In today’s stock market, the three largest ETFs by assets under management are all S&P 500 (SPX) ETFs. The massive SPDR S&P 500 ETF Trust (NYSEARCA:SPY) comes in first at nearly $410 billion. The iShares Core S&P 500 ETF (NYSEARCA:IVV) comes in second with over $328 billion in assets under management, while the Vanguard S&P 500 ETF (NYSEARCA:VOO) is close behind in third place with $313 billion in AUM. Combined, these three S&P 500 giants have over $1 trillion in assets under management between them.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Why are S&P 500 ETFs Appealing to Investors?

Why invest in the S&P 500? While it may not sound like the most exciting or exotic investing strategy, it is an effective one. While past performance is no guarantee of future results, the S&P 500 index itself has been a pretty good performer for a really long time. Going back to 1957, when the S&P 500 as we know it was made, the index has posted an average annualized return of 10.15%.

Harnessing the Power of the U.S.’s Top Companies

Adding to this appeal, an investment in an S&P 500 ETF gives investors exposure to over 500 of the strongest companies in the United States. An investment in an S&P 500 ETF also gives you instant diversification across sectors and industries.

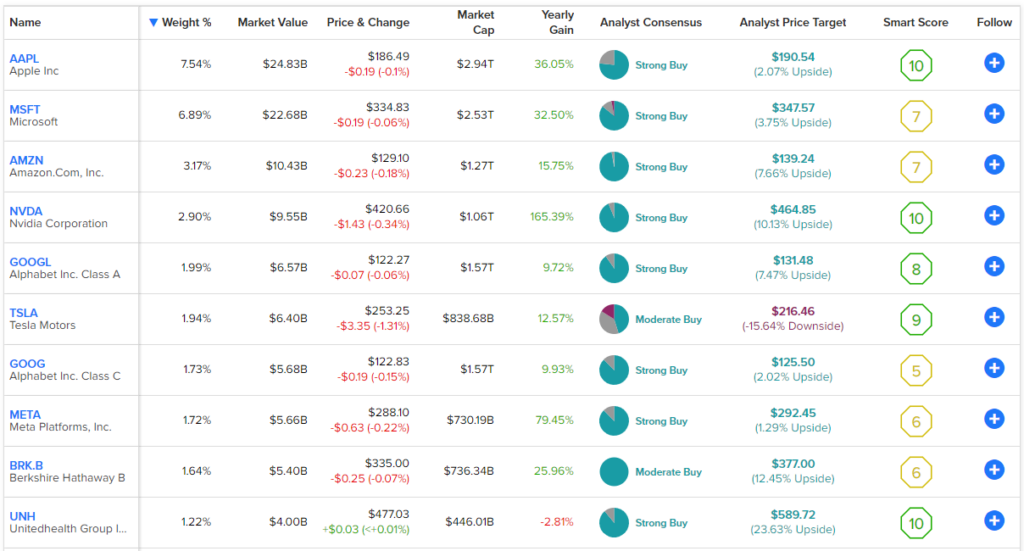

SPY, the world’s largest ETF, holds 503 stocks, and its top 10 holdings account for 30.3% of the fund. Below, you can take a look at SPY’s top 10 holdings.

Because the S&P 500 is the underlying index for all of these funds, differences between their portfolios are negligible. Also, because mega-cap tech stocks have come to dominate today’s market as the largest stocks in the S&P 500, all three of these ETFs give investors significant exposure to these tech leaders, including Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Tesla (NASDAQ:TSLA), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Meta Platforms (NASDAQ:META).

