While the U.S. government seemingly did enough to avert a possible financial sector implosion, PacWest Bancorp (NASDAQ:PACW) can be the next troubled bank to suffer severe damage. Of course, the dilemma centers on the fact that regional banking firm PacWest has already incurred woeful hemorrhaging. Nonetheless, the lack of federal support to shareholders amid this banking crisis bodes poorly for the entire industry. Therefore, I am bearish on PACW stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

To be fair, PacWest’s leadership team isn’t merely sitting on its hindquarters. The embattled enterprise is in talks with Atlas SP Partners and other investment firms to boost liquidity. As well, management ponders other options. However, a deal might not materialize, which may then condemn PACW stock to hefty losses.

Already, investors have dumped bank stocks due to liquidity concerns. Recently, bank runs eventually collapsed SVB Financial Group and Signature Bank. Also, the banking crisis impacted Switzerland-based Credit Suisse (NYSE:CS), which was recently taken over by UBS Group (NYSE:UBS). CS stock is down 70% year-to-date.

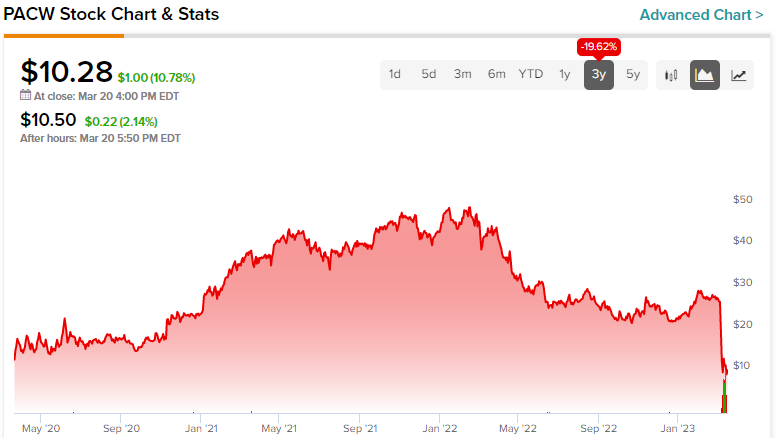

Sadly, it’s a similar situation with PACW stock. After starting off the new year auspiciously, PacWest now finds itself bleeding in shark-infested waters. Since the January opener, shares have fallen 54%. Last Friday alone, PACW stock fell nearly 19%.

Put another way, the hemorrhaging must stop for PACW stock to not incur catastrophic damage. Unfortunately, investors have little reason to hold onto shares.

Uncle Sam’s Support is a Double-Edged Sword for PACW

A major tipping point for bank runs stems from the Federal Deposit Insurance Corporation (FDIC). Although the agency protects depositors if a bank fails, the limit only goes up to $250,000 per deposit account customer. Therefore, the biggest enterprises have every reason to take their money out of high-risk institutions quickly. However, the U.S. government got in front of this catastrophe, providing support to depositors. Unfortunately, that’s not holistically good news.

According to a joint statement by the Treasury, Federal Reserve, and the FDIC, impacted shareholders and certain unsecured debtholders will not be protected. In other words, shareholders of SVB Financial and Signature will most likely receive nothing for their investments. So, it’s no surprise that people have abandoned ship with PACW stock and its ilk. Simply, too much risk exists to be comfortable with the exposure.

In fairness, common stock shareholders typically stand last in line during liquidation proceedings. However, the recent bank failures came in like a thief in the night. Investors had little chance of doing anything before it was game over. Inherently, others don’t want to repeat the same mistake, sparking massive sell-offs in PACW stock.

Further, because the federal government basically declared that it will not help shareholders of future bank failures, exposed regional banks must undergo a difficult revaluation process. Moving forward, the realistic downside risk isn’t just some fraction of a total loss. Rather, a total loss is very much on the table.

Even worse, unlike a struggling retailer, a bank could go to zero overnight. Surely, that has stakeholders of PACW stock on edge.

PACW’s Financials are Under Fire

With viability concerns rising, it’s no wonder that market observers question the stability of PacWest’s financial profile. To be honest, on paper and without context, PACW stock looks attractive. For instance, the market prices shares at a forward multiple of 2.66. This ranks better (lower) than almost 97% of its peers. However, PACW may be a possible value trap.

Specifically, asset growth of 15.5% a year (for the last three years) outpaces revenue growth of 5.7% over the same period. This indicates that PacWest may be getting less efficient. Also, if those assets comprise bonds purchased when yields sat lower than they do today (which would mean that PACW is sitting on heavy losses), PACW stock could repeat the aforementioned banking failures.

Also, another cautionary factor focuses on the issuance of debt. Over the past three years, PacWest issued over $348 million in debt. Prior to the banking failures, this wasn’t such a big deal. However, in light of the banking crisis along with a high interest-rate environment, PACW stock may struggle.

Is PACW Stock a Buy, According to Analysts?

Turning to Wall Street, PACW stock has a Hold consensus rating based on one Buy, four Holds, and zero Sell ratings. The average PACW stock price target is $29.00, implying 182.1% upside potential.

The Takeaway: No Compelling Reason to Hold PACW Stock

Ultimately, the narrative for PACW stock comes down to one major takeaway: no compelling reason exists to hold PacWest shares. With the very real possibility that other banks may fail, exposed investors face an all-or-nothing proposition. Arguably for most market participants, it’s better to live another day.