It’s official, Twitter is no longer available for the general public to trade. With Elon Musk already making his mark on the microblogging social-media platform, many investors are likely wondering where they should look if they still seek upside from the battered social-media space. In this piece, we’ll look at two social-media companies, META and SNAP, that look far more compelling than Twitter. Indeed, social media turnarounds will not be easy, but Elon Musk’s big bet, I believe, suggests he sees value in the space.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Undoubtedly, Twitter is a beast when it comes to microblogging. It has more than its fair share of baggage. However, with visionary leader Elon Musk at the helm, anything is possible as he looks to lift the firm out of its historic funk.

Whether we’re talking about huge layoffs to improve upon profitability prospects or introducing controversial product changes (paying for verification), there’s no question that boldness and a willingness to pivot could be key to turning the ship around.

With interest rates on the rise, it’s about time that unprofitable (or barely profitable) social media platforms take the steps toward earnings growth. Though Musk’s reign will surely be turbulent, we, as investors, won’t be able to witness the choppiness of TWTR stock in the public markets anymore. It was a fun ride, but investors must look elsewhere for exposure to the social rebound, which may be in the cards for 2023.

With Twitter delisted, here are two stocks to consider.

Meta Platforms (NASDAQ: META)

Meta Platforms is already a profitable company that’s been raking in the cash flow from its social-media family of apps. Undoubtedly, Meta is an unpopular company among the general public and investors.

CEO Mark Zuckerberg is going all-in on the metaverse, with around $15 billion spent on metaverse initiatives. In a rising-rate environment, blowing such sums of cash will be met with a penalty, even if such projects promise prosperous gains in the future.

Recently, Meta stock has been gaining traction after its catastrophic implosion of more than 75% from peak to trough. Meta is laying off 11,000 workers, a move met with optimism on Wall Street.

As Meta continues to pull the brakes on its forward-thinking ambitions while righting the ship with Facebook, I do think META stock has the means to produce solid results for investors moving forward. If anything, Meta is still the best publicly-traded social media stock out there. While TikTok is a formidable rival to stack up against, I do not doubt Meta’s abilities to replicate and build upon the success of its video-based social-media counterpart.

Going into 2023, analysts will be far more upbeat with the “leaner” version of Meta. Even as ads weigh in a recession year, the stock is oversold here, leaving considerable upside for brave dip-buyers. Over the last five trading days (at writing), the stock is up more than 24%.

Despite the run, Meta stock is still cheap at 10.7x trailing earnings. Such a multiple does no justice to the durable social-media family of apps. Forget the metaverse; the portfolio of wonderful social-media apps will help Meta stock power higher from its crash.

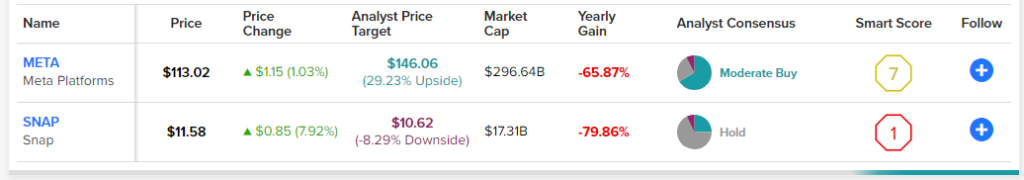

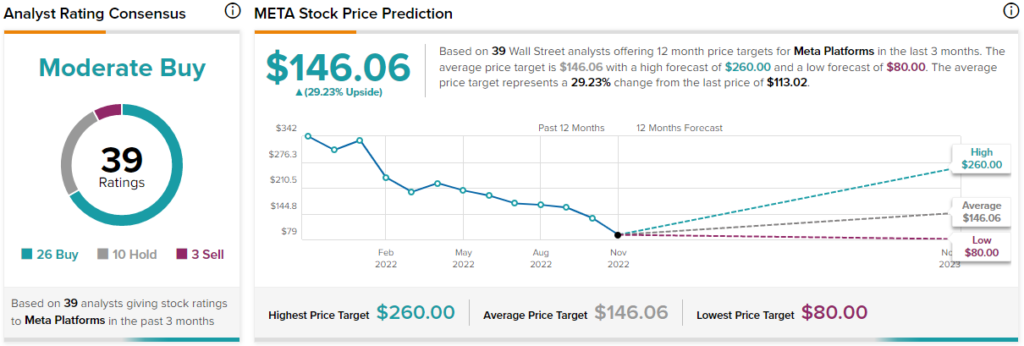

What is the Price Target for META Stock?

Wall Street is bullish on Meta. The average META stock price target of $146.06 has come down a long way over the past year. Still, the average price target suggests 29.2% gains to be had from here.

Snap (NYSE: SNAP)

Recovering from the social-media wreckage will be no snap for companies that have struggled to sustain profitability. Even after its recent bounce, Snap stock remains down 86% from its all-time high. Amid Meta layoffs, Snap investors seem upbeat that similar job cuts could be in the cards for Evan Spiegel’s empire.

Undoubtedly, Snap has many forward-thinking projects, including augmented reality (AR) software and hardware (glasses) tech. Indeed, such products could be essential to next-level growth. However, as rates rise, the brakes may need to be pulled to get Snap out of the gutter.

Like TikTok, Snap’s user base is comprised in large part of younger audiences. As the company looks to increase engagement (and growth) while being more mindful of profitability metrics, I think the firm can find a sweet spot.

At writing, shares trade at 4.1x sales, a modest multiple to pay for a firm that could turn a corner as it gets its costs under control.

What is the Price Target for SNAP Stock?

Wall Street is cautious about Snap shares, with a “Hold” rating. The average SNAP stock price target of $10.62 suggests 8.3% downside potential from here.

Conclusion: Wall Street Sees More Upside in META Stock

The social-media stock scene is less crowded, with Twitter now off the public markets. Still, there’s no shortage of promising (and beaten-down) social stocks to play a recovery. META stock is preferred by Wall Street over the likes of Snap.