Higher mortgage rates and rising home prices seem to be keeping buyers away from residential properties.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On April 20, The Wall Street Journal reported data from the National Association of Realtors that sales of residences fell month-over-month to 2.7% in March, and a drop of 4.5% year-over-year.

The report quoted Lawrence Yun, chief economist for the National Association of Realtors (NAR) as saying that with mortgage rates currently at 5%, its highest level since 2011, “He expects home sales in 2022 to decline 10% from last year.”

However, analysts cited in the report expect that home prices will continue to soar due to lower inventory in the market. According to NAR data, cited by the report, the inventory of 950,000 homes in March that were up for sale was down 9.5% year-over-year.

In this scenario, could REITs profit from this trend? Let us take a look.

Using the TipRanks stock screener, for the purpose of this article, we looked at Real Estate Investment Trusts (REITs) that own and operate residential properties. REITs are publicly traded companies that operate and own income-producing real estate properties.

NexPoint Residential Trust (NYSE: NXRT)

NexPoint Residential Trust is a REIT that is focused on the “acquisition, asset management, and disposition of multifamily assets, located primarily in the Sun Belt region of the United States.” The Sun Belt region is located primarily in the South-eastern and Southwestern regions of the U.S.

As of December 31, NXRT owns 39 properties and 14,825 units. The company primarily invests in middle income ‘multifamily real estate properties’ with a ‘value-add component,’ where we can invest significant amounts of capital to provide ‘life-style’ amenities to ‘workforce’ housing.”

In Q4, NXRT reported total revenues of $58.5 million, up 15.8% year-over-year. The company’s Fund From Operations (FFO) came in at $17.1 million versus $15.7 million in the same quarter last year.

Brian Mitts, EVP and CFO of NXRT stated on the company’s Q4 earnings call that with higher migration continuing into its core Sun Belt markets and a shortage of housing inventory in this market, “NXRT continues to enjoy enormous pricing power with new lease rates increasing 24.5% and renewal rates increasing 15.6% across the portfolio in Q4 of 2021.”

This is a primary reason that Raymond James analyst Buck Horne is bullish on the stock with a Buy rating, and raised his price target from $67 to $95 on the stock following NXRT’s Q4 earnings. Horne’s price target implies an upside potential of 4.5% to early morning trading levels on Thursday.

The analyst’s price target is the lowest one on the Street. Horne added that the higher population migration into the Sun Belt markets is bringing many households with high income into this region’s real estate pool as prospective tenants.

Besides Horne, two other analysts are also upbeat about the stock with a Strong Buy consensus rating. The average NXRT stock forecast is $98.33, implying 6.7% upside potential from early morning trading levels on Thursday.

AvalonBay Communities (NYSE: AVB)

AvalonBay Communities is an equity REIT that develops, acquires, and manages apartment communities in metropolitan areas in the New York, New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California. AVB has also expanded to other markets in North Carolina, Southeast Florida, Texas, and Colorado.

As of December 31, AVB owned directly or indirectly 297 apartment communities with 87,992 units in 12 states and the District of Columbia.

Earlier this month, the company gave an update for Q1 stating that its same-store residential (SSR) revenue was up 7.3% year-over-year for the two months ended February 28,2022. This surpassed even Deutsche Bank analyst Derek Johnston’s forecasts and AVB’s management forecast by 60 basis points.

Johnston believes that “AVB’s portfolio as best positioned to benefit from ongoing suburbanization and coastal market revival as the company’s March update set a positive tone for 2022.” The analyst is also positive about the possibility of higher rental income as people return to cities post the pandemic and “controlled” expense growth.

As a result, the analyst is optimistic about the stock with a Buy rating but has reduced the price target to $272 from $285 on the stock. Johnston’s price target implies an upside potential of 7.3% from early morning trading levels on Thursday.

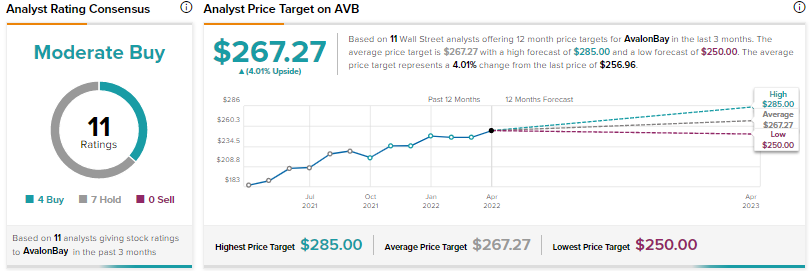

Other Wall Street analysts, however, are cautiously optimistic about the stock with a Moderate Buy consensus rating based on four Buys and seven Holds. The average AVB stock forecast is $267.27, implying 4% upside potential from early morning trading levels on Thursday.

Camden Property Trust (NYSE: CPT)

Camden Property Trust, headquartered in Houston, Texas is another REIT on this list. The company primarily owns, manages, acquires, and is engaged in the development, construction, and redevelopment of multifamily apartment communities.

As of March 31, Camden owns and operates “170 properties containing 58,055 apartment homes across the United States.”

Earlier this month, the company announced a share offering of 2.9 million shares for gross proceeds of $493 million. Camden stated that it intends to use the “net proceeds to reduce borrowings under its $900 million unsecured line of credit incurred to fund the acquisition from Teacher Retirement System of Texas of its 68.7% interest in two of Camden’s investment funds and for general corporate purposes.”

Following the announcement, Evercore research analyst Steve Sakwa stated that investors “shouldn’t be surprised by the CPT equity raise as the company has employed a conservative balance sheet over the past several years and we expect management to maintain this low leverage going forward.”

The analyst also expects to hear “positive commentary on the company’s Q1 conference call regarding demand trends and pricing power.”

However, Sakwa is sidelined on the stock with a Hold rating and a price target of $176 as he sees the stock “fairly valued at these levels.” The analyst’s price target implies a 4.1% upside potential from early morning trading levels on Thursday.

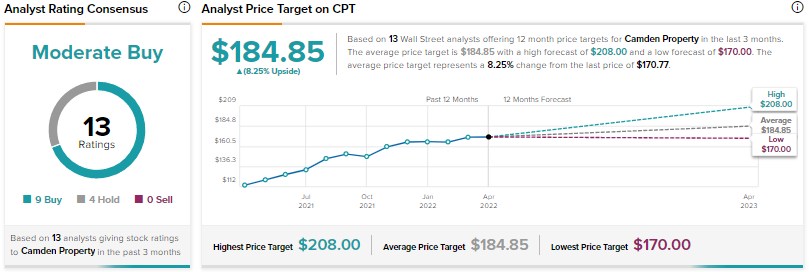

Rest of the analysts on Wall Street, however, are cautiously optimistic with a Moderate Buy consensus rating based on nine Buys and four Holds. The average CPT stock forecast is $184.85, implying 8.3% upside potential from early morning trading levels on Thursday.

Bottom Line

It seems evident from this list that REITs invested in residential properties are highly likely to benefit in the current macroeconomic scenario. With higher inflation, rental incomes are also likely to rise. Moreover, as the pandemic eases, the migration of people back to cities closer to their offices could also result in benefitting these stocks.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.