Investors are showing strong appetite for Australian metals and mining stocks. That can be seen from the S&P/ASX 300 Metals and Mining Index’s strong rise over the past week. Mineral Resources Limited (ASX:MIN) and Pilbara Minerals Limited (ASX:PLS) are among the ASX metals and mining shares that have stood out as top favourites.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mineral Resources and Pilbara Minerals run lithium production businesses. Lithium is a central material in the manufacturing of batteries that power electric cars and store energy from renewable resources like solar and wind. As a result, demand for lithium is soaring and is expected to remain strong for many years. The strong demand has resulted in high prices for the metal, presenting a lucrative profit opportunity for lithium businesses.

Mineral Resources shares rise 24% in a week

Mineral Resources, also called MinRes, provides mining services with a focus on iron and lithium production. Its shares have gained around 24% over the past five days. MinRes shares soared recently following media speculation that the company was considering spinning off its lithium business into a public company.

In its response to the speculation, Mineral Resources neither confirmed nor denied the rumours. But instead, said that it did not have anything yet to disclose about the strategic review of its business. The company explained that it regularly weighs its strategic options as part of an effort to maximise the value for its shareholders. MinRes formed a lithium production joint venture with Pantoro Limited (ASX:PNR) and Tulla Resources.

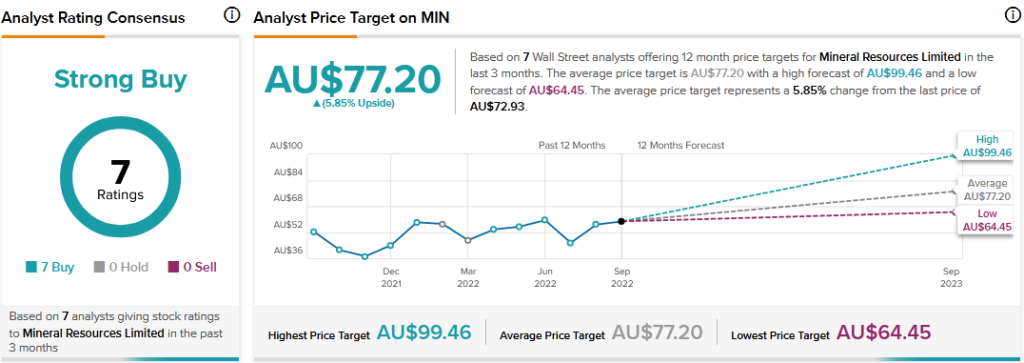

According to TipRanks’ analyst rating consensus, MinRes stock is a Strong Buy. The average Mineral Resources share price prediction of AU$77.20 implies about 6% upside potential.

MinRes shares are seeing favorable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 89% Bullish on MIN, compared to a sector average of 75%.

Pilbara Minerals shares up 20% in a week

Pilbara Minerals is a lithium mining company. It is the owner of the largest, independent hard-rock lithium operation in the world. Pilbara Minerals’ share gains have also outpaced the metals and mining sector average. The stock has risen about 20% over the past five days.

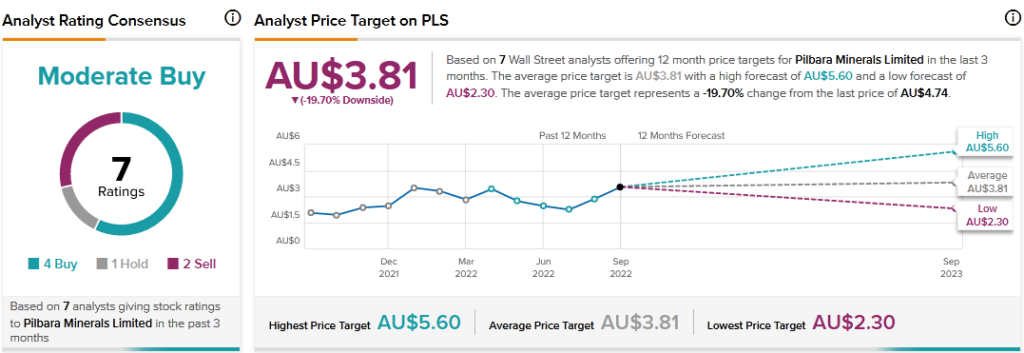

According to TipRanks’ analyst rating consensus, PLS stock is a Moderate Buy. The average Pilbara Minerals share price target of AU$3.80 implies about 20% downside potential. It seems analysts are lagging behind in their review of Pilbara Minerals’ stock price forecast.

Pilbara Minerals scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Moreover, Pilbara Minerals stock has continued to receive favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 96% Bullish on PLS, compared to a sector average of 75%.

Final thoughts

For ASX investors looking to gain exposure to electric vehicle and renewable energy markets, MinRes and Pilbara Minerals shares are worth considering. The companies are well-positioned to ride the lithium business boom.