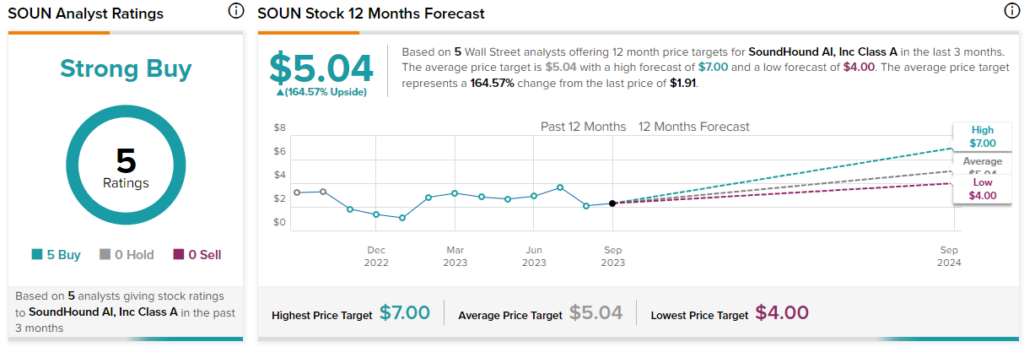

SoundHound AI (NASDAQ:SOUN) stock has been on a roller coaster ride so far this year (see the image below). However, Wall Street analysts see significant upside potential in this penny stock (learn more about penny stocks here) due to AI -(artificial intelligence) led demand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SoundHound offers voice AI solutions, including Smart Answering, Smart Ordering, and Dynamic Interaction.

On September 27, D.A. Davidson analyst Gil Luria initiated coverage on SoundHound with a Buy recommendation and a price target of $5. Luria opines that SoundHound’s Voice AI platform is poised to set the standard in the voice AI market. Moreover, with the company’s improving financial performance and the expansion of its sales team, it is well-positioned to secure a significant portion of the market share.

Echoing similar sentiments, Scott Buck of H.C. Wainwright started the coverage of SOUN stock with a Buy rating and a price target of $5 on September 1. The analyst believes that SoundHound stands at the forefront of conversational AI and has a clear go-to-market strategy. Further, the analyst highlighted that the company’s impressive backlog of over $339 million, solid client base, and strong IP (intellectual property) portfolio position it well to emerge as a leader in the conversational AI sector.

Buck suggests acquiring SoundHound stock as he anticipates that the shares may experience a jump in value due to the projected acceleration in revenue growth and profitability, potentially as early as the fourth quarter of 2023.

With this backdrop, let’s look at the analysts’ consensus estimate for SOUN stock.

Is SoundHound Stock a Buy, According to Analysts?

In addition to Luria and Buck, the other three analysts covering SoundHound stock have also issued Buy ratings. With five unanimous Buy recommendations, SoundHound currently boasts a Strong Buy consensus rating on TipRanks. At the same time, the average SOUN stock price target of $5.04 implies 164.6% upside potential from current levels.

The Takeaway

SoundHound stock has experienced a volatile year, but Wall Street analysts believe the company has significant growth potential due to its leadership in conversational AI. Further, its substantial backlog, renowned customer base, and strong portfolio position it well to deliver solid growth, reflected through its Strong Buy consensus rating.

Finally, while SOUN stock has solid upside potential, investors can also utilize TipRanks’ penny stock screener to discover other enticing penny stock opportunities.