Cathie Wood‘s popular ARK Innovation ETF (ARKK) is off to a hot start in 2023, with a 21% gain year-to-date. However, based on recent events concerning some of its top holdings, ARKK could be under some pressure in the near term and cool down after this scintillating start.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While ARKK itself finished only 1.5% lower today, two of its top holdings, Block (SQ) and Coinbase Global (COIN), were under considerable pressure based on negative news that came out about them.

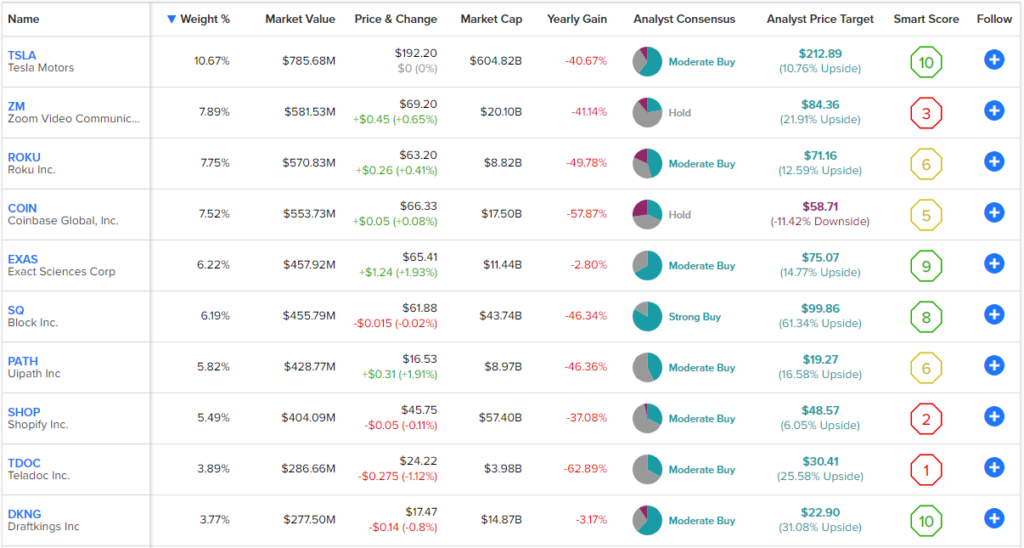

See below for an overview of ARKK’s top holdings using TipRanks’ Holdings screen, which gives investors a holistic overview of an ETF’s components. As you can see, Coinbase is ARKK’s fourth-largest position, accounting for 7.5% of funds, and Block is the sixth-largest holding, accounting for 6.2%.

What’s Going on with Coinbase?

Coinbase received a Wells notice from the SEC (essentially a warning that the SEC will recommend enforcement action against a company for violating securities laws), and the stock finished 14.1% lower today, while it was down nearly 20% at one point. The warning is likely related to Coinbase’s EARN product, which allows customers to stake their crypto and receive rewards on it, or possibly products like Coinbase Prime and Coinbase Wallet.

The unwelcome development caused a number of sell-side analysts to take note. Oppenheimer downgraded Coinbase from Outperform to Perform, while Jefferies says that the potential enforcement action could jeopardize as much as 35% of Coinbase’s revenue, which would be a significant blow to the stock.

What Is the Price Target for COIN Stock?

The analyst community, in general, is cautious about Coinbase, especially after its recent run. Even after today’s sell-off, Coinbase is still up 87% year-to-date. The consensus on Coinbase is that the stock is a Hold, and the average COIN stock price target of $59.88 implies downside potential of ~10%. Of the 22 analysts covering the stock, 7 maintain a Buy rating, 9 have a Hold rating, and 6 analysts say Coinbase is a Sell.

What Happened to Block Stock?

Meanwhile, Block had the ignoble distinction of being the latest company to find itself as the subject of a short-seller report from Hindenburg Research. Hindenburg has grown in stature with well-timed and high-profile short calls on stocks like Nikola Motors, Lordstown Motors, and India’s Adani Group.

Hindenburg’s allegations are wide-ranging, claiming that “the magic” behind what Block calls its “magical” financial technology is not disruptive innovation “but rather the company’s willingness to facilitate fraud against consumers and the government, avoid regulation, and dress up predatory loans and fees as revolutionary technology,” while misleading investors “with inflated metrics.” To this last point, Hindenburg claims that Block has “overstated” its number of total users and that it has “understated” its customer acquisition costs.

These are some pretty serious allegations, and they are yet to be substantiated, and we haven’t yet heard Block’s side of the story. In any case, they could prove to serve as an overhang to the stock, which was off to a solid start to 2023 before today’s slide erased its year-to-date gains. Block stock finished 14.8% lower on the day, although it was down about 22% earlier.

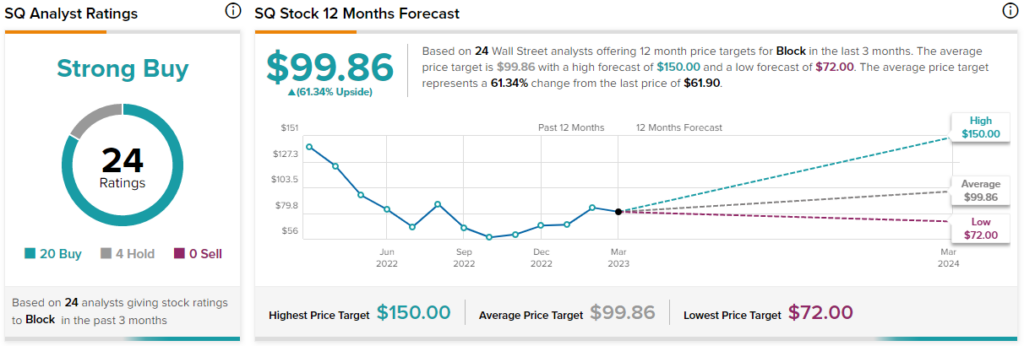

What is the Price Target for SQ Stock?

