Nio (NYSE:NIO) stock has dropped over 51% in the past three months. Moreover, shares of this Chinese EV (electric vehicle) maker have lost over 76% of its value since 2021. As Nio stock lost substantial value and continues to underperform the broader markets, we are wondering if Nio could hit penny-stock (learn more about penny stocks here) levels or rise from here. However, based on analysts’ average price target, Nio stock will likely head north and deliver significant returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s see why.

Factors to Drive Nio Stock Higher

It’s worth noting that the macro weakness in China, heightened competitive activity, promotional discounts, and lower sales and production volume took a toll on Nio’s margins and its stock price. For instance, Nio’s gross margin reached 1% in the second quarter, down significantly from 13% in the prior-year quarter. In addition, its vehicle margin stood at 6.2% in Q2 compared to 16.7% in the prior-year period.

Nonetheless, Nio’s management maintains an optimistic outlook and anticipates significant sequential margin growth in the latter half of 2023. Stanley Qu, the company’s Senior Vice President of Finance, said during the Q2 conference call that the increased sales and volume of their NT2 products, which command higher average selling prices, will be the driving force behind improved margins. Qu is confident in achieving a double-digit gross profit margin in Q3 and envisions gross margins reaching 15% in Q4, assuming effective cost control measures, particularly regarding battery costs.

Furthermore, Nio’s delivery numbers are showing month-over-month improvement. After delivering 15,641 vehicles in September 2023, its deliveries increased to 16,074 cars in October, reflecting a year-over-year increase of 59.8%.

While these factors support Nio’s bull case, let’s look at the Street’s consensus rating on the stock.

What is the Prediction of NIO Stock?

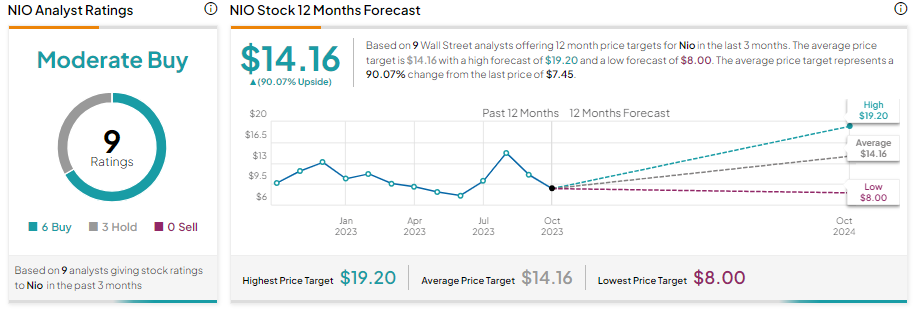

Wall Street analysts are cautiously optimistic about Nio stock. It has received six Buy and three Hold recommendations for a Moderate Buy consensus rating. Moreover, the average NIO stock price target of $14.16 implies a considerable upside potential of 90.17% from current levels.

Bottom Line

The expected improvement in margins, increased sales, the ramp-up in volume for NT2 products, and improved delivery performance bode well for future growth. Nevertheless, increased competitive activity in China continues to pose challenges for Nio, prompting analysts to remain cautiously optimistic about its future prospects.

While analysts don’t expect Nio stock to hit penny stock levels, investors can leverage TipRanks’ penny stock screener to find compelling penny stocks.