General Motors (NYSE:GM) recently reported upbeat third-quarter earnings. Investors were particularly impressed with the growing adoption of the company’s electric vehicles (EVs) and its expansion plans in the EV space. While GM stock is in the red year-to-date, it has gained nearly 15.3% over the past month.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Recently, General Motors, along with Microvast Holdings, Inc. (NASDAQ:MVST), bagged a $200 million grant from the U.S. Department of Energy to develop specialized EV battery separator technology and build a new separator plant in the U.S.

The grant is a part of President Biden’s Battery Materials Processing and Battery Manufacturing initiative. Notably, more than 200 companies had applied for the funding, of which only 20 companies were selected.

General Motors and Microvast have joined hands to work on a new separator technology aimed at improving EV safety, charging, and battery life. Along with the grant, both parties will invest over $300 million in a new separator manufacturing facility in the U.S.

General Motors’ EVs to Drive Future Growth

General Motors sold 14,700 Chevrolet Bolt EVs and Bolt EUVs in Q3. It is now increasing production for the Chevrolet Bolt EVs and Bolt EUVs from 44,000 units this year to 70,000 units in 2023. The company plans to produce 400,000 EVs in North America through the first half of 2024.

General Motors CEO Mary Barra noted that the new clean energy tax credits under the Inflation Reduction Act would support domestic supply chain capacity expansion and drive EV adoption.

Further, the company said that it has entered the second phase of its EV growth strategy, which includes “the rapid scaling of our product portfolio based on Ultium and Altify while leveraging ICE vehicles to maintain strong margins.” In the final phase, GM expects a top-line boost and margin expansion as a result of all initiatives.

The company is moving well on its pledge to provide an EV everywhere, as it has scheduled model launches in almost all auto segments in 2023.

Is GM a Good Buy?

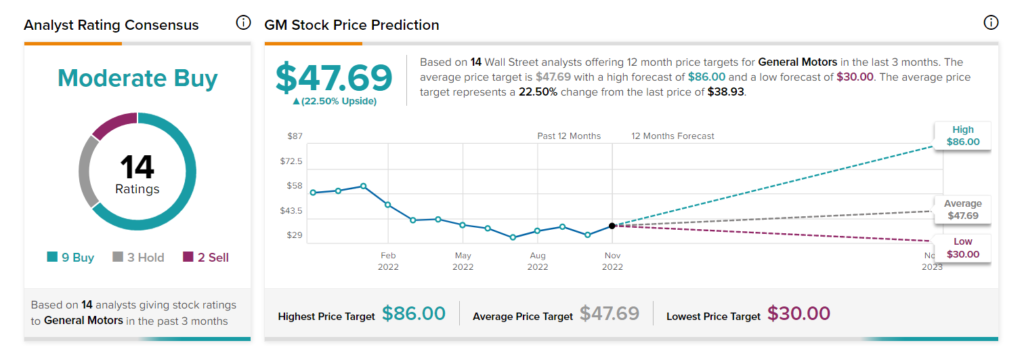

General Motors has a Moderate Buy consensus rating based on nine Buys, three Holds, and two Sells. The average GM stock price target of $47.69 suggests 22.5% upside potential.

Parting Thoughts

Despite a slowing economic environment, strong demand for EVs is expected to be a tailwind for General Motors. Moreover, GM’s expertise in the area and plans to launch affordable as well as high-end EVs in the near term keep us optimistic.