Chipotle (NYSE:CMG) has sustained an incredible rally year-to-date, with its stock advancing by roughly 38% to $3,162 during this period. Despite such extended share price gains, it seems that Chipotle stock could soon approach the $3,500 threshold. The fast-casual Mexican restaurant keeps posting impressive same-store sales growth while quickly advancing its store expansion strategy. In the meantime, its margins keep expanding by the quarter, sustaining superb earnings growth. Thus, I remain bullish on CMG stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q1-2024 Results Fuel Bullish Sentiment

Chipotle’s Q1-2024 results once again fueled the bullish sentiment that has long surrounded the company. The stock’s sustained rally certainly displays this. What’s quite interesting is that, despite the years of skepticism from critics who dismiss Chipotle as merely a cult stock, the company consistently delivers exceptional results that defy industry norms. Let’s take a closer look at Chipotle’s Q1 report, which demonstrates this continuous success.

Chipotle Replicates Its Strategy, Drives Double-Digit Growth

Chipotle’s Q1 earnings once again delivered double-digit revenue growth, driven by the company replicating its well-established strategy. More specifically, total revenues grew by 14.1% to $2.7 billion for the quarter. This marked the 15th consecutive quarter of double-digit growth. This stunning momentum can be attributed to the company replicating what has already proven to be a seemingly simple yet effective strategy: open new stores and grow sales in existing ones.

In Q1, comparable sales from existing locations rose by 7.0%. Meanwhile, by the end of March, Chipotle had 3,479 restaurants open, up from 3,437 last quarter and 3,224 last year.

Notably, the opening of 47 restaurants in Q1 continued the accelerated expansion trend observed in Q4, with the company opening six more restaurants than the same period last year. This illustrates Chipotle’s capacity to support higher levels of capital expenditures due to the gradual generation of significantly higher operating cash flows. More importantly, even with raised capital expenditures, there is still room left for the company’s free cash flow levels to grow substantially.

To support this argument, Chipotle generated operating cash flow of $1.90 billion during the past four quarters, up 27% from last year. Thus, despite capital expenditures hitting a record high of $573.1 million during the same period—an increase of 13.8% year-over-year, reflecting Chipotle’s boosted spending to expand its footprint—free cash flow still surged by 33%, reaching $1.32 billion.

Margin Expansion to Sustain Surging Profits

You might have noticed that Chipotle’s 27% year-over-year increase in operating cash flow over the past 12 months significantly outpaces its revenue growth. This can be attributed to its steadily improving restaurant-level margins, driven by rising same-store sales.

As same-store sales keep rising against a backdrop of stable overhead costs, it’s quite easy for Chipotle to achieve economies of scale. Also, the fact that Chipotle owns all of its restaurants eliminates the need to pay incremental royalties with the growth of same-store sales, further strengthening its restaurant-level margins. In fact, Chipotle’s restaurant-level margin expansion tends to significantly affect its overall profitability prospects, with earnings growth historically exceeding revenue growth by a wide margin.

Chipotle’s Q1 numbers were a great example of this trend. Chipotle’s average restaurant sales climbed to $3.082 million from last year’s $2.892 million, reflecting the same-store sales growth mentioned earlier. Consequently, its restaurant-level operating margin rose by 190 basis points to 27.5%.

Now, factor in Chipotle’s robust revenue growth of 14.1%, the bolstered restaurant-level margin, and the absence of debt on its balance sheet—meaning no interest expenses to weigh down net income growth—and it’s clear how adjusted earnings for the quarter soared by an impressive 27% to $369.3 million.

Valuation Concerns Remain, But Winners Come at a Hefty Price

Chipotle’s extended rally has actually exceeded the company’s underlying growth, resulting in a notable valuation expansion in recent months. This is certainly concerning. In particular, the stock is now trading at a forward P/E of about 55x, which sounds quite absurd. It’s even more absurd to support that the stock can sustain its ongoing rally toward $3500—and yet I wouldn’t exclude the possibility of this scenario unfolding.

Why? As I mentioned earlier, Chipotle undeniably enjoys a revered status among investors—and rightfully so. The company posts strong same-store sales growth quarter after quarter while aggressively expanding its presence worldwide. This trend clearly instills confidence in investors, who foresee ample room for future growth.

The argument here is that with Chipotle poised to maintain its robust double-digit revenue and earnings growth, it will eventually be able to grow into its rich valuation. My time researching stocks has taught me that winners rarely trade at a discount, and Chipotle’s hefty valuation certainly proves this.

Is CMG Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Chipotle Mexican Grill has gathered a Moderate Buy consensus rating. This is based on 18 Buys and eight Hold ratings assigned in the past three months. At $3250.58, the average CMG stock price target suggests 2.8% upside potential.

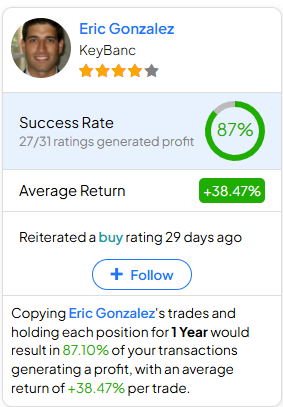

If you’re unsure which analyst you should follow if you want to buy and sell CMG stock, the most accurate analyst covering the stock (on a one-year timeframe) is Eric Gonzalez from KeyBanc, with an average return of 38.47% per rating and an 87% success rate. Click on the image below to learn more.

The Takeaway

Chipotle’s first-quarter results once again stressed its strong momentum, marked by double-digit revenue growth and a continuous margin expansion. Valuation concerns will likely keep investors questioning the stock’s prospects. Yet, as long as Chipotle keeps showing such progress across the board, I believe that there will be enough bulls to keep propelling the stock higher—at least for now. Thus, I wouldn’t exclude the possibility of Chipotle seeing further share price gains in the short term.