With drug regulatory approval or rejection at stake, possibly no sector is more adept at delivering massive one-day gains – or for that matter, losses – than the biotech industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this in mind, it is safe to say Wednesday brought a smile to the faces of AVEO Pharmaceuticals (AVEO) investors. Shares skyrocketed after the FDA sprung on the company a positive surprise.

The FDA has given its nod of approval for Tivozanib, the company’s drug for the third and fourth-line treatment of advanced renal cell carcinoma (RCC), earlier than the March 31 designated PDUFA date.

The oral vascular endothelial growth factor (VEGF) tyrosine kinase inhibitor (TKI) was given the go-ahead based on positive results from the pivotal Phase 3 study, with the regulatory body granting the treatment a clean label. The FDA hasn’t asked for a post-market tivozanib study, either.

A launch date has already been set for March 31, with the drug given the brand name of Fotivda.

In preparation for the US launch, AVEO has been busy conducting market research, and has been hiring suitable personnel for the commercial push, including the recruitment of David W. Crist for the role of Vice President of Sales. Crist brings with him 20 years of oncology sales experience.

By the launch date, management has said the 65 strong oncology sales force’ training should be complete.

“Considering its commercial readiness, we expect AVEO to execute a successful Fotivda launch,” said H.C. Wainwright’s Swayampakula Ramakanth. “Together with the announcement of Fotivda’s approval, management also disclosed the pricing for the drug, set at a WAC price of $24,150 per cycle, which is higher than our assumption but within the range of cost for approved TKIs.”

With the higher pricing, Ramakanth increased Fotivda’s projected price per U.S. patient from $100,000 to $200,000. The analyst expects Fotivda to rule the roost, at least until generics enter in 2029.

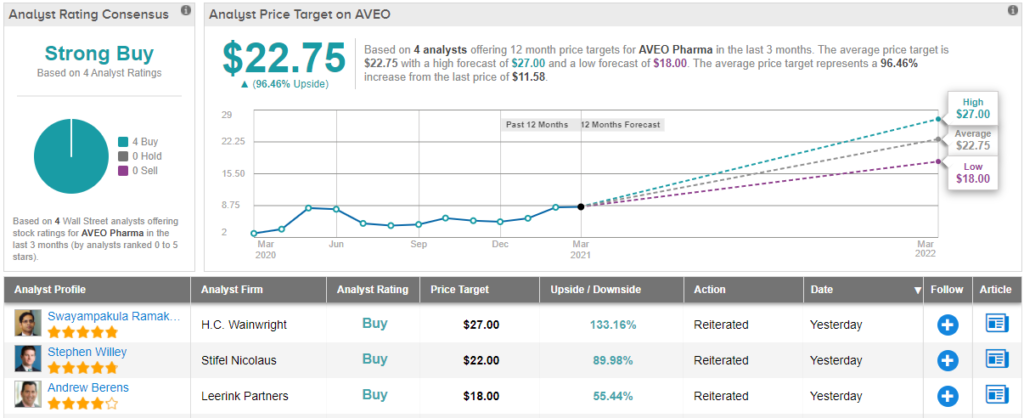

Following the FDA approval, Ramakanth more than doubled his AVEO price target from $12 to $27, implying upside of 133% on the 12-month time frame. Unsurprisingly, the 5-star analyst’s rating remains a Buy.

Two other analysts have recently reviewed AVEO’s prospects, and both have reached the same conclusion as Ramakanth. AVEO’s Strong Buy consensus rating is backed by a $22.75 average price target, suggesting gains of ~96% in the year ahead. (See AVEO stock analysis on TipRanks)

To find good ideas for biotech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.