The share prices of REITs (Real Estate Investment Trusts), which primarily focus on office buildings, have underperformed over the past year and are trading close to their 52-week lows. Despite the easing of COVID-led restrictions, the slower return to in-person work, higher interest rates, and a significant reduction in the workforce have weighed on their financial performance and share prices.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For instance, shares of Vornado Realty (NYSE:VNO), Boston Properties (NYSE:BXP), SL Green Realty (NYSE:SLG), and Cousins Properties (NYSE:CUZ) are down about 59%, 52%, 61%, and 39%, respectively, in one year.

In the short term, the operating environment is unlikely to change much, implying that demand and utilization for office space could remain soft. Further, liquidity concerns and rising interest rates will likely weigh on their share prices.

Additionally, BMO’s 18th Annual Real Estate Summit, held this year in New York, highlighted that corporations operating in the office REIT space are now focusing on diversifying their income streams as the economic environment remains uncertain.

While office REITs have lagged behind the broader markets, let’s check what the future holds for these companies.

What’s the Prediction for Office REITs?

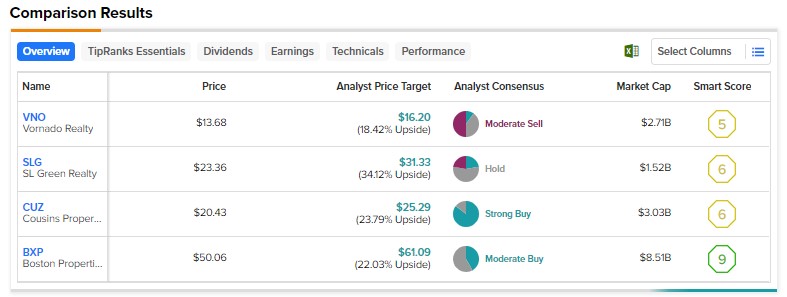

Our Stock Comparison tool shows that analysts are bearish about Vornado Realty due to the higher leasing and refinancing risks. Further, VNO has paused dividend payments for the second and third quarters.

While VNO stock has a Moderate Sell consensus rating, analysts remain sidelined on SL Green Realty stock. Both VNO and SLG carry a Neutral Smart Score of five.

As for BXP stock, analysts are cautiously optimistic due to its solid balance sheet and ability to grow occupancy as the market improves. However, BXP also has a Neutral Smart Score of six on TipRanks.

CUZ stock has an Outperform Smart Score of eight. Meanwhile, it carries a Strong Buy consensus rating due to its strong balance sheet, relatively lower net debt-to-EBITDA ratio, ample liquidity, and no immediate debt maturities.

Bottom Line

While office REITs are under pressure, Cousins Properties is more likely to outperform the overall market averages based on analysts’ Strong Buy consensus recommendation and an Outperform Smart Score.