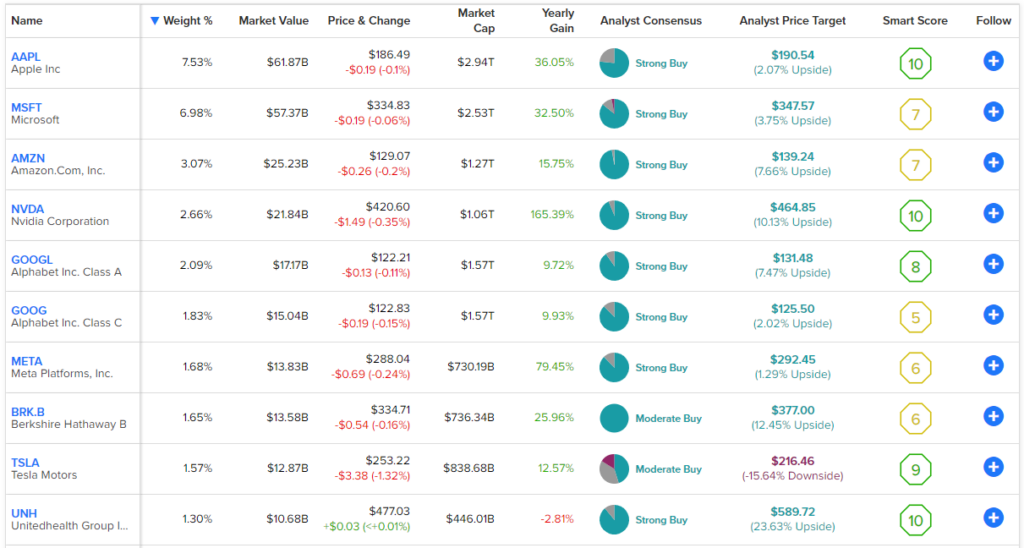

IVV holds 502 stocks, and its top 10 holdings also make up 30.3% of its holdings. Take a look at IVV’s top 10 holdings below.

Lastly, VOO is unsurprisingly similar, with 504 holdings, and its top 10 holdings make up 30.4% of the fund.

As you can see, the funds are largely the same, although there are some minor differences based on when the funds rebalance.

Dividends

SPY, IVV, and VOO all pay dividends, and they currently all yield roughly 1.5%. Because of the S&P 500’s strong performance in 2023 (it’s up about 14% year-to-date), this yield is a bit low for dividend investors to get excited about, but holders will not be complaining.

Long-Term Performance of S&P 500 ETFs

Unsurprisingly, because these funds all invest in the S&P 500, there is a high degree of correlation in their long-term performances. However, most importantly, all three have delivered strong long-term returns for investors.

As of the end of May, SPY had a three-year annualized total return of 12.8%, a five-year annualized total return of 10.9%, and a 10-year annualized total return of 11.9%. Meanwhile, IVV provided annualized total returns of 12.9% over three years, 11% over five years, and 12% over the last 10 years. Lastly, VOO posted annualized total returns of 12.8%, 11%, and 11.9% over the same time frames, respectively, so all three funds provided investors with very similar double-digit annualized returns over the course of the past decade.

Expense Ratios

One area where there is some difference is when it comes to the fees they charge. IVV and VOO both have expense ratios of just 0.03%. Meanwhile, SPY comes in at 0.09%.

While 0.09% is a fantastic expense ratio in the overall ETF landscape, it is quite a bit higher than that of IVV and VOO in this comparison. Investors in SPY are paying three times as much in fees as investors in IVV and VOO.

See below for a comparison of SPY, IVV, and VOO based on their fees as well as other criteria using TipRanks’ ETF Comparison Tool, which lets you compare up to 20 ETFs at a time based on a variety of customizable factors.

Hard to Go Wrong

Investing in the S&P 500 has historically delivered strong results for investors for a long time, and investing in an S&P 500 ETF allows you to add the power and future growth of 500+ of the U.S.’s top companies to your portfolio with one investment vehicle.

As you can see in the comparison above, SPY, IVV, and VOO all feature identical ETF Smart Scores of 8. The Smart Score is TipRanks’ proprietary quantitative stock scoring system. It gives stocks a score from 1 to 10 based on eight market key factors. The score is data-driven and does not involve any human intervention. A Smart Score of 8 or above is equivalent to an Outperform rating.

It’s hard to go wrong with any of these ETFs, and picking between the three is a good problem to have. All three look like great choices for investors. Also, for investors just starting out, these ETFs are nice for instantly diversifying portfolios.

With similar portfolios and long-term track records over the past decade, the key difference between these ETFs is their fees. While all have favorable expense ratios, SPY’s comes in three times higher than that of IVV and VOO, making those the best buys.

SPY has the longest track record (it launched in 1993, long predating IVV and VOO, which launched in 2000 and 2010, respectively), the most assets under management, and incredible liquidity (it accounts for 20% of ETF trading volume on a daily basis), so there’s certainly nothing wrong with choosing it over its counterparts. Nonetheless, the fees will be a bit higher over time.