October deliveries reported by Chinese electric vehicle makers Nio (NYSE:NIO), Li Auto (NASDAQ:LI), and XPeng (NYSE:XPEV) on Tuesday reflected the continued impact of supply chain issues in China and macro challenges. These issues could further drag down Nio stock over the near term.

Citing local media outlet 36kr, CnEVPost reported that Nio has temporarily paused production at two plants in Hefei due to COVID-19 restrictions.

Despite a month-over-month decline in October deliveries, Nio stock, along with certain other Chinese stocks, spiked in the early trading hours on Tuesday due to an unconfirmed social media post, as per which China intends to ease COVID-19 restrictions and reopen in March. However, according to Reuters, a Chinese foreign ministry spokesman said that he was unaware of any such development.

Nio stock declined 39% in October and is down over 69% year-to-date. The stock has been battered this year for multiple reasons, including the impact of China’s stringent COVID restrictions, delisting concerns, political and regulatory risks in China, tensions between the U.S. and China, and the growing fears of an economic slowdown.

Nio Faces Near-Term Pressures

Nio’s October deliveries grew 174.3% year-over-year to 10,059 vehicles in October 2022. However, deliveries declined 7.5% compared to the September figure. Nio stated that October production and deliveries were impacted by operational challenges in its plants as well as COVID-led supply chain issues in certain regions in China.

Overall, NIO’s year-to-date deliveries have increased 32% year-over-year to 92,493. COVID-led disruptions could impact the company’s ability to meet the demand for its EVs, including the recently launched ES7, ET5, and ET7 models.

Nio’s losses widened significantly in the second quarter even as revenue increased 22%. Higher costs, growth investments, and supply chain bottlenecks could weigh on the third quarter’s profitability as well.

Is Nio Stock a Buy, Sell, or Hold?

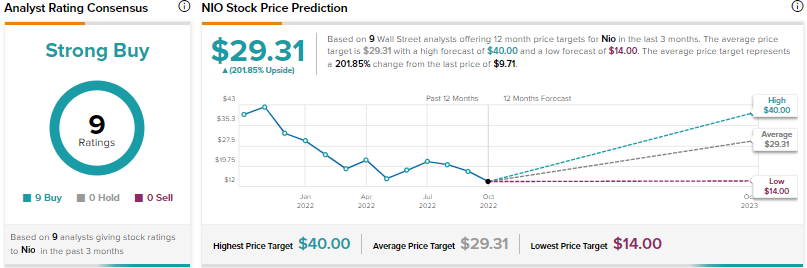

Recently, Barclays analyst Jiong Shao slashed his price target for Nio stock to $19 from $34 but maintained a Buy rating on the stock. Amid the ongoing turmoil, the analyst revised estimates and 12-month price targets for all the Chinese tech and internet companies under his coverage as the year-end approaches.

Overall, Nio scores the Street’s Strong Buy consensus rating based on nine unanimous Buys. The average NIO stock price target of $29.31 implies 202% upside potential from current levels.

Conclusion

The sequential decline in Nio’s October deliveries reflects persistent supply chain issues in China. Production disruptions and macro challenges could continue to weigh on Nio stock over the near term.

However, Wall Street analysts remain optimistic about Nio’s growth potential based on the growing adoption of EVs, its expansion into Europe, innovative new EV models, and its battery swap technology.