The past month has seen SoFi Technologies (NASDAQ:SOFI) shares go on an absolute tear. In total, now the shares have accumulated year-to-date gains of 105%, far surpassing the 15% returns notched by the S&P 500.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The problem – if you can call it that – is that the shares have gotten too far ahead of themselves, and that is now an issue for Oppenheimer analyst Dominick Gabriele.

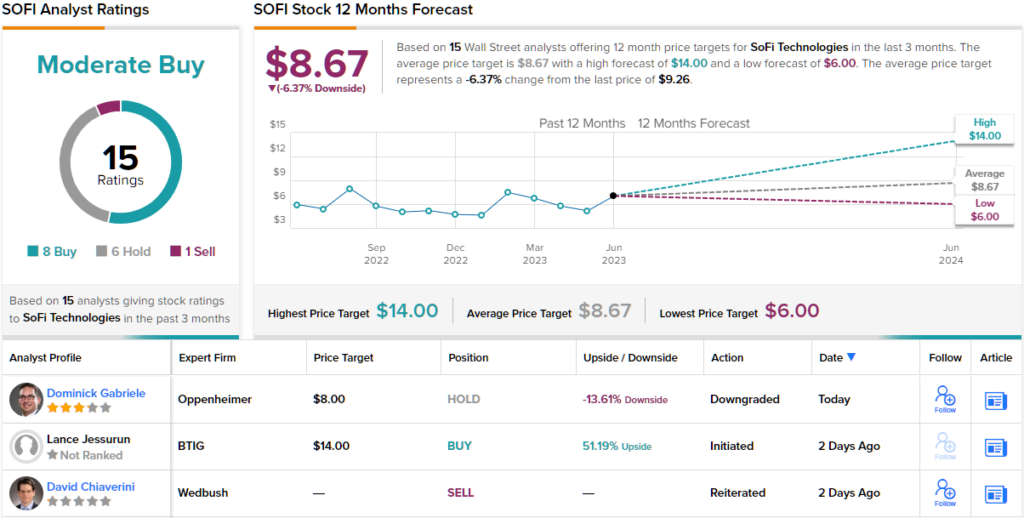

As such, Gabriele has now downgraded SOFI’s rating from Outperform (i.e., Buy) to Perform (i.e. Neutral) and taken the “high end of his valuation” ~$9.50 price target off the table. (To watch Gabriele’s track record, click here)

That’s not to say Gabriele has changed his tune regarding the fintech company’s prospects.

“This downgrade is purely on valuation after what we suspect is a significant short squeeze on a likely bear thesis based on accounting changes away from FV accounting, inflated assumptions by management, capital capacity and worries around credit quality,” Gabriele explained. “We aren’t worried about any of these items today, except we are cautious on credit heading into year-end across our coverage.”

In fact, Gabriele’s long-term bullish thesis remains intact, and he makes the case that SOFI’s top brass is due credit for its “execution and diversified business.”

Additionally, Gabriele’s downgrade comes at the same time he boosts his revenue estimates for 2024FYE, from $2.4 billion to $2.6 billion, with the raised expectations now positing Gabriele’s forecast ~$100 million above consensus.

This is based on the company expanding the balance sheet to ~$30 billion (almost double present book) in 5.7 quarters, even if they don’t sell any loans. “We think they will sell loans,” opined the analyst, “but this exercise is to say, they have significant capital to beat 2024PE consensus loans by ~$7.5B should they decide to $0 loan origination income.”

So, that’s Oppenheimer’s take, what does the rest of the Street think lies in store for SOFI? 5 other analysts join Gabriele on the sidelines and with an additional 8 Buys and 1 Sell, the stock claims a Moderate Buy consensus rating. However, given the stock’s surge, the $8.67 average target now sits ~6% below the current share price. It will be interesting to see whether other analysts readjust their models too over the coming sessions. (See SoFi stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.