In this piece, I evaluated two fast-casual restaurant stocks, Wingstop (NASDAQ:WING) and Shake Shack (NYSE:SHAK), using TipRanks’ comparison tool to determine which is better. Wingstop is a fast-casual restaurant chain that focuses on chicken wings, while Shake Shack is a fast-casual restaurant chain that focuses mostly on hamburgers, French fries, and shakes.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wingstop shares are up 22% year-to-date and 25% over the last year, while Shake Shack has surged 76% year-to-date, bringing its 12-month gain to 42%.

Despite these year-to-date rallies, Wingstop shares have plummeted 16% over the last month. Meanwhile, Shake Shack is off 6% for the last month, demonstrating its strength versus Wingstop.

However, while Wingstop is profitable, Shake Shack is not. Thus, we can compare their valuations by looking at their price-to-sales (P/S) ratios and comparing them to the restaurant industry’s current P/S of 2.2, which is in line with its three-year average. Nevertheless, the ultra-wide variance between these valuations calls for a closer look to determine the reasons for the large gaps.

Wingstop (NASDAQ:WING)

At a P/S multiple of 11.8, Wingstop looks grossly overvalued relative to its industry, especially considering its price-to-earnings (P/E) ratio of 77.5 versus the restaurant industry’s current P/E of 50.1. The fast-casual restaurant chain’s stock is simply too expensive, especially considering its debt position. Thus, a bearish view seems appropriate.

Notably, Wingstop’s five-year mean P/S is 15.4, while its five-year mean P/E is 123.9, so it usually trades at a steep premium to its industry. In fact, the shares recently hit a record high in May, and the company’s market capitalization currently stands at $4.9 billion. While WING has been putting up solid revenue growth, it still captured only $413.4 million in revenue and $62.8 million in net income for the last 12 months.

Wingstop does enjoy stable net income margins of around 15% annually and has managed to beat consensus estimates on both the top and bottom lines for the second quarter, even as most restaurants missed their consensus numbers for revenue. However, its valuation has simply gotten too far ahead of itself.

As a result, it could take quite some time before Wingstop grows into the valuation Wall Street has assigned it, even after the recent plunge. Finally, the company’s debt-to-equity ratio is negative, suggesting significant risk.

What is the Price Target for WING Stock?

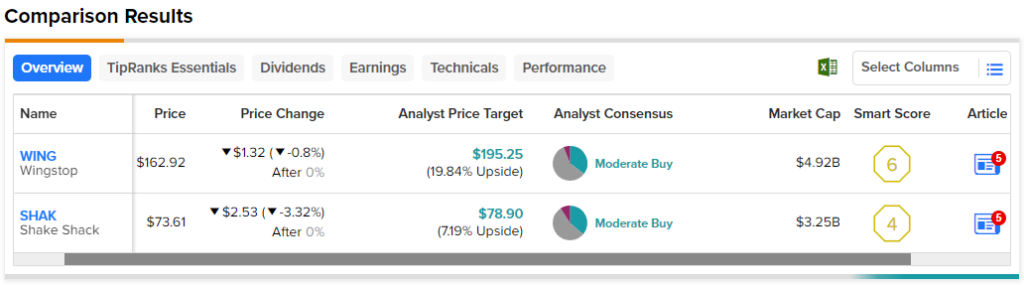

Wingstop has a Moderate Buy consensus rating based on six Buys, 10 Holds, and one Sell rating assigned over the last three months. At $195.25, the average Wingstop stock price target implies upside potential of 19.8%.

Shake Shack (NYSE:SHAK)

At a P/S of 3.0, Shake Shack immediately looks more reasonably valued than Wingstop, especially considering its five-year mean P/S of 4.1. However, its lack of annual GAAP (generally accepted accounting principles) profitability requires a closer look. Shake Shack’s valuation suggests a neutral view may be appropriate, at least for now.

The company is profitable on an adjusted basis, so it’s on the way to full GAAP profitability. Also, management said in their recent shareholder letter that they’re focused on improving profitability, which is certainly a good sign. In fact, Shake Shack’s net income margin improved to -0.7% for the last 12 months.

Like most other restaurant chains, Shake Shack beat the consensus estimate for second-quarter earnings but posted a small miss on sales, triggering a small decline in its stock price. However, the company’s share price had skyrocketed in May.

Activist investor Engaged Capital established a position in Shake Shack, which is also good for the stock. The firm is planning a proxy battle for three board seats and calling for operational changes that Engaged Capital founder Glenn Welling expects to boost profits by 50%.

Shake Shack has been opening new stores at a rapid pace, paving the way for steady growth. However, all that construction has taken a bite out of its profitability. Nonetheless, the company is making other moves to boost profitability, like shifting customer orders to kiosks to cut labor costs.

What is the Price Target for SHAK Stock?

Shake Shack has a Moderate Buy consensus rating based on four Buys, six Holds, and one Sell rating assigned over the last three months. At $78.90, the average Shake Shack stock price target implies upside potential of 7.2%.

Conclusion: Bearish on WING, Neutral on SHAK

Wingstop’s and Shake Shack’s long-term trends look very solid, so at some point, both could make great plays on the restaurant space. However, despite its lack of full profitability, Shake Shack’s balance sheet is slightly more solid than Wingstop’s due to its positive debt-to-equity ratio. Shake Shack’s more reasonable valuation also makes it the clear winner versus Wingstop, although not yet to the point where a bullish view is appropriate.