Philip Morris International (NYSE:PM) is a very strong dividend stock, with the company’s resilient industry traits and robust profitability ensuring that its 5.2% dividend is well-covered. Its latest financial results were impressive, leading management to anticipate a record-breaking year in profits in 2023. That said, the stock could be slightly overvalued at its current levels. To secure a more substantial margin of safety, I believe the stock’s investment case would be notably more attractive at $95/share or lower. Hence, I am neutral on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

An Excellent Start to 2023

Philip Morris’ Q1 results marked an excellent start to Fiscal 2023, paving the way for record profits this year. Net revenues came in at $8.0 billion, which didn’t only translate to a 3.5% year-over-year increase but also celebrated the best Q1 in the company’s history in terms of sales. In fact, if it weren’t for a negative foreign exchange impact, Philip Morris’s net revenues would have grown by an impressive 9.6%. The company’s vigorous sales can be attributed to accelerated combustible tobacco pricing, robust underlying heated tobacco unit shipment volume growth, and the Swedish Match acquisition.

Strong Numbers in Combustibles

Philip Morris’ resilient business model allowed the company to once again leverage its unparalleled pricing power to more than offset the decline in combustible tobacco volumes. Given that cigarettes are highly inelastic, Philip Morris was able to raise prices by 7.4%, more than offsetting the 3.1% decline in the shipment of tobacco volumes. The only reason the division posted a net revenue decline of 1.5% was due to foreign exchange headwinds.

Robust Growth in Heated Tobacco

The heated tobacco division also continued to expand its customer base, posting unit shipment volume growth of 10.4%. Specifically, the company estimates that total IQOS (a type of electronic cigarette) users at quarter-end were roughly 25.8 million, up 3.5% compared to the previous quarter. Further, its market share for heated tobacco units in IQOS markets also grew by 90 basis points to 9.0%.

It’s also worth noting that while the 10.4% growth in HTU (heated tobacco unit) shipment volumes implies a deceleration compared to previous quarters, they were adversely affected in the quarter by the net impact of both distributor and wholesaler inventory movements. If we were to exclude these movements to make for a fair comparison, HTU adjusted in-market sales volume would have risen by an estimated 16%, signifying continued strong IQOS momentum.

Oral Nicotine Revenues Skyrocketing

Besides strong performances in combustibles and heated tobacco, Philip Morris posted explosive growth in its oral nicotine as a result of the Swedish Mathch acquisition, now actively contributing to its results.

The company posted oral product shipment volumes of 173.3 million, a massive increase from the 3.5 million in Q1 2022. Nicotine pouches and Snus volumes skyrocketed from 1 million and 2.5 million to 81.3 million and 55.6 million. Moist Snuff was a brand new source of revenue for the company, contributing 35.2 million in shipment volumes. Overall, as Philip Morris is marching toward a smoke-free future, its market-leading position in oral nicotine delivery should make this transition smooth and drive growing sales.

Outlook for Record Profits in Fiscal 2023

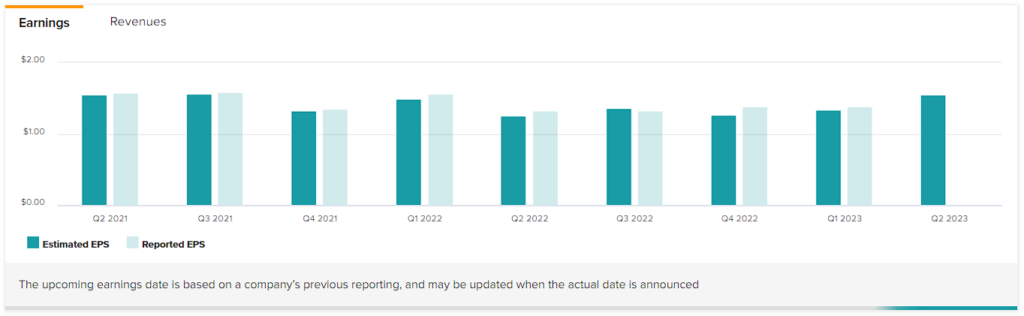

While inflationary pressures negatively impacted Philip Morris’s operating expenses, the company posted robust net earnings during the quarter, setting the stage for record profits in Fiscal 2023. Notably, despite earnings per share decreasing to $1.28 in Q1, which was a 14.7% decline compared to the same period last year, profitability is expected to improve significantly in the coming quarters.

This will be driven by the continued growth in non-combustible revenues and improved foreign exchange conditions due to the recent weakening of the dollar. As a result, the company anticipates GAAP earnings per share of $5.88 to $6.00 for Fiscal 2023, with the midpoint of this range indicating 2.2% growth compared to last year and a new all-time high.

The Dividend is Encouraging, but Expect Modest Growth

Philip Morris’ investment case is mainly anchored on the company’s renowned dividend, which has been growing uninterruptedly for 53 years, dating back to the time before the company’s separation from Altria (NYSE: MO).

Again, by utilizing the midpoint of management’s guidance, the payout ratio now stands at about 86%. In light of this, I would expect management to keep hiking the annual payout every year but at a modest pace. It makes sense, as paying down the debt incurred to complete the Swedish Match acquisition in a rising-rate environment should be a priority in terms of capital allocation. This is also hinted at by the company’s most recent dividend hike, which was by a mere 1.6%.

Is PM Stock a Buy, According to Analysts?

Turning to Wall Street, Philip Morris has a Strong Buy consensus rating based on 11 Buys and three Holds assigned in the past three months. At $114.38, the average Philip Morris stock price target implies 15.9% upside potential.

The Takeaway: Wait for a Drop

Philip Morris kicked off 2023 on a high note, laying the groundwork for what promises to be a year of exceptional profits. That said, given the company’s trading pattern, right now may not be an ideal time to be bullish on the stock. The stock’s trading range over the past few years has been between $90 and $100 per share, with investors essentially pricing Philip Morris based on its underlying dividend yield.

Given that the stock is now trading at the high end of this range and that dividend growth is likely to remain slowed down in the coming years, it might be prudent to wait for a better entry point, potentially below $95. This would enable investors to benefit from a larger yield and a more secure margin of safety.