Unlike Coinbase, Wall Street analysts are very bullish on Square, giving it a Strong Buy consensus rating. Interestingly, 20 of the 24 analysts covering the stock have a Buy rating on it. Meanwhile, there are four Hold ratings and no Sells. The average SQ stock price target of $99.86 implies attractive upside potential of 61%.

ARKK Could Come Under Pressure

Surprisingly, the maelstrom of bad news about two of its top holdings didn’t seem to affect ARKK itself all that much today, relatively speaking. That said, Coinbase and Square could both be under considerable pressure for the time being, so ARKK is not out of the woods yet and might experience some more selling pressure at some point in the near future.

ARKK isn’t particularly diversified as it holds just 29 positions, and its top 10 positions make up 64.8% of assets. This can be great when its underlying holdings are surging, but it can also lead to more volatility to the downside when individual holdings are falling. However, the upside of even this lower level of diversification is that it clearly provides more downside protection than owning just Coinbase or Square, as evidenced by today’s market action.

What is the Price Target for ARKK Stock?

The analyst community is still bullish on ARKK, giving it a Moderate Buy consensus rating. Further, the average ARKK stock price target of $52.47 implies significant upside potential of ~39% from current levels.

ARKK also has a neutral ETF Smart Score of 6. Looking at some of the other indicators that TipRanks monitors, blogger sentiment on ARKK is neutral, while crowd wisdom is very negative.

ARK’s Fintech ETF May Feel Even More Pressure

ARKK is ARK Invest’s flagship fund and by far its largest ETF, with a market cap of about $7.7 billion. However, ARK has a smaller ETF focused specifically on fintech stocks called the ARK Fintech Innovation ETF (ARKF).

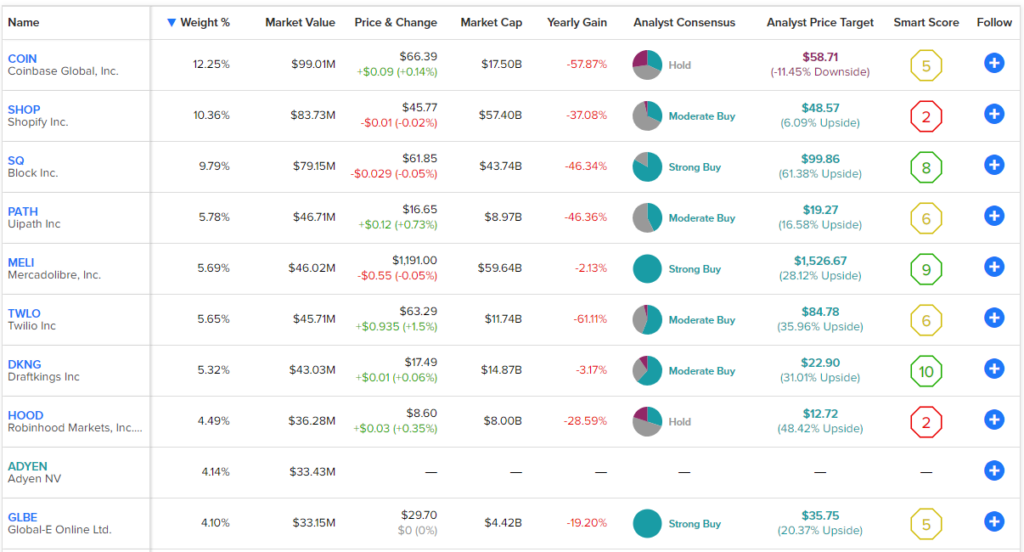

Everything said above about ARKK applies to ARKF, except more so, as Coinbase and Square make up an even larger portion of this ETF, as you might expect, given its fintech focus.

As you can see in the overview of ARKF’s top holdings below, Coinbase is ARKF’s biggest holding, accounting for 12.25% of assets, while Square is the third largest holding, accounting for 9.79% of the fund.

Given that these two positions make up more than 20% of ARKF, it will likely face even more headwinds relative to ARKK from any further negative developments surrounding these stories. From an overall diversification standpoint, ARKF is similar to ARKK, with 30 holdings in total and its top 10 holdings accounting for 67.6% of the ETF.

What is the Price Target for ARKF Stock?

Still, analysts are bullish on ARKF. It has a Moderate Buy consensus rating, and the average ARKF price target of $22.52 implies upside potential of 27.5% from here.

Investor Takeaway

In conclusion, ARKK (and ARKF) could face some selling pressure in the days and weeks ahead if the negative news surrounding Coinbase and Block intensifies, and it’s hard to predict how these stories will play out. ARK Invest updates the holdings of its ETFs on a daily basis, so it will be interesting to see if it trims its positions in Coinbase or Block over the next several days or if ARK doubles down and buys the dip on these already large positions.

I don’t think investors who are bullish on ARKK need to sell at this point, but I would expect the ETF to pull back some in the coming days. I would also expect ARKF to face more adversity, given its larger allocation toward Coinbase and Block.

For investors who are bullish on disruptive technology stocks over the long term, ARKK is still a good ETF to use to gain exposure to that theme. The same could be said about ARKF and long-term views on fintech technology, but I’m more cautious here for the reasons stated above.

For investors looking to buy in, there could be some good entry points to do so over the coming days and weeks. Analysts are still bullish on both of these ETFs, so there is long-term potential, but there is likely to be plenty of volatility ahead.