Struggling for many years to rid itself of its legacy businesses, the new IBM (NYSE:IBM) offers a compelling opportunity, as evidenced by its recent solid earnings report. Essentially, the company now stands as an unignorable artificial intelligence (AI) stock. Backed by satisfactory financials and strong passive income, “Big Blue” now also commands practical AI initiatives. Therefore, I am bullish on IBM stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Encouraging Earnings Print Bodes Well for the Tech Stalwart

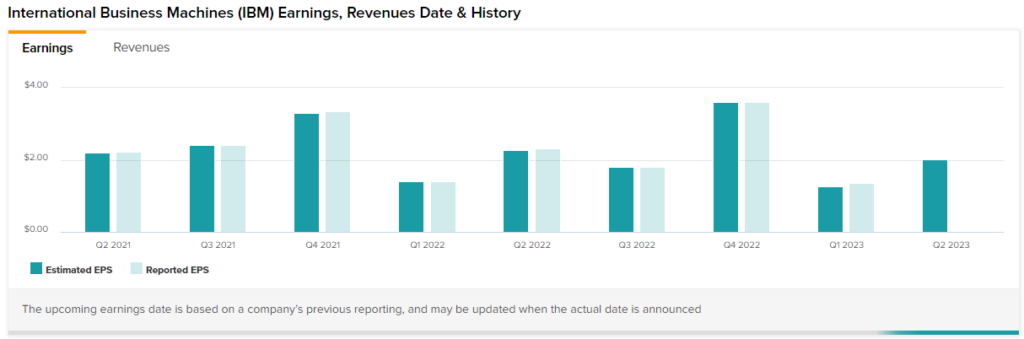

In the middle of last week, IBM stock popped higher as the underlying enterprise released its results for the first quarter of Fiscal Year 2023. As TipRanks contributor Steve Anderson pointed out, earnings per share came in at $1.36, which beat analysts’ consensus estimate of $1.26 per share. In addition, sales increased by 0.7% year-over-year to $14.3 billion. However, it slightly missed the target of $14.33 billion.

Anderson continued, noting that most of IBM’s segments posted some kind of year-over-year increase (albeit most of them stemming from trivial upgrades, “The software segment, for example, picked up 2.6% to reach revenues of $5.9 billion. Consulting services, meanwhile, added an extra 2.8% to hit $5 billion. The lone exception was infrastructure, however, which brought in $3.1 billion, a figure down 3.7%.”

Further, management offered some projections for full-year 2023. Anderson stated that management “expects revenue growth of between 3% and 5% on a constant-currency basis. Further, the company stands behind earlier projections of around $10.5 billion in free cash flow, which is up $1 billion against 2022’s figures.”

In fairness, not everybody broadcasted overtly bullish sentiment for IBM stock. Per TheFly, BMO Capital analyst Keith Bachman lowered IBM’s price target to $145 from $155 while keeping a Market Perform rating on the shares.

Fundamentally, BMO Capital remains skeptical that “Big Blue” can grow its software segment. In addition, IBM stock may suffer from margin challenges. Still, this narrative may be overlooking the bigger picture.

Big Blue’s Big AI Investment Should Pay Off

During IBM’s transition from a legacy hardware-based enterprise to one embracing burgeoning innovations, Big Blue made significant investments in various AI research centers totaling multiple billions of dollars. Thankfully, those investments appear to be paying off, which should bolster the bullish case for IBM stock.

In particular, during the company’s Q1 conference call, management stated that its technology undergirded the AI-powered commentary on videos in the Masters Tournament golf app, according to a CNBC report. Research firm McKinsey & Company notes that generative AI describes algorithms that can be used to create new content, including audio, code, images, text simulations, and videos.

Enticingly, other tech powerhouses such as Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) have moved into the generative AI space to help advertisers produce creative content. Certainly, Alphabet’s Google should benefit from the AI competition. However, it’s also possible that IBM may have a leg up on this generative subsegment, given its already-proven product.

Moreover, the aforementioned CNBC report noted that IBM was working with Citigroup (NYSE:C) to use AI for auditing and compliance. In other words, IBM is taking the lead with not just AI protocols but also practical AI-driven solutions.

Intriguing Financials

Although the financials underlying IBM stock don’t represent a remarkable profile, they’re attractive enough to intrigue onlookers. In particular, Big Blue ranks as a consistently profitable enterprise, which then supports its attractive passive income. Specifically, IBM carries a dividend yield of 5.25%, well above the tech sectors’ average yield of 1.025%.

In addition, the stock may be undervalued. Right now, the market prices IBM stock at a forward earnings multiple of 13.3. This ranks better (lower) than over 80% of the companies listed in the software industry.

Is IBM Stock a Buy, According to Analysts?

Turning to Wall Street, IBM stock has a Moderate Buy consensus rating based on four Buys, five Holds, and one Sell rating. The average IBM stock price target is $143.22, implying 13.7% upside potential.

The Takeaway: IBM Stock May Continue to Surprise Investors

Because IBM stock long suffered under the weight of its legacy business units, investors might not appreciate it as a viable tech enterprise today. However, such a mentality ignores the many changes that occurred in recent years. In particular, IBM’s investment in AI appears to have paid off, particularly in the generative realm. Combine that with its solid financials and strong passive income, and Big Blue is now difficult to ignore.