureFly multicopter. The company was in 2007 and is headquartered in Loveland, Ohio.

I am bearish on WKHS stock, as the company has severe problems wih its operating plans that cause a huge opportunity cost in revenue. The stock has underperformed Nasdaq and poses a lot of risks now for retail investors.

Workhorse Group Business News

The firm in September 2021 announced it had plans to transform from an “advanced technology start-up to an efficient manufacturing company.”

The company identified a plethora of enhancements in both the production process and design of its C-1000 vehicles, so it decided to suspend the deliveries of C-1000 vehicles. It also had to recall 41 vehicles already having been delivered.

Initially, Workhorse Group stated it expected the testing and modifications would be completed in the fourth quarter of 2021. There has been a considerable delay as of today with no update other than the one during the Q3 2021 earnings call, stating a production forecast will be given in early Q1 2022.

If there are more delays the news is certainly not good for Workhorse. Investors are aware of this as WKHS stock has had losses of nearly 33% year-to-date, and approximately 84% in the past year.

On November 8, 2021, the electric van-maker announced that there was an investigation by the U.S. Department of Justice and the U.S. Securities and Exchange Commission that was related to an award of a U.S. Postal Service (USPS) contract.

The firm had challenged the decision by the U.S. Postal Service to choose a competitor, Oshkosh Defense to provide vehicles for its postal delivery operations.

The latest update by Workhorse Group is that it “strategically withdrew from the USPS lawsuit to pursue opportunities with the federal government.” I would argue that this is a smart move.

Q3 2021 Results

For the third quarter ended September 30, 2021, Workhorse Group announced sales, net of returns, and allowances of ($0.6 million) compared to $0.6 million in the third quarter of 2020.

As expected, this related to a $1.1 million refund liability to the recall of the C-1000 vehicles.

Cost of sales increased to $11.5 million from $2.8 million in Q3 2020, and selling, general and administrative expenses increased to $10.6 million from $6 million in the same period last year. Research and development expenses increased to $2.8 million, compared to $1.6 million in the same period last year.

Net loss was $81.1 million, compared to a net loss of $84.1 million in the same period last year, and the loss from operations widened to $25.5 million compared to $9.8 million in Q3 2020. The company reported having on its balance sheet $230.4 million in cash and cash equivalents.

Fundamentals – Risks

The Piotroski F-Score of 3 is low, which is justified by poor business operations. The revenue per share has been in decline for the last five years, and there is poor financial strength.

Workhorse has been issuing new debt, and the D/E ratio of 1.28 is high considering there is a cash burn problem both on an annual, and quarterly basis.

Wall Street’s Take

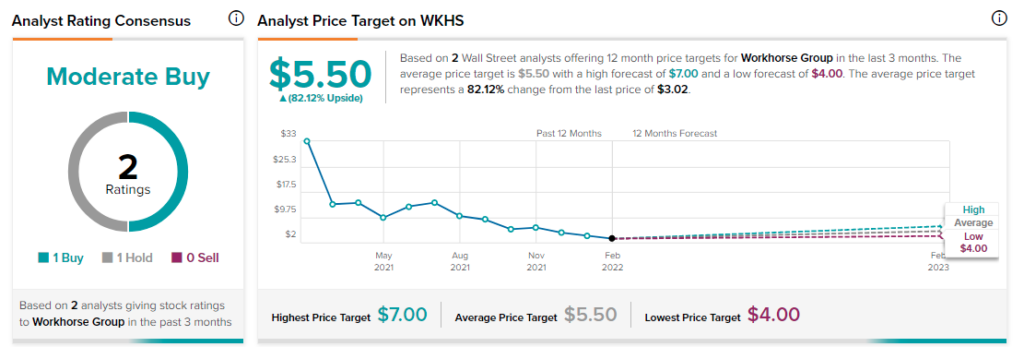

Workhorse Group has a Moderate Buy consensus based on one Buy and one Hold. The average Workhorse Group price target of $5.50 represents 82.1% upside potential.

Conclusion

The delays in putting C-1000 models back to production are severe as there is a serious cash burn problem. Emphasis must be given to commercialization plans, as there is also a debt problem running.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure