At first glance, Dollar General (NYSE:DG) — known for selling everyday household goods at rock-bottom prices — appears to be a no-brainer. Amid a rough backdrop in the consumer economy, discount retailers should be all the rage. However, despite its super-relevant business model, the company is losing traction largely due to a cruel irony. Therefore, I am regrettably bearish on DG stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

DG Stock Only Seems Like a Strong Buy

Historically, Dollar General has thrived by positioning itself as a haven for cost-conscious consumers. With its vast array of products at discounted prices, it has carved a niche in an economy that has increasingly been characterized by sharp wealth disparities. Based on this, DG stock should be a Strong Buy.

Even better, contemporary trends support Dollar General’s rise. For one thing, the nation continues to grapple with the challenges of surging inflation. Second, the Federal Reserve’s response (inducing interest rate hikes) has contributed to economic challenges, particularly mass layoffs. However, for DG stock, these headwinds should be upside catalysts.

Regrettably, many Americans are feeling the financial pinch. In such times, the allure of dollar stores tends to rise, offering essentials without breaking the bank. Despite some potential stigma attached to these discount stores and their often-questionable locales, dire economic circumstances push consumers to prioritize savings over perception.

Still, it’s not all smooth sailing for Dollar General. Obviously, DG stock has plunged over the past year, shedding over half its value. While such a decline might seem like a golden opportunity for those with a bullish disposition, investors must tread carefully.

What might seem like a steep discount could also be a reflection of underlying challenges in the company’s quest to maintain its competitive edge in a fiercely contested market.

A Cruel Irony Capsizes Sentiment for Dollar General

Amid challenging circumstances, consumers naturally gravitate toward discount retailers. Historically, Dollar General has been a beacon for such budget-conscious shoppers. Yet, in a twist of fate, the very discounts that bolstered the company’s reputation may now be its undoing, casting a shadow over DG stock.

Recent financial disclosures only accentuate this concern. According to TipRanks reporter Shrilekha Pethe, while Dollar General saw a year-over-year revenue increase of 3.9%, reaching $9.8 billion in the second quarter, it fell short of analysts’ expectations, which were pegged at $9.93 billion. Even more disconcerting was the decline in earnings, which fell by 28.5% to $2.13 per share, missing the anticipated $2.47.

Wall Street’s consternation was further exacerbated by the company’s revised outlook. Management dialed back its fiscal 2023 projections, expecting net sales to grow only between 1.3% and 3.3%. That was a significant drop from its prior estimate of 3.5% to 5%. Furthermore, earnings are anticipated to decline steeply, ranging between a 34% and 22% drop, settling between $7.10 and $8.30 per share.

In an almost poetic twist of numbers, while revenue increased by 3.9%, Dollar General’s gross margin concurrently eroded by the same percentage. This signifies that the discounts that once drew customers to the brand are now threatening its fiscal health. The very allure of Dollar General might, ironically, be the cause of its financial strain.

Watch Out for Falling Knives

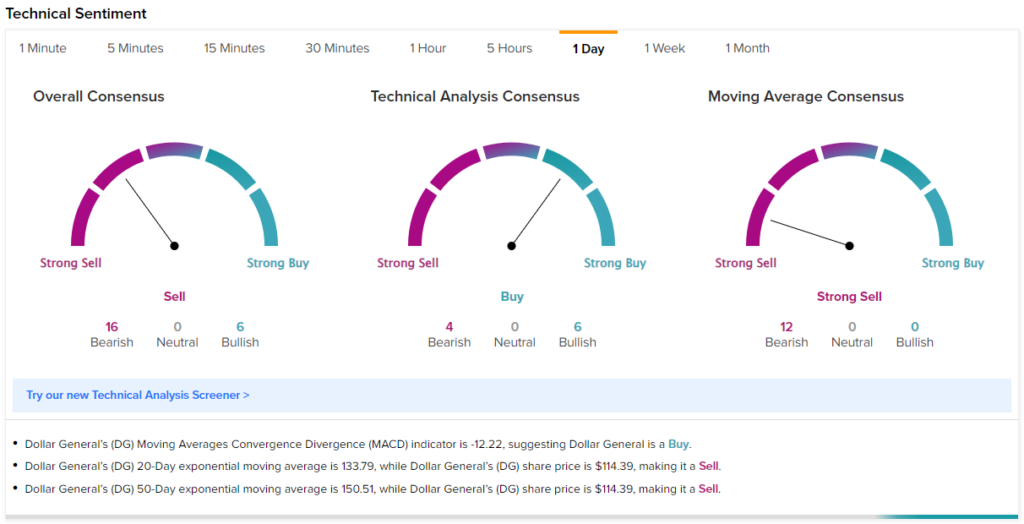

Dollar General’s recent struggles have left the stock in a precarious position, prompting many investors to approach it with trepidation. A cursory glance at TipRanks’ technical analysis indicator for DG stock reveals a “Sell” consensus.

When stocks experience such rapid and pronounced declines, retail investors are well-advised to exercise extreme caution. Fear and uncertainty tend to dominate during these tumultuous periods, making it challenging to predict when the downward spiral will finally come to an end.

Moreover, the presence of significant block trades in Dollar General options suggests that major investors are actively engaged in hedging behavior. This indicates a sense of caution among more sophisticated market participants. For less experienced investors, it may be prudent to observe DG stock’s trajectory from the sidelines until a clearer path forward emerges.

Is DG Stock a Buy, According to Analysts?

Turning to Wall Street, DG stock has a Moderate Buy consensus rating based on seven Buys, 12 Holds, and one Sell rating. The average DG stock price target is $154.41, implying 35.1% upside potential.

The Takeaway: DG Stock Discounted Itself Out of Contention

Once revered for its discounts, Dollar General now faces an ironic downfall as those same discounts undermine its viability. Essentially, its declining margins provide the business with limited protection ahead of possibly even more trying times. Thus, retail investors should consider treading cautiously with DG stock.