Shares of Starbucks (NASDAQ:SBUX) have been rattled over the past few years, thanks in part to macro headwinds and union woes. Even amid intense competition in the coffee shop business, Starbucks has many growth drivers it can pull to help its stock make new highs. Currently, SBUX’s average price target sits 15% shy of its all-time high. Still, if CEO Laxman Narasimhan can work his magic, I believe Starbucks has what it takes to return to glory, making me incredibly bullish on the stock after a forgettable 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, Mr. Narasimhan took the helm at a pretty tough time for the Seattle-based coffee giant. The man has since risen to the occasion with new targets that could help Starbucks become a growth darling on Wall Street again. Though competition in the coffee scene has always been quite fierce, it’s grown even fiercer of late, with the likes of Dutch Bros. (NASDAQ:BROS) and even McDonald’s (NYSE:MCD) aggressively seeking to take a bigger share of the morning crowd.

Can SBUX Maintain Its Growth as McDonald’s and Dutch Bros. Move In?

Dutch Bros. and McDonald’s seem to view the drive-thru model as a means to eat into Starbucks’ moat. And with the rise of McDonald’s drive-thru-only concept, CosMc’s, which seems to be targeting consumers looking to get a quick (and cheap) caffeine and sugar fix, McDonald’s has arguably never looked this intimidating for Starbucks as its stock sails through some rough waters. That said, don’t count on red-hot rivals to impair Starbucks’ growth as it looks to fend off rivals with its premium brand.

Indeed, McDonald’s coffee doesn’t seem nearly as hot as the potential of McCafe and, now, CosMc’s. Over the near-to-medium term, CosMc’s is rolling out steadily, with just a handful of new stores launching in the Texas market. However, in 10 years from now, it’s unclear just how many CosMc’s locations there will be nationwide (there isn’t a set long-term expansion plan in place quite yet) and whether they’ll take a big bite into the market share of the likes of Starbucks.

In my prior piece, I noted that Starbucks shareholders had little to fear as McDonald’s looked to increase its market overlap with Starbucks.

Why? It all comes down to Starbucks’ premium brand. Though some Starbucks patrons may move over to CosMc’s for their morning brew due to lower prices, I’d argue most probably won’t. At the end of the day, a Starbucks cup is as much a status symbol as a pair of Louis Vuitton boots, at least in my opinion. And as good as McCafe coffee and baked goods are, McDonald’s just isn’t the upscale brand that’d resonate with Starbucks’ most hardcore fanatics.

Remember, there’s power to be had in brands, especially in the restaurant space. And under Mr. Narasimhan, I believe the Starbucks brand can be a source of explosive growth as the firm expands overseas.

Starbucks’ India Expansion Could Pay Massive Dividends

Recently, Starbucks announced its intention to open 1,000 stores in India by 2028. Undoubtedly, India is a fast-growing economy with a middle class that could boom over the coming years. With an internationally recognized (and praised) brand, I have no doubt that Starbucks’ push into India will be nothing short of a ground-breaking success. Should the world economy heal sooner rather than later, I’d also not be surprised if the company decides to surpass its long-term target.

As Starbucks expands into India, it will also be busy growing its presence in the Chinese market, a tea-drinking nation with a newfound taste for coffee. In China, there are different rivals (think Luckin Coffee (OTC:LKNCY), which leap-frogged Starbucks to become China’s largest coffee firm) hungry for that morning crowd. But just like in the U.S., I believe no rival can outdo Starbucks.

As Starbucks gets more aggressive internationally, I think it will be tough for investors to ignore the long-term growth opportunity at hand. In the meantime, union headlines are going to hog the headlines. But don’t let it distract you from the impressive growth runway ahead of the firm.

In five years from now, count me as unsurprised if Starbucks automates more aspects of its business such that union woes become a thing of the past. And if Starbucks rolls out such automation technologies across stores around the world, the scale of longer-term margin growth could stand to be unprecedented.

Is SBUX Stock a Buy, According to Analysts?

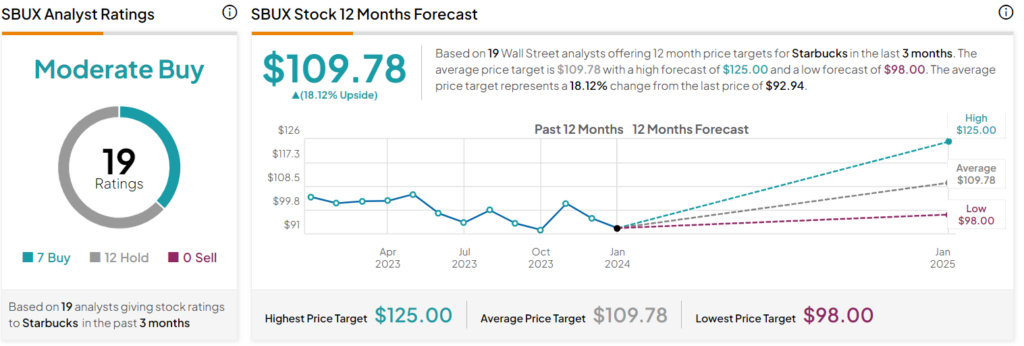

On TipRanks, SBUX stock comes in as a Moderate Buy. Out of 19 analyst ratings, there are seven Buys and 12 Hold recommendations. The average SBUX stock price target is $109.78, implying upside potential of 18.1%. Analyst price targets range from a low of $98.00 per share to a high of $125.00 per share.

The Bottom Line

Laxman Narasimhan is a terrific CEO who’s about to make Starbucks stock hot again. From the Indian and Chinese market expansion opportunities to automation tech, the future of Starbucks has arguably never looked this bright.

Competitors are hungry for Starbucks’ morning crowd, but I think it will be tough to dethrone the Seattle-based coffee kingpin. As more investors appreciate the long-term narrative, expect SBUX stock to start warming up again, perhaps sooner rather than later.