Technology giant Apple (NASDAQ:AAPL) will release its fourth quarter Fiscal 2023 financial results on Thursday, November 2. However, analysts’ revenue forecast indicates that the company’s hardware sales may disappoint in Q4.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s delve into Q4 expectations.

Apple’s Q4 Sales Could Remain Muted

Analysts expect Apple to generate revenue of $89.34 billion in Q4, representing a year-over-year decline of approximately 1% from $90.15 billion in the prior-year quarter. Analysts’ Q4 sales estimate reflects a continued weakness in Apple’s hardware sales.

Investors should note that the company’s hardware sales have declined during the third quarter, with its iPhone revenue decreasing by 2%. In addition, it registered a decline of 7% and 20% in Mac and iPad sales, respectively, during the same period. Apple’s management said during the Q3 conference call that its iPhone and Services revenue could show sequential improvement. However, Mac and iPad revenue could register a double-digit decline due to the tough year-over-year comparisons.

While Apple’s Q4 top line could remain muted, its bottom line is expected to show an improvement both on a sequential and year-over-year basis. Analysts expect Apple to post an EPS of $1.39, up from $1.29 in the prior-year quarter. AAPL’s cost-saving measures and favorable mix shift towards Services will cushion its bottom line. With this backdrop, let’s look at what the analysts suggest for Apple stock ahead of fourth-quarter earnings.

Is Apple a Good Stock to Buy Right Now?

Analysts remain cautiously optimistic about Apple stock ahead of Q4 earnings, given the short-term headwinds. Jefferies analyst Andrew Uerkwitz lowered his 2024 revenue and earnings estimates for Apple ahead of the Q4 print. The analyst stated that the lengthening replacement cycle and competitive challenges in China could hurt the company’s performance. Uerkwitz lowered his price target to $195 from $200 on October 30. Nonetheless, the analysts reiterated the Buy recommendation.

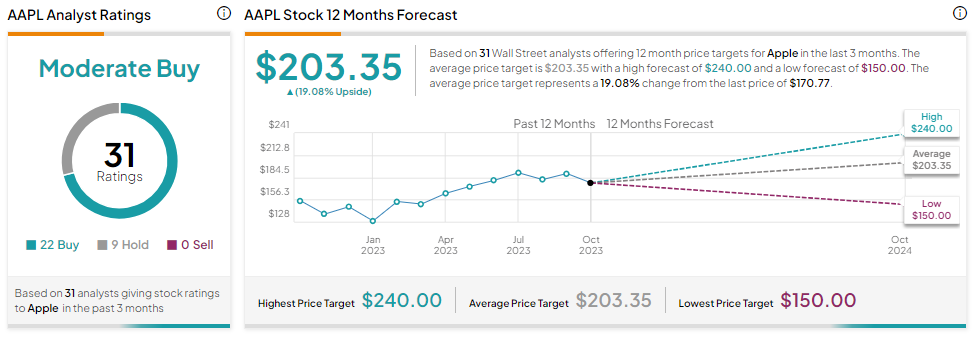

Including Uerkwitz, 22 analysts have rated Apple stock a Buy. At the same time, nine analysts maintain a Hold. Overall, Apple has a Moderate Buy consensus rating on TipRanks. Further, analysts’ average AAPL stock price target of $203.35 implies 19.08% upside potential from current levels.

Insights from Options Trading Activity

Options traders are pricing in a +/- 4.12% move on earnings, slightly lower than the previous quarter’s earnings-related move of -4.80%.

Bottom Line

Apple’s top and bottom lines are expected to benefit from the strength of the Services segment and favorable mix. However, weakness in Mac and iPad sales is expected to put pressure on its overall revenue, as evidenced by the analysts’ consensus rating of Moderate Buy.