Apple’s (NASDAQ:AAPL) incredible success, fueled by a diverse product line and reputable brand, has made it the crème de la crème of tech stocks over the past few years, and it remains an unstoppable force in the consumer market. Moreover, despite macroeconomic headwinds, AAPL stock’s long-term positioning remains as attractive as ever. Hence, we are bullish on AAPL stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

2022 was certainly a challenging year for Apple and other tech stocks. The strength of the U.S. dollar weighed down the attractiveness of the iPhone in foreign markets for the better part of the year. However, since late September, the U.S. dollar has shed its value by about 11%, which can be a robust growth catalyst for AAPL, going forward. With economic growth still expected in the next two years — albeit at a low-single-digit pace, according to the Federal Reserve — and consumer expectations also rising, it appears that Apple has every reason to keep growing.

Why Invest in AAPL Stock?

The technology industry continues to evolve at a breathtaking pace, but despite these changes, AAPL stock remains a rock-solid investment option. With its massive cash position of $48.3 billion, combined with strong revenue and profit growth over the years, the company has weathered many economic storms. The excess cash also positions Apple to grow its business aggressively for the foreseeable future, as it has money to invest.

Further, the diversity of its products acts as a safety net for its underperforming products, and with its strong reputation comes customer loyalty from individuals across the globe.

Stepping Up Its Virtual and Augmented Reality Game

Apple’s plans to enter the immersive technology markets of virtual/augmented reality (VR/AR) this year with a new headset have investors salivating over its future. With investments made over the last few years in various technologies and patents related to the upcoming product, it’s clear Apple has been preparing to jump into these booming markets for quite some time.

With an increasing number of people turning to technology in their everyday lives, it is no surprise that experts are foreseeing significant growth in AR and VR technology. According to Grand View Research, the augmented reality market is expected to grow by a spectacular 40.9% CAGR from 2022 through 2030, and it had a market size of $25.3 billion in 2021.

Apple is set to benefit from this burgeoning market and has the potential to become its major leader through its strong brand loyalty and successful track record regarding entering new markets. With these initiatives underway and other possible ones in the works, Apple looks set to make an even bigger mark on the tech world within the next decade.

Is Apple Stock a Buy, According to Analysts?

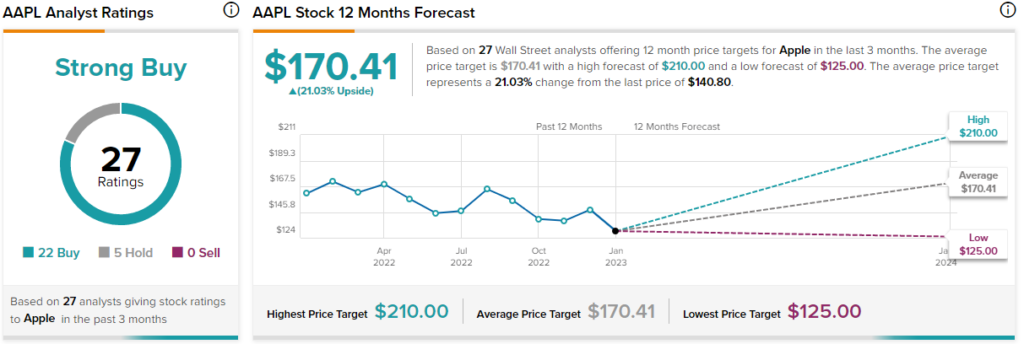

Turning to Wall Street, AAPL stock maintains a Strong Buy consensus rating. Out of 27 total analyst ratings, 22 Buys, five Holds, and zero Sell ratings were assigned over the past three months.

The average AAPL price target is $170.41, implying 21% upside potential. Analyst price targets range from a low of $125 per share to a high of $210 per share.

Also supporting the bullish narrative is AAPL’s 8 out of 10 Smart Score rating, which suggests that the stock can outperform the market from here.

The Takeaway

The second half of 2022 looked bleak for Apple, with multiple risks and unfavorable consumer sentiment threatening to take a bite out of its profits. However, fast forward to today, and the conditions seem far more favorable.

The strong U.S. dollar, which had investors worried, has eased off considerably, allowing Apple to manage its troubles effectively. Furthermore, consumer sentiment has been slowly improving, increasing consumer demand for Apple’s discretionary products.

Overall, I believe now is the time to invest in Apple again, as the risk factors that plagued its business last year have largely dissipated. Its earnings in the past four quarters have beaten analyst forecasts, and the company looks poised to continue this trend in its upcoming quarter.

Join our Webinar to learn how TipRanks promotes Wall Street transparency