Choice Properties Real Estate Investment Trust (TSE:CHP.UN) is a popular Canadian REIT. However, we think investors shouldn’t buy this 4.8%-yielding stock despite it having an 8 out of 10 Smart Score “outperform” rating, and we’ll explain why.

But first, let’s explain the company’s operations briefly. CHP.UN collects rental income from high-quality tenants, mostly retail ones (80% comes from retail, 15% from industrial, and the remaining 5% from mixed-use, residential & other). Notably, 70% of its retail net operating income comes from grocery stores and pharmacies. Therefore, its cash flows seem secure, but its dividend and valuation aren’t appealing. We are neutral on the stock. Let’s analyze.

Choice Properties’ 4.8% Dividend Yield Isn’t Impressive

CHP.UN hasn’t raised its dividend since 2017. This is likely because the company hasn’t experienced any FFO/share (funds from operations per share, an earnings metric used by REITs) growth in the past several years. In fact, its FFO/share in 2021 was about the same as it was in 2015. If a company can’t grow its earnings, it can’t really grow its dividends much.

Besides this, the company had an 88.3% adjusted-funds-from-operations (AFFO) payout ratio for the nine months ended September 30, 2022, meaning that most of its cash flow was paid out to shareholders, leaving little room for further dividend hikes. If you ask us, a 4.8% dividend yield with little to no room for growth isn’t really that impressive.

CHP.UN’s Valuation is Unappealing

You can easily look at CHP.UN’s lack of dividend-growth potential combined with its mediocre dividend yield (compared to other Canadian REITs) and conclude that the stock is likely overpriced. Still, let’s also look at analysts’ FFO estimates for the company. Analysts estimate the company’s FFO/share to come in at C$0.96 for 2022, C$0.98 for 2023, and C$1.01 the following year. This implies forward FFO/share multiples of 16x, 15.7x, and 15.2x, respectively, or FFO yields of approximately 6.5%.

For such low growth potential, we’d want to buy the stock at a lower price to get a higher yield.

Is CHP.UN Stock a Buy, According to Analysts?

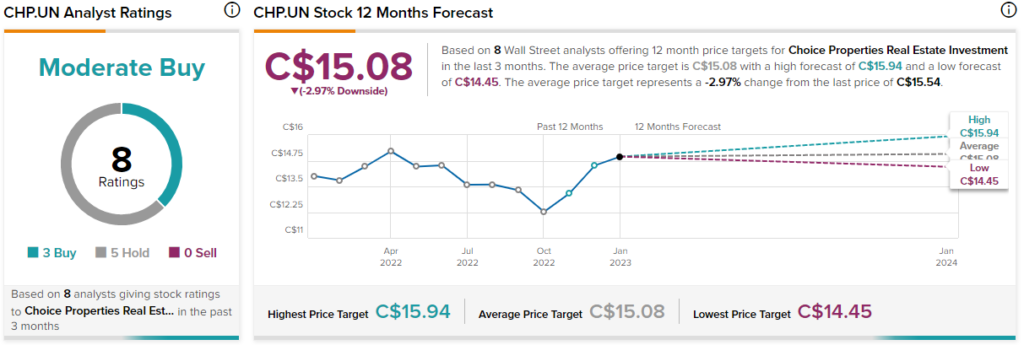

According to analysts, CHP.UN stock comes in as a Moderate Buy based on three Buys and five Hold ratings assigned in the past three months. Nonetheless, the average Choice Properties stock price target of C$15.08 implies 3% downside potential, adding to the thesis that the stock may be overvalued right now.

The Takeaway: CHP.UN Stock Just Isn’t Worth It

While Choice Properties is a stable company that collects money from high-quality tenants, the stock just isn’t worth buying at its current price. Investors that purchase this stock today will be getting a mediocre 4.8% dividend that likely won’t see any growth in the short-to-medium term (or very little growth). Combine that with little to no FFO/share growth, and its total-return potential doesn’t look appealing.