Walmart (NYSE:WMT) and Linde (NYSE:LIN) boast an impressive history of consistent dividend payments and stable operations. Investors looking for reliable and steady income could consider these stocks, often referred to as Dividend Aristocrats (companies that have increased their dividends for over 25 consecutive years). Furthermore, Top Wall Street Analysts are bullish on these stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Before moving forward, it’s important to mention that TipRanks identifies the Top Analysts per sector, per timeframe, and against different benchmarks. The ranking shows an analyst’s ability to deliver returns through recommendations.

Therefore, let’s take a closer look at these two Dividend Aristocrat stocks.

Walmart (NYSE:WMT)

The retail powerhouse continues to expand its offerings. It recently opened a pet care center in its store located in Dallas, Georgia.

Moreover, WMT has been setting up Walmart Health locations with the aim of providing low-cost healthcare services to its customers. With most of the Walmart stores located in prime locations, this expansion may help the company benefit from a huge growth opportunity in healthcare.

Overall, Walmart has a strong track record of financial stability, with 50 consecutive years of dividend increases. Additionally, the company is experiencing increased foot traffic in its stores and more manageable food price inflation. These factors make WMT stock an attractive option for income-focused investors.

Is Walmart Stock a Buy, According to Top Analysts?

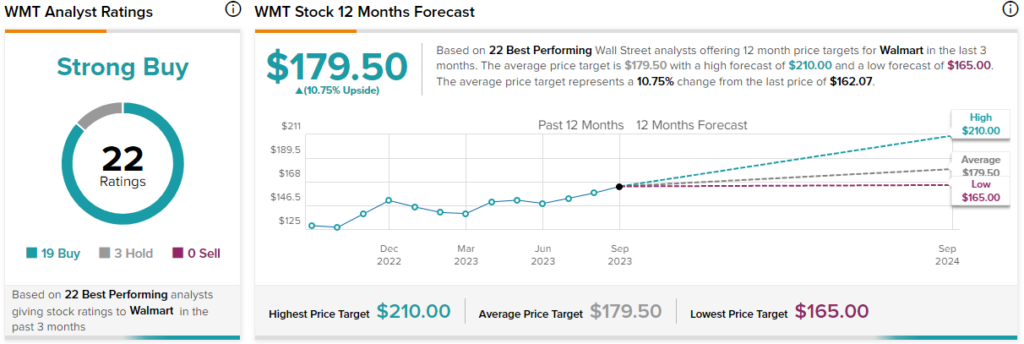

Walmart has received 19 Buys and three Hold recommendations from Top Analysts for a Strong Buy consensus rating. Further, WMT stock’s 12-month average price target of $179.50 implies 10.75% upside potential from current levels.

Linde (NYSE:LIN)

Linde, an industrial gas company, is making considerable investments in clean hydrogen. Also, its strong financial position keeps the company well-poised to undertake acquisitions, capital structure optimization, and share buybacks. Finally, it has the potential to reap benefits from the growing demand for industrial gases, particularly in the APAC region.

LIN stock has an impressive track record of increasing its dividend for 30 consecutive years. With its integrated asset base, pricing strategy, and productivity initiatives, it’s well-positioned to maintain its strong earnings and cash flows, potentially leading to higher dividend payments in the future.

Is LIN Stock a Buy, According to Top Analysts?

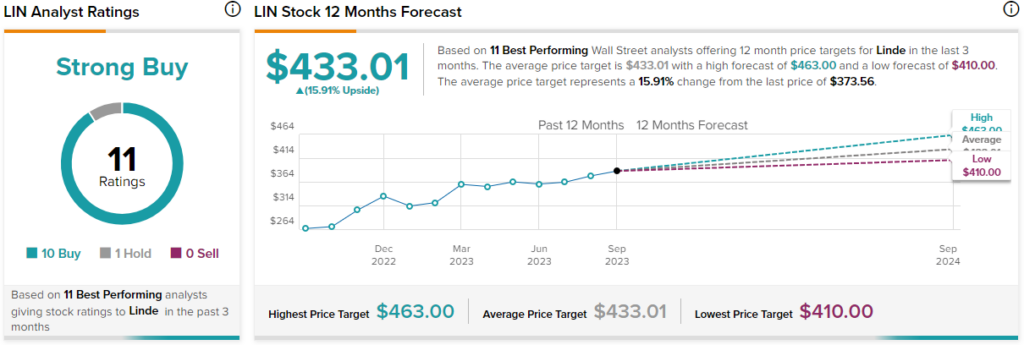

Linde stock has a Strong Buy consensus rating based on 10 Buys and one Hold recommendation assigned in the past three months by Top Analysts. Meanwhile, LIN stock’s 12-month average price target of $433.01 implies 15.9% upside potential from current levels.

The Takeaway

Strong growth prospects, impressive dividend growth histories, and sound financial positions make WMT and LIN attractive choices for those seeking consistent income and long-term portfolio stability. Additionally, the positive sentiment from Top Analysts adds to the overall confidence in these stocks.