Starbucks (SBUX) is one of the best-known restaurant businesses in the world, with about 34,300 locations worldwide. By 2030, the business hopes to have 55,000 outlets in over 100 regions around the world.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The coffee chain has lost nearly 34% of its value year-to-date. Inflation, a tight labor market, issues in China, leadership changes, a pause in share buybacks, and the present unionization movement have all weighed on the stock.

In terms of earnings, Starbucks provided mixed results in Q122. Revenues of $8.1 billion exceeded the consensus forecast of $7.97 billion, but earnings per share of $0.72 fell short of the $0.79 per share consensus projection.

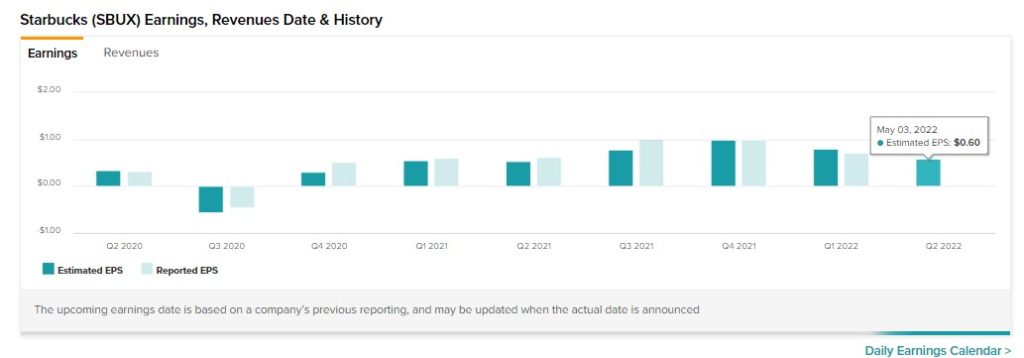

The company will report its Q222 earnings next week, on May 3. Let’s look at how the company is expected to do in the upcoming quarter.

Q2 Expectations

According to analysts, Starbucks is projected to report adjusted earnings of $0.60 per share in the second quarter. This represents a year-over-year increase of 3.2%.

Meanwhile, analysts expect Starbucks to report $7.97 billion in revenue for the second quarter.

Website Visit Stats Reflect a Downward Trend

We have used TipRanks’ Website Traffic Tool to dive into Starbucks’ monthly website visits ahead of the Fiscal Q2 print to gain a better idea of the company’s present state.

We discovered through the tool that overall estimated visits to the Starbucks website decreased in Q2. In particular, the total projected worldwide visits to starbucks.com decreased by 20.4% sequentially from the first quarter.

Wall Street’s Take

UBS analyst Dennis Geiger prefers to remain on the sidelines for now due to a lack of visibility on margin possibilities and profit growth prospects.

Geiger expects Starbucks to lower or withdraw its earnings guidance for Fiscal 2022, “given pressures from China government restrictions, suspended repurchase, and (most importantly) the impact from greater investment in people & stores.”

As a result, Geiger maintained a Hold rating on the stock and decreased the price target to $86 from $105 per share. This implies 12.3% upside potential from current levels.

On TipRanks, Starbucks stock commands a Moderate Buy consensus rating based on 11 Buys and 11 Holds. As for price targets, the average SBUX price target of $106.55 implies almost 39% upside potential from current levels.

Bottom Line

Starbucks’ short-term prospects do not appear to be very encouraging, given the various headwinds. However, the company’s long-term growth could be fueled by a macroeconomic rebound and a resumption of growth in China.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure