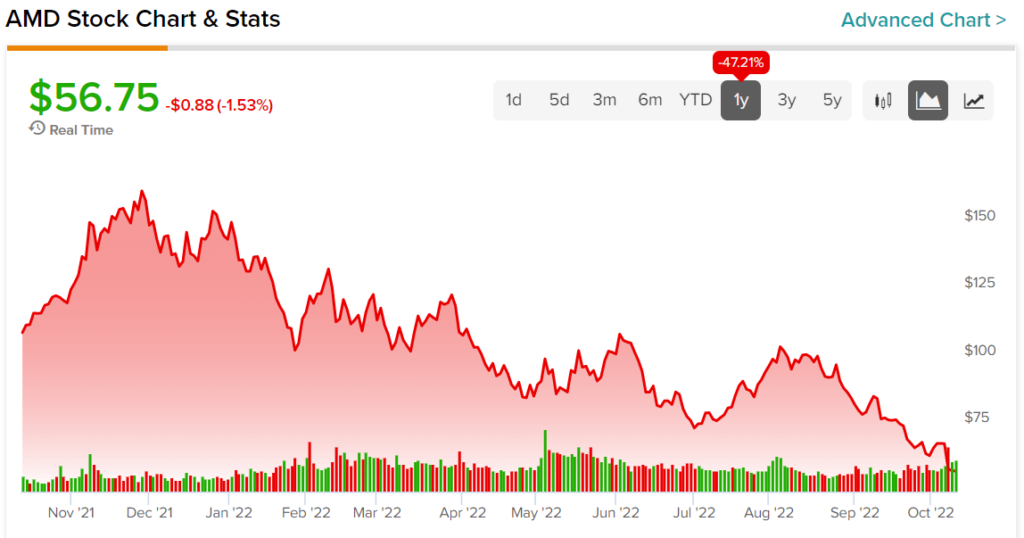

Chip giant Advanced Micro Devices (NASDAQ:AMD) has been one of this year’s biggest casualties in the stock market, with its shares down more than 60% from their peak. Contrary to its stock performance, its fundamentals remain rock solid, with multiple long-term catalysts in play. Hence, we are bullish on AMD stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In recent years, it’s been growing at an aggressive pace. Revenues have shot up from $2 billion per quarter in 2019 to over $6 billion in the second quarter of 2022. Moreover, it has achieved remarkable quarterly results, beating analyst estimates by a healthy margin. In addition, its earnings per share have gone from a negative figure to $2.79 last year.

Advanced Micro Devices has also seen market share gains in client and server processors and niche markets such as gaming consoles. Moreover, investors have reaped the benefits of AMD’s impressive top and bottom-line growth over the past five years. Despite the hiccups in its preliminary results, they continue to beat its benchmarks handsomely.

AMD’s Robust Performances and Market Share Gains

AMD’s market share gains are helping offset the weakness in this PC sector. They’ve taken 8% more of its central processing unit (CPU) from rival Intel over last year, bringing its total up 31%. This is evidenced in its impressive financial results in the second quarter, where revenues rose by 70% while earnings per share grew 67%.

Many companies have cut back on their spending on new hardware. However, AMD’s Client segment revenue increased by 25% from last year in the second quarter. It also saw strong growth in its Embedded segment, along with its Data Center businesses which grew by a whopping 83%.

Moreover, despite market headwinds, it is now selling more chipsets and processors with better performance. Also, its acquisition of businesses such as Xilinx has helped significantly grow its revenue base. Additionally, its Ryzen CPUs offer significant performance advantages over Intel’s currently available chips, with savings of up to $100 compared to past models.

Chipmakers have been struggling to keep up with demand, yet there have been signs that these production challenges may abate over time due to increased inventory levels across all industries.

The massive growth of the data center and PC industries has allowed AMD to capture a large share in these sectors. The company’s strong performance should continue, despite near-term macroeconomic challenges. Moreover, the acquisition of Xilinx will help AMD grow in areas such as AI and edge computing. This provides an opportunity for long-term success.

AMD Shows Strong Performance in the Gaming Realm

The video game console industry is a fast-growing market, and AMD has been supplying semi-custom chips to manufacturers like Microsoft, Sony, and Valve. Despite the decline in graphics card revenue, its gaming business grew by 32% year over year, reaching $1.7 billion in the second quarter.

In just five years, AMD’s partnership with Sony and Microsoft could set it up for impressive long-term expansion. For instance, the PlayStation 5 is expected to hit 67 million units by 2024, up significantly from 17.9 million units last year. Meanwhile, Xbox series X may see 37 million more unit sales during this time compared to last year.

Analysts expect AMD to grow earnings by 27% over the next five years. Additionally, it reported $1.04 billion in cash at the end of the second quarter, and investors should take advantage before its stock price rebounds again!

What is a Fair Price for AMD Stock?

Turning to Wall Street, AMD stock has a Moderate Buy consensus rating based on 20 Buys, seven Holds, and one Sell assigned in the past three months. The average AMD price target is $97.86, implying 72.2% upside potential. Analyst price targets range from a low of $65 per share to a high of $200 per share.

Takeaway: AMD Stock Investors Need to Think Long-Term

AMD’s long-term outlook is very favorable. Its stock has taken a hammering as of late and is a great buy at current levels. Nevertheless, investors need to be able to stomach the stock’s short-term volatility to reap the long-term benefits. Shifting consumer spending patterns, lower demand for PC due to an oversupply of chips on the market, and supply chain disruptions have significantly impacted the industry. Nevertheless, investors should look past the temporary slump and focus on the long-term picture.

With Fortune Business Insights forecasting a compound annual growth rate of 12% through 2029 for the chip industry, it’s not surprising that its latest numbers are consistent with what we’ve seen. In fact, an upcoming secular bull market in data centers and other segments should only help AMD’S position even more. Hence, the company looks well-positioned for long-term success.

Its valuation is significantly more attractive compared to historical levels. It trades at just 3.9 times forward sales, roughly 35% lower than its 5-year average. I expect the stock to shed more value in the current market environment. However, its current price is highly attractive and worth investing in.