For the past 17 months, the United Parcel Service, Inc. (UPS) under Carol Tomé has been laser-focused on a “better, not bigger” strategy to drive up shareholder value across the company’s three operating divisions. The plan focuses on improving three things: revenue quality, efficiency, and improved capital allocation. According to Tomé, the company is executing in all three areas effectively and has properly allocated capital so as to increase the quality of its revenue, the efficiencies of its package handlers, and the productivity of its trailer loads.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

An example of this initiative can be observed in UPS’ acquisition of Roadie. The crowdsourced delivery company uses a platform that enables it to handle small packages in a flexible way that UPS could not. This will open new growth opportunities for both Roadie as well as UPS.

Thus far, Tom´é’s strategy is paying off. The stock is up 33.68% over the past 12 months. UPS has also increased its weekend service to cover 90% of the U.S. for Saturday deliveries, which has added capacity to the UPS system and allowed it to free up Sunday overflows. This has led to consolidated operating revenue increasing by 9.2% to $23.2 billion for Q3 2021, and consolidated operating profit to increase by 23.4% to $3 billion.

I also calculate the intrinsic value of the stock to be $340.25. Considering that shares closed trading Friday at $206.54; there is a significant upside between where I calculate the intrinsic value verses where the market currently values the stock. Due to the stock price’s increase over the past 12 months, my calculation of the share’s intrinsic value, and the dividend the company is paying, I am bullish on UPS.

Recent Results and Dividend

UPS’s stock has been trading between $154.76 (the 52-week low set on January 29, 2021) and $220.64 (the 52-week high set on January 07, 2022).

Over the past year, UPS brought in revenues of $94.41 billion with a net income of $6.45 billion.

The company has reported third-quarter earnings of $2.71 per share, beating analyst estimates of $2.55 per share by $0.16. It has also reported $8.54 in earnings per share for 2021, beating Wall Street consensus estimates of $7.09 for that period.

Additionally, UPS pays a dividend of $1.02 per quarter. This represents just under a 1% increase over the past year and is also the thirteenth year in a row that UPS has increased its dividend.

The company has a solid set of financial statements. United Parcel has a Current Ratio of 1.47, denoting enough existing assets on hand to pay their bills for the next year and a half at their current burn rate.

When I calculated the stock’s intrinsic value by modeling discounted cash flows, I pegged it at $340.25. This stock has quite a lot of room to increase share price before the market value catches up with the stock’s intrinsic value.

Wall Street’s Take

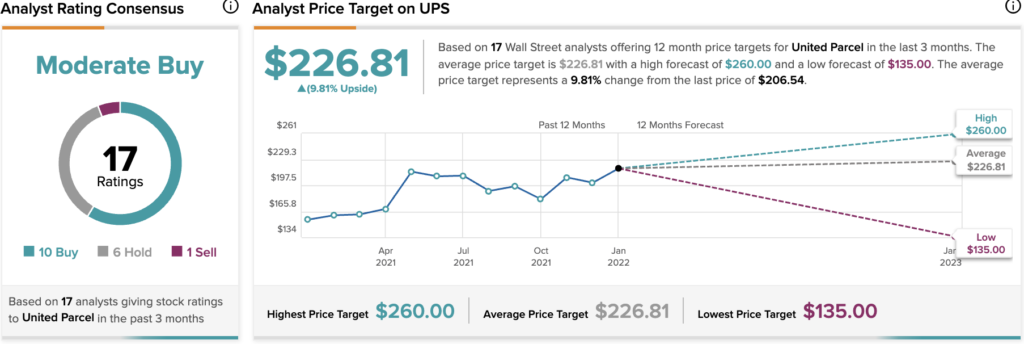

UPS has an analyst rating consensus rating of Moderate Buy, based on 10 Buy and 6 hold ratings, and 1 Sell rating. The average United Parcel Service price target is $226.81, reflecting a possible 12-month upside of 9.81%.

TipRanks.com shows that of the 16 bloggers that have blogged about UPS, 93% of them are bullish. This is above the overall blogger sentiment on the Industrial Goods sector, which stands at 75%.

Conclusion

Based on my calculated intrinsic value of the stock, the Wall Street analyst estimates, and blogger estimates covering the United Parcel Service, I am bullish on this stock. Carol Tomé seems to have the plan to drive shareholder value, and the market is responding to her efforts so far with a 33% increase in share price over the last twelve months.